Real property owners in Taguig need to pay a higher tax starting January.

The Taguig City government announced that a new city ordinance was approved that imposes an increase of 0.25 percent in real property tax (RPT) that will take effect on Jan. 1 next year.

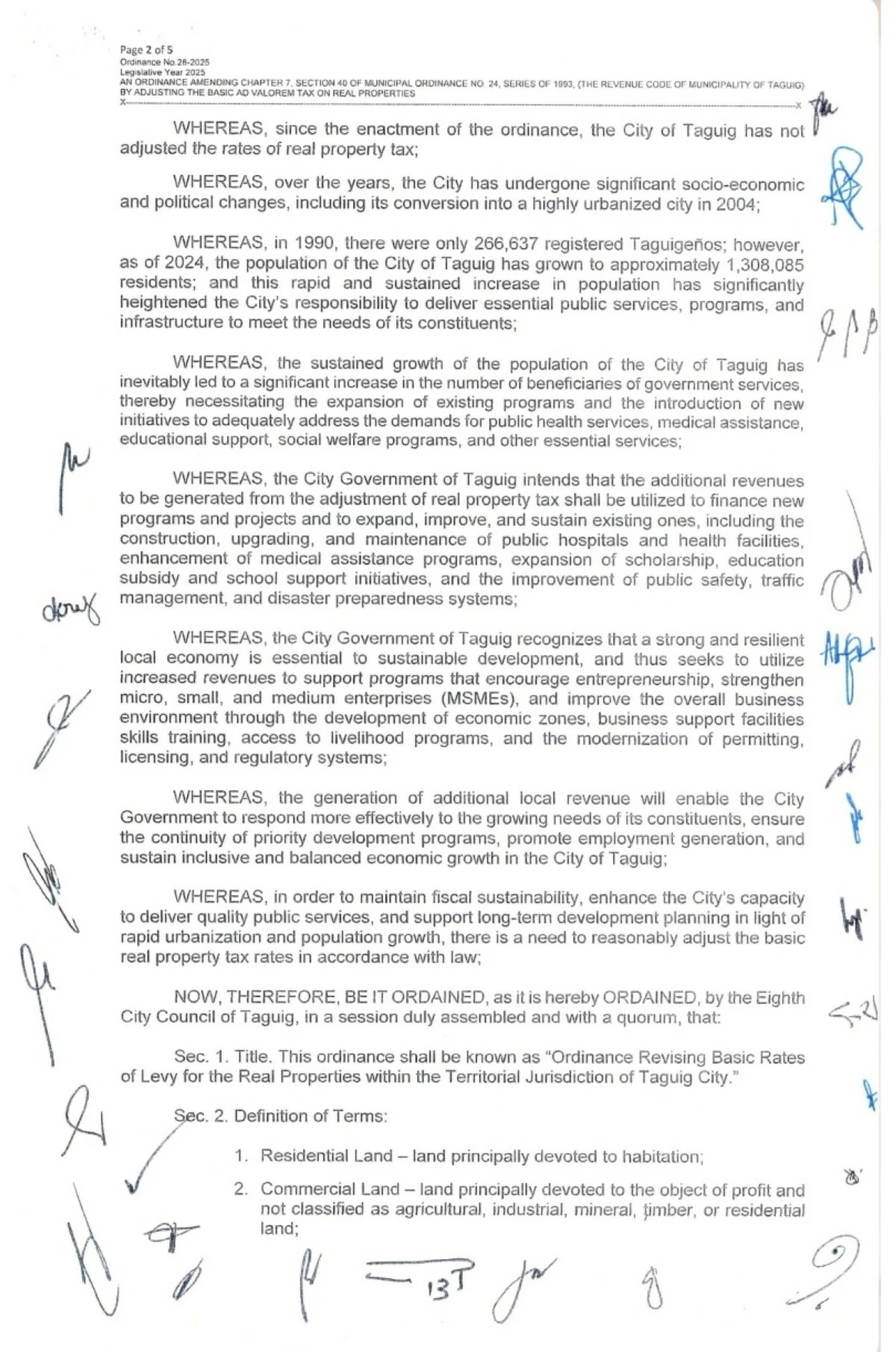

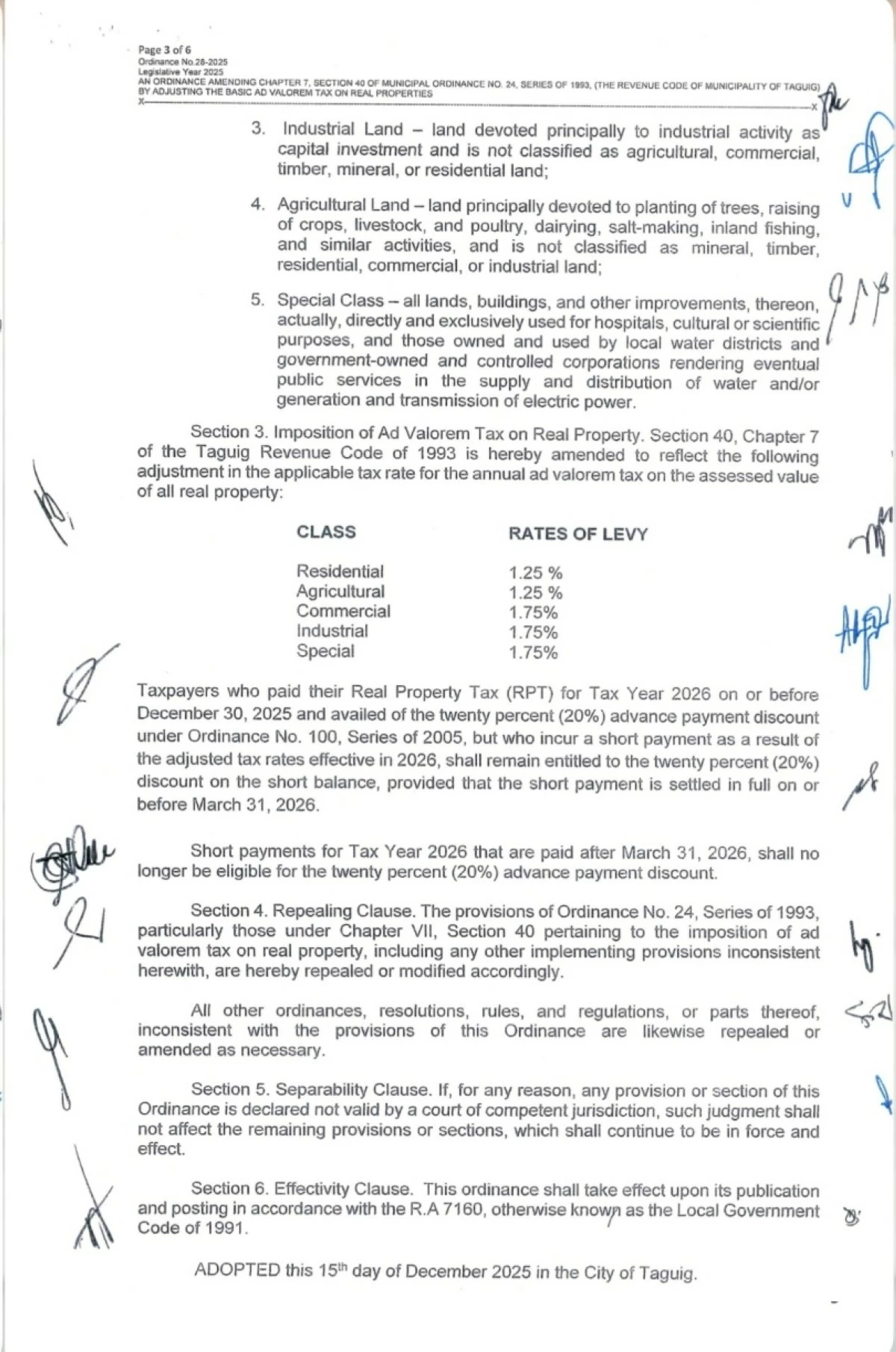

On Dec. 15, the Taguig City Council approved Ordinance No. 28 or an "Ordinance Revising Basic Rates of Levy for the Real Properties within the Territorial Jurisdiction of Taguig City."

Under the new ordinance, which was sponsored by all 24 councilors, Sangguniang Kabataan president and Liga president, real property owners need to pay the following taxes on the assessed values starting Jan. 1, 2026:

CLASS

Residential - 1.25 percent (from the old rate of 1 percent)

Agricultural - 1.25 percent (from the old rate of 1 percent)

Commercial - 1.75 percent (from the old rate of 1.5 percent)

Industrial - 1.75 percent (from the old rate of 1.5 percent)

Special - 1.75 percent (from the old rate of 1.5 percent)

They also need to pay an additional 1 percent for the Special Education Fund (SEF).

“Taxpayers who paid their Real Property Tax (RPT) for Tax Year 2026 on or before December 30, 2025 and availed of the twenty percent (20%) advance payment discount under Ordinance No. 100, Series of 2005, but who incur a short payment as a result of the adjusted tax rates effective in 2026, shall remain entitled to the twenty percent (20%) discount on the short balance, provided that the short payment is settled in full on or before March 31, 2026,” according to the new ordinance.

It added, “Short payments for Tax Year 2026 that are paid after March 31 , 2026, shall no longer be eligible for the twenty percent (20%) advance payment discount.”

This is the first time since 1993 that Taguig has adjusted the rates for real property tax.

The ordinance stated “in 1990, there were only 266,637 registered Taguigenios; however, as of 2024, the population of the City of Taguig has grown to approximately 1,308,085 residents; and this rapid and sustained increase in population has significantly heightened the City's responsibility to deliver essential public services, programs, and infrastructure to meet the needs of its constituents.”

It added that “the City Government of Taguig intends that the additional revenues to be generated from the adjustment of real property tax shall be utilized to finance new programs and projects and to expand, improve, and sustain existing ones, including the construction, upgrading, and maintenance of public hospitals and health facilities, enhancement of medical assistance programs, expansion of scholarship, education subsidy and school support initiatives, and the improvement of public safety, traffic management, and disaster preparedness systems.”

The Taguig City government announced a 20 percent discount for those who will pay their 2026 real property tax on or before Dec. 29.

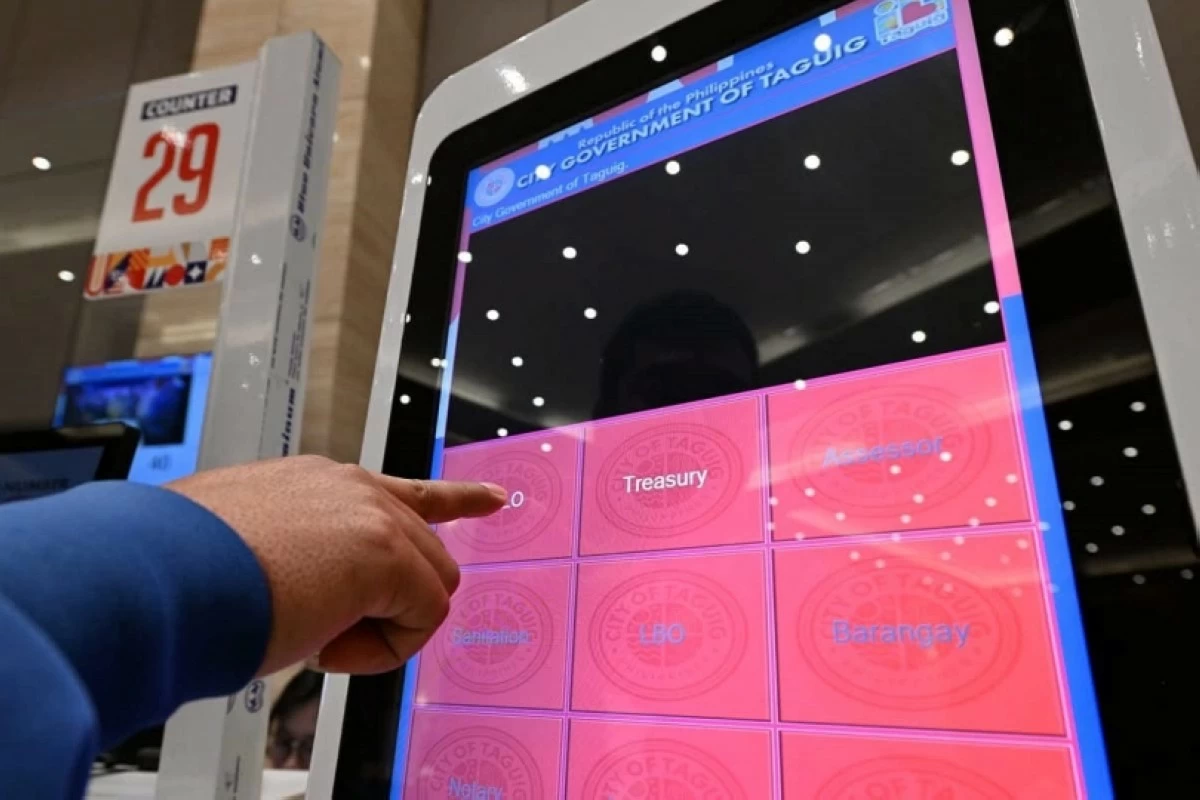

Here are the steps, according to the city government:

DISCOUNTED REAL PROPERTY TAXES

Pay your 2026 Real Property Taxes on or before December 29, 2025 to get a 20% discount.

You may pay at

SM Aura Satellite Office - 10h Floor, Satellite Office, SM Aura Tower, McKinley Parkway, Fort Bonifacio

Taguig City Hall Auditorium - 2nd Floor, Main Building, Gen. Luna St., Barangay Tuktukan

The payment centers will be open from Monday to Friday from 7 a.m. to 4 p.m.

From December 1 to 29, the payment centers will be open also on Saturdays, from 7 a.m. to 4 p.m.

Requirements

Copies of latest RPT Official Receipt (O.R.) and Tax Declaration (T.D.). To obtain a copy of your latest TD, please proceed to the City Assessor's window.

Steps

1. Present your RPT O.R. and T.D. to the biller to get your Notice of Assessment (NOA).

2. Present your NOA to the cashier and pay.

Mode of Payment

Copies of latest RPT Official Receipt (O.R.) and Tax Declaration (T.D.). To obtain a copy of your latest TD, please proceed to the City Assessor's window.

• Cash

• Credit/Debit Card

• Manager's Check or Cashier Check (???????????????????????????? ???????? ???????????? ???????????????????? ????????: ???????????????????????? ???????????????? ????????????????????????????????????)

• Other payment channels, when available

For more information, contact City Treasurer's Office at (02) 8640 5597 Facebook: City Treasurer's Office - City of Taguig

2026 REAL PROPERTY TAX FOR EMBO BARANGAYS

Taguigeños from EMBO barangays pay your Real Property Tax (RPT) with 2 easy steps!

Step #1: Bring your Makati Tax Declaration (T.D.) or latest Makati official receipt (O.R.) to the Taguig City Assessor’s Office and obtain a copy of your Taguig T.D., which will be available within 1–3 days upon request.

The office is located at 2nd Floor, Taguig City Hall, Gen. Luna St., Barangay Tuktukan.

Step #2: Bring your new Taguig T.D. and latest RPT O.R., get a Notice of Assessment, and pay the applicable taxes.

You may pay at either of the following RPT payment centers:

You may pay at

SM Aura Satellite Office - 10h Floor, Satellite Office, SM Aura Tower, McKinley Parkway, Fort Bonifacio

Taguig City Hall Auditorium - 2nd Floor, Main Building, Gen. Luna St., Barangay Tuktukan

The payment centers will be open from Monday to Saturday from 7 a.m. to 4 p.m.

Modes of Payment

• Cash

• Credit/Debit Card

• Manager’s Check or Cashier Check (payable to the order of Taguig City Treasurer)

• Other payment channels, when available