The Bureau of Internal Revenue (BIR) seized thousands of cartons of untaxed perfumes, colognes, and toiletries during a nationwide inspection of malls and retail outlets. The majority of these confiscated items were found in Metro Manila, with the largest seizure occurring at the facilities of...

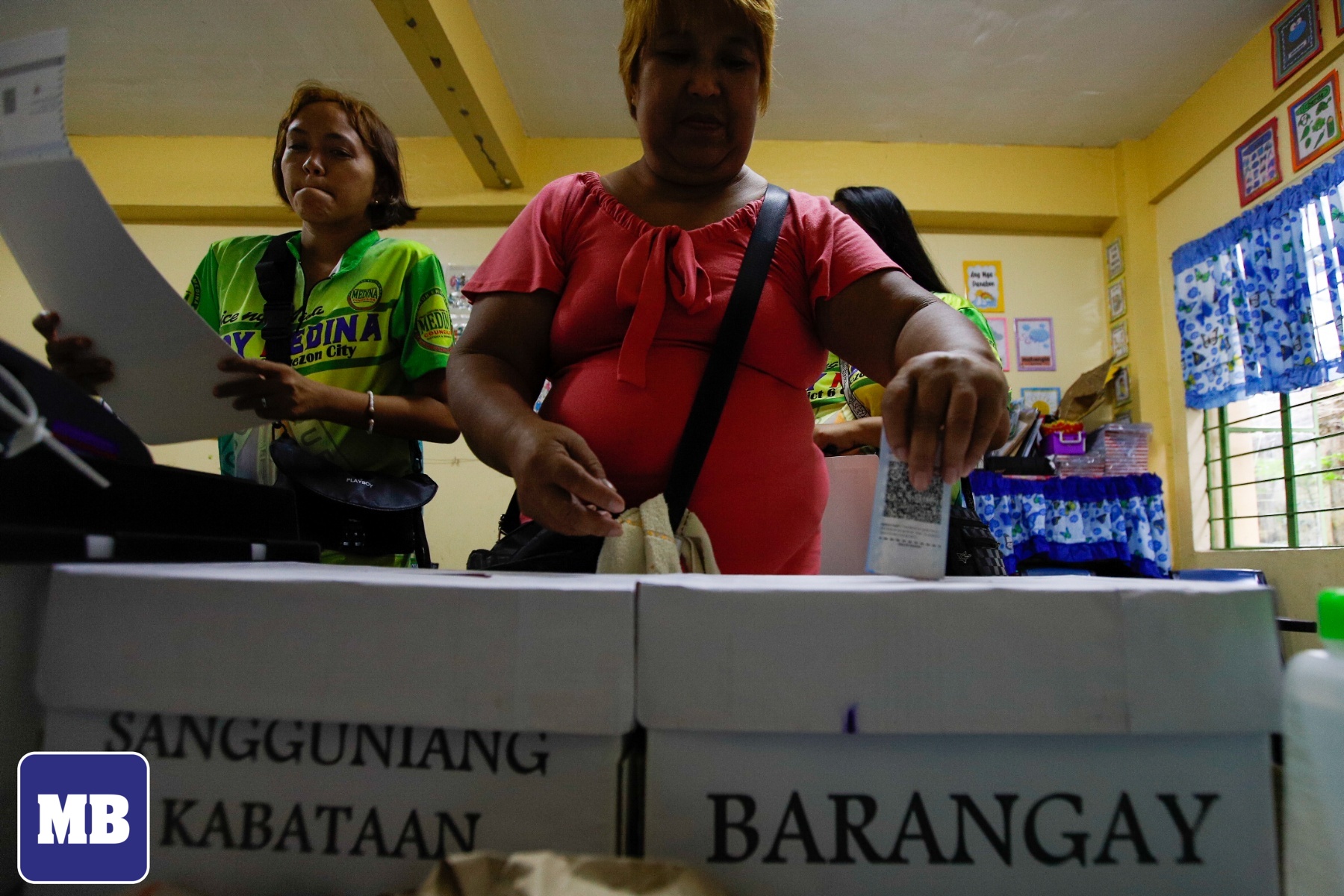

Candidates running for national and local elections, including barangay positions, no longer need to register with the Bureau of Internal Revenue (BIR). BIR Commissioner Romeo D. Lumagui, Jr. clarified in Revenue Memorandum Circular (RMC) No. 97-2023 that registration and registration fees are not...

The Bureau of Internal Revenue (BIR) has successfully addressed all complaints and inquiries forwarded by Malacañang during the initial seven months of this year. The 8888 Citizens' Complaint Center, affiliated with the Office of the President, conveyed a total of 842 concerns from January to...

The Bureau of Internal Revenue (BIR) has issued updated regulations for the new estate tax amnesty program to benefit more than one million heirs of the deceased. Finance Secretary Benjamin E. Diokno issued Revenue Regulations No. 10-2023 to implement these changes prescribed by Republic Act (RA)...

The Bureau of Internal Revenue (BIR) has issued Revenue Regulations (RR) introducing changes to the old RR Nos. 17-2011 and 2-2022, which pertain to the implementation of the Personal Equity and Retirement Account (PERA) Act of 2008. Under the new RR No. 7-2023, the maximum annual PERA...

The Bureau of Internal Revenue (BIR) has been acknowledged by the Philippine Commission on Women (PCW) for its he contribution to the advancement and empowerment of women in public service. The PCW has awarded the BIR with the prestigious Gender and Development Transformation and...

The Bureau of Internal Revenue (BIR) has achieved a remarkable feat by completely resolving all complaints it received in the first half of the year, resulting in a significant reduction in corruption and bureaucratic delays. This notable accomplishment was highlighted in a report from the 8888...

The Bureau of Internal Revenue (BIR), the government's main tax agency, exceeded its collection target for July this year due to a significant boost in tax enforcement efforts. In a statement on Tuesday, Aug. 29, BIR Commissioner Romeo D. Lumagui, Jr. said the bureau collected P273.13 billion in...

Bureau of Internal Revenue (BIR) Commissioner Romeo D. Lumagui Jr. has been commended by the National Tobacco Administration (NTA) for his relentless efforts to combat the illicit distribution of untaxed tobacco products. During a recent event, the BIR chief discussed the bureau's initiative in...

The Bureau of Internal Revenue (BIR) has revealed that the use of fake invoices and receipts by certain business establishments has resulted in an annual loss of up to P546 billion in value-added tax (VAT) for the government. BIR Commissioner Romeo D. Lumagui Jr. made the disclosure during the 119th...

As the deadline for the filing and payment of the 2022 Annual Income Tax Return (AITR) approaches, the Presidential Communications Office (PCO) has reminded the public to maximize the Bureau of Internal Revenue (BIR)'s "File and Pay Anywhere" setup. *Presidential Communications Office / Facebook* In...

The Bureau of Internal Revenue (BIR), the government’s main tax agency, is leaving no stone unturned to catch taxpayers and businesses that are using fictitious receipts. BIR Commissioner Romeo D. Lumagui, Jr. said Thursday, March 16, that taxpayers and businesses caught with illegal receipts...