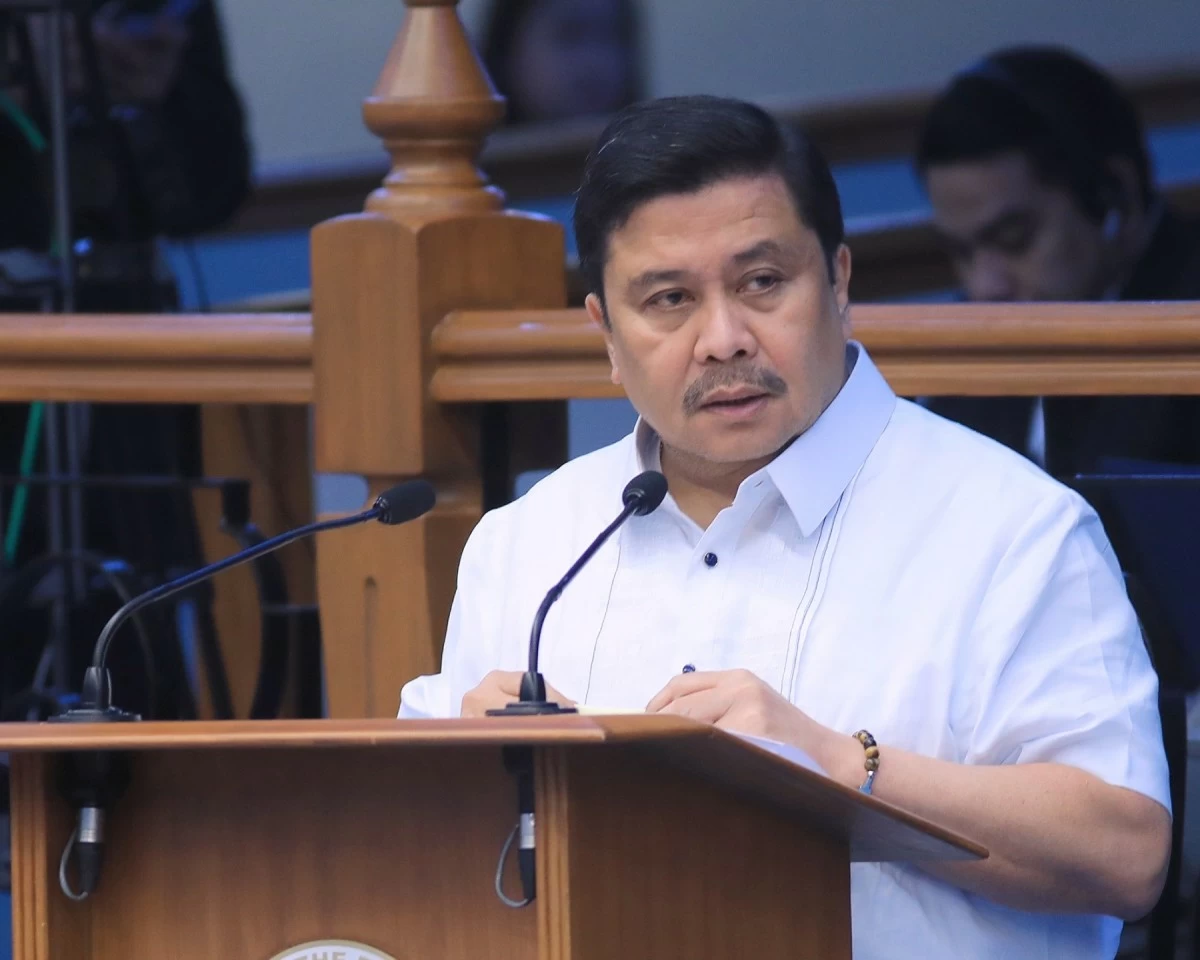

Senate Majority Leader Juan Miguel “Migz” Zubiri has joined the move to abolish the travel tax and lift what he described as an unnecessary financial burden on millions of Filipinos flying abroad. Zubiri filed Senate Bill No. 1793 titled “Travel Tax Abolition Act of 2026,” which was...

Senator Joel Villanueva on Wednesday, February 11 expressed his support to calls that seek the abolition of the travel tax, saying the policy has long outlived its purpose and hindered the mobility based on financial capacity of Filipinos. Villanueva said he is optimistic that the measure would...

President Marcos has approved 21 priority measures up for passage in June this year, including the proposal to abolish travel tax, Malacañang said. Marcos met with the Legislative Executive Development Advisory Council (LEDAC) on Tuesday morning, Feb. 10, to discuss the priority bills that are...

A measure in the Senate seeks to offer bigger, fairer, and more rational rewards for informants who would expose large-scale violators of the country’s tax and customs laws. Senator Jinggoy Estrada, who filed Senate Bill No. 1011, said that it aims to strengthen the fight against tax fraudsters...

To support and ease the financial burdens on small businesses, the local government of Marikina has approved 100 percent tax relief for qualified sari-sari stores and carinderias for the tax year 2026, while also granting full amnesty on interest and surcharges for delinquent real property...

Senator Raffy Tulfo called anew for the passage of a measure seeking to remove the travel tax being imposed on Filipinos flying economy class to any part of the world. Tulfo, who chairs the Senate Committee on Public Services, filed Senate Bill (SB) No. 88, which highlights how the travel tax...

Under Article XIII, Section 9 of the 1987 Constitution, the State is mandated to make decent housing and basic services” available to underprivileged and homeless citizens at an affordable cost. However, the wanton increase in Real Property Taxes (RPT)—which have surged by as much as 2,300...

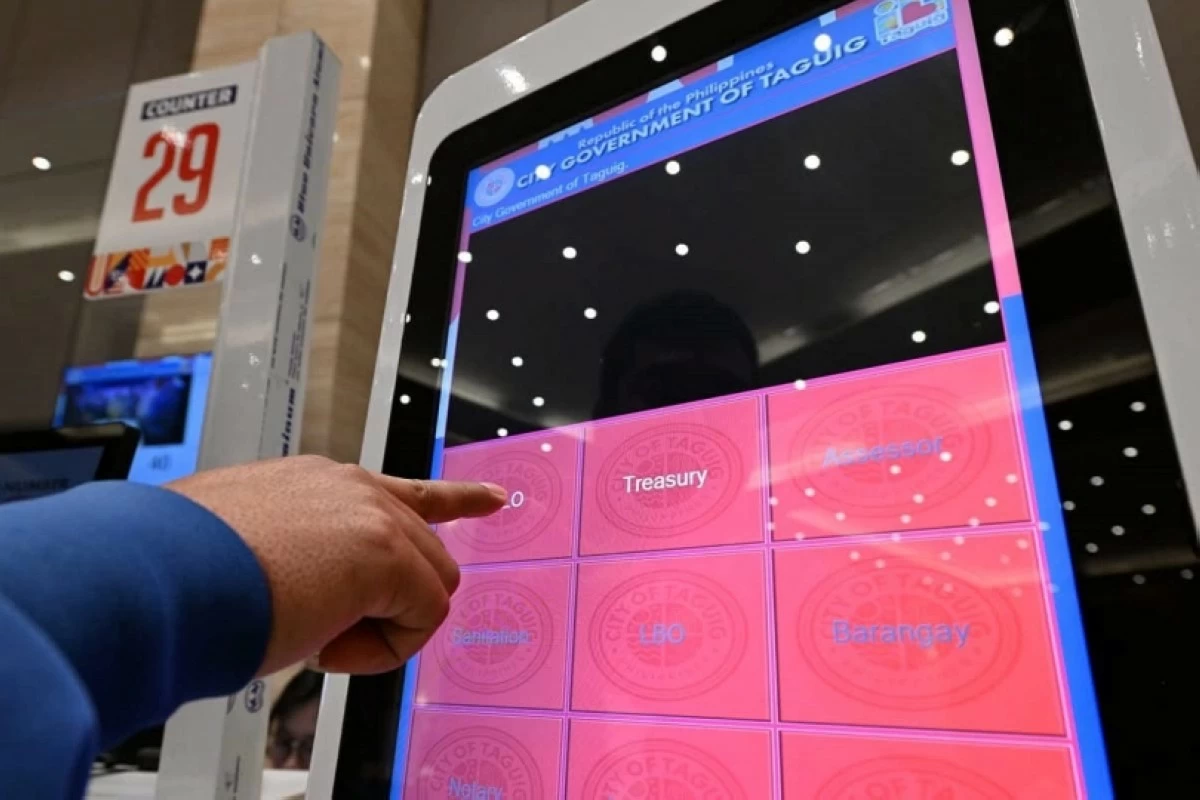

Real property owners in Taguig need to pay a higher tax starting January. The Taguig City government announced that a new city ordinance was approved that imposes an increase of 0.25 percent in real property tax (RPT) that will take effect on Jan. 1 next year. On Dec. 15, the Taguig City...

The Washington-based multilateral lender International Monetary Fund (IMF) sees the narrowing of Philippine debt relative to the size of the economy being delayed until it reaches 60 percent, with the proposed revenue-generating general tax amnesty (GTA) among the measures seen as offering limited...

President Marcos has appointed Associate Justice Ma. Belen Ringpis-Liban as the new Presiding Justice of the Court of Tax Appeals (CTA), effective Dec. 17, 2025, Malacañang announced. In a statement on Wednesday evening, Dec. 17, Presidential Communications Office Undersecretary Claire Castro said...

Senator Jinggoy Ejercito Estrada has filed a bill seeking to extend the estate tax amnesty for another three years. The program ended last June 14, 2025, but Estrada, in filing Senate Bill No. 1488, sought to extend it until June 14, 2028 to give Filipino families more time to settle...

TACLOBAN CITY — Southern Leyte Rep. Christopherson Yap has filed House Bill 6702 that proposes to abolish the estate tax under the National Internal Revenue Code. The “Estate Tax Abolition Act” aims to help families make better use of the properties left by their loved ones by removing the...