Finance Secretary Ralph G. Recto vowed to enhance government enforcement actions against tax evaders to provide support to the Bureau of Internal Revenue (BIR) in boosting its tax collections. At the BIR’s National Tax Campaign Kick-off event, Recto has assured the unwavering support of the...

Vlogger and businesswoman Rosmar Tan has recently shared her encounters with the tax authorities, shedding light on her struggles with the Bureau of Internal Revenue (BIR) not once, but twice. Tan bravely admitted that her interactions with the BIR had been quite stressful before, particularly when...

The Bureau of Internal Revenue (BIR) has announced that the agency has 1,518 job vacancies that urgently require staffing. According to BIR Commissioner Romeo Lumagui Jr., these positions span across various roles including administrative aides, statisticians, revenue and intelligence...

The Bureau of Internal Revenue (BIR) has added 21 medicines for conditions like diabetes and hypertension to the list of those exempt from value-added tax (VAT). BIR Commissioner Romeo Lumagui Jr. said that two cancer drugs, five for diabetes, two for high cholesterol, five for hypertension, four...

BIR Commissioner Romeo D. Lumagui Jr. received the prestigious "Business Enabler Award" from the Philippine Chamber of Commerce and Industry - Quezon City (PCCI-QC) last Jan. 25 during the latter's induction and turnover ceremovies. The award is given to Commissioner Lumagui for his significant...

The Bureau of Internal Revenue (BIR) has cautioned social media influencers considering tax evasion, emphasizing that the agency has mechanisms to accurately ascertain the earnings of all individuals involved. BIR Commissioner Romeo D. Lumagui Jr. said the bureau has various methods to effectively...

The Bureau of Internal Revenue (BIR) vowed to focus on addressing the common tax violations frequently encountered by business establishments. After conducting a two-day tax compliance verification drive (TCVD), the BIR compiled a list of prevalent tax compliance issues observed during visits to...

The Bureau of Internal Revenue (BIR) is intensifying its tax efficiency by actively reaching out to business owners to discuss their tax responsibilities, with the goal of enhancing its collection performance for the year. The Nationwide Tax Compliance Verification Drive (TCVD), which runs from...

Bureau of Internal Revenue (BIR) Commissioner Romeo Lumagui Jr. said that imposing withholding tax on online transactions will not increase the price of goods in online marketplaces. As per the BIR Revenue Regulations No. 16-2023, withholding tax will be imposed on one percent of the gross...

The Bureau of Internal Revenue (BIR) has increased the threshold for value-added tax (VAT) exemption on the sale of residential properties. In a statement, BIR Commissioner Romeo Lumagui Jr. said on Wednesday, Jan. 17, that house and lots, as well as other residential properties priced at P3.6...

With the implementation of a law aimed at simplifying tax payments, the Bureau of Internal Revenue (BIR) has announced that it will no longer require business taxpayers to pay the annual registration fee (ARF). In a notice posted on its website and signed by BIR Commissioner Romeo D. Lumagui, Jr.,...

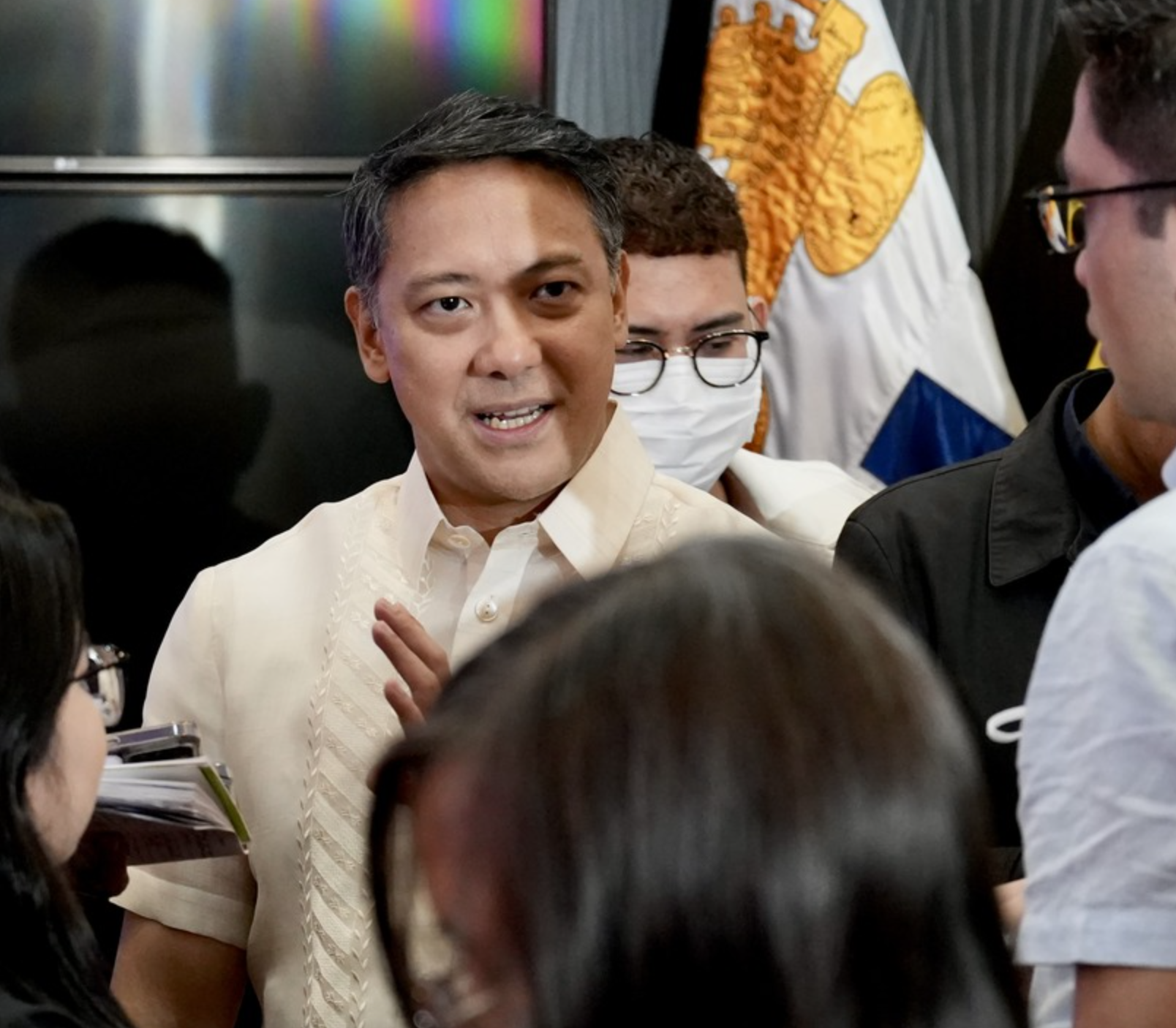

The Department of Finance (DOF) is urging the Bureau of Internal Revenue (BIR) to not only meet but surpass its record collection target for this year in order to provide additional funding for the priority programs and projects of the Marcos administration. In a statement released on Tuesday, Jan....