The Bureau of Internal Revenue (BIR) on Tuesday, April 29, filed before the Department of Justice (DOJ) tax evasion complaints involving P8.7 billion against unregistered importers and distributors of vape products in the country. "We have warned all those who want to enter the vape industry...

BIR Commissioner Romeo D. Lumagui Jr. Bureau of Internal Revenue (BIR) Commissioner Romeo Lumagui Jr. is confident that the government’s main tax agency will meet its ₱3.23 trillion collection goal this year after it exceeded its first quarter targets. “Based on the progress of...

LTO chief, Assistant Secretary Vigor D. Mendoza II The Land Transportation Office (LTO) collected at least P8.3 billion in revenue in the first three months of this year. LTO chief, Assistant Secretary Atty. Vigor D. Mendoza II said the...

BIR Commissioner Romeo D. Lumagui, Jr. The Bureau of Internal Revenue (BIR) is reminding taxpayers to file and pay their 2024 income tax returns (ITR) by the April 15, 2025 deadline to prevent incurring penalties. In a statement on Friday, March 28, BIR Commissioner Romeo D. Lumagui, Jr. said that...

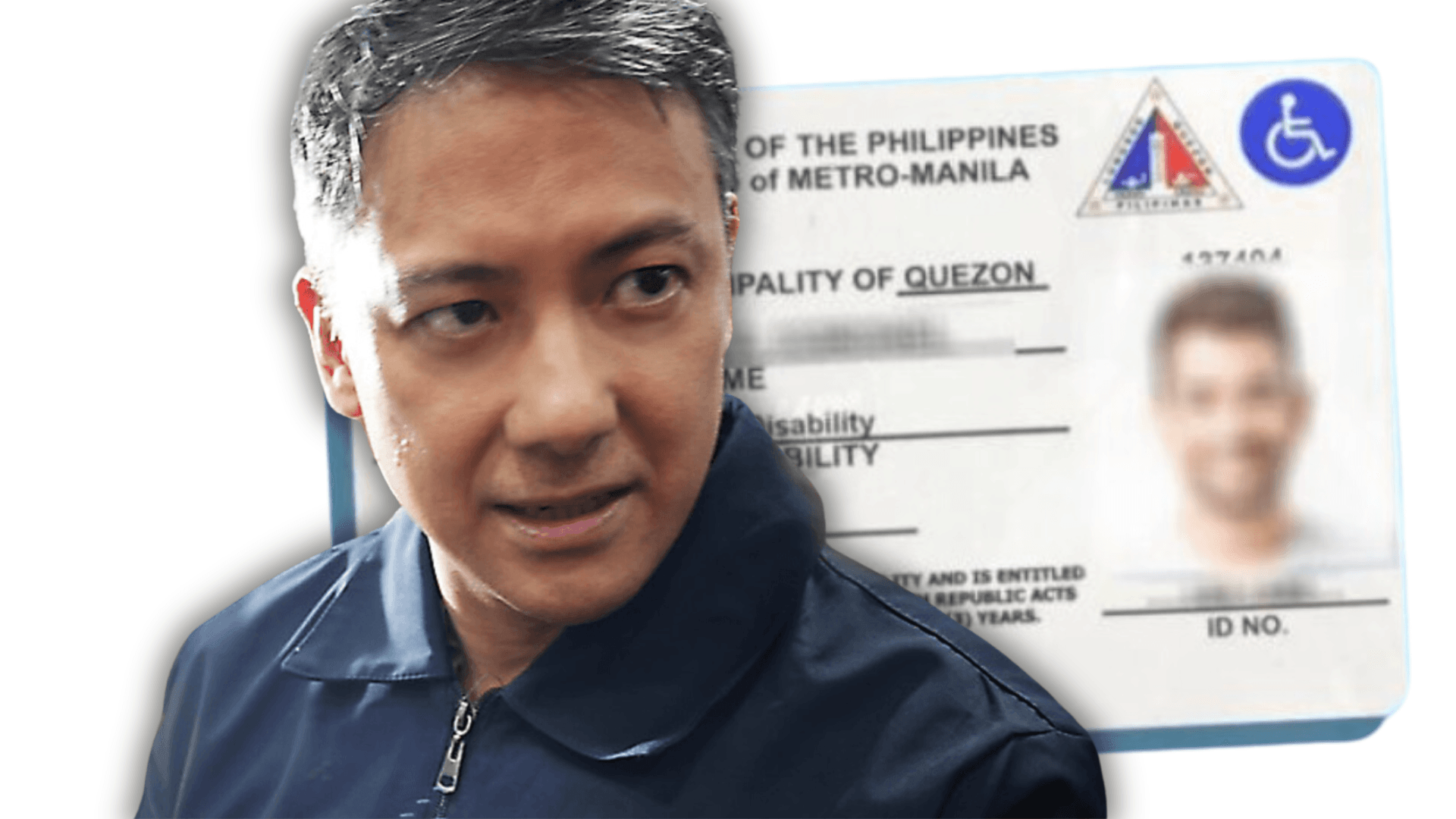

The Bureau of Internal Revenue (BIR) is launching a nationwide crackdown on fake Persons with Disability (PWD) identification cards to protect legitimate PWD privileges and prevent government revenue losses. In a statement, BIR Commissioner Romeo D. Lumagui Jr. expressed that the bureau maintains a...

The Bureau of Internal Revenue (BIR) has secured a major victory in a ₱5.7-billion tax evasion case after the Department of Justice (DOJ) ruled in its favor. The case, which the BIR filed in February, resulted in the DOJ filing two criminal charges with the Court of Tax Appeals (CTA) on March 13,...

BUTUAN CITY – The Bureau of Internal Revenue-10 this week spearheaded the destruction of smuggled cigarettes valued at P156 million in Northern Mindanao. BIR officials said the move is part of the nationwide crackdown against tax evasion and underscores their commitment to enforcing tax...

The Bureau of Internal Revenue (BIR) bared that it has created a task force to audit social media personalities' tax compliance even as a House probe discovered that some of them supposedly rake in millions worth of earnings a day. Lawyer Ron Mikhail Uy, who represented the BIR during third...

The Court of Tax Appeals (CTA) has ordered a businessman to pay the Bureau of Internal Revenue (BIR) P6.6 million in deficiency income and value-added taxes of his company for calendar year 2016. Redentor Agpuldo Tagala, proprietor of 7th Concept Trading and 7C Construction, filed a petition for...

To increase government revenues, tax authorities such as the bureaus of Internal Revenue (BIR) and of Customs (BOC) in the Philippines should set their sights on bigger enterprises and other entities that are difficult to tax, according to an Asian Development Bank (ADB) report. “Focus on larger...

Malacañang believes that the Philippines' increasing tourism revenues are proof of the improved peace and order situation in the country, contrary to claims of the administration's critics. Communications Undersecretary Claire Castro (RTVM) Palace Press Officer and Communications Undersecretary...

The Court of Tax Appeals (CTA) has denied for lack of merit the petition of Green Cross, Inc. which sought the refund of P117.9 million in alleged erronously paid taxes to the Bureau of Internal Revenue (BIR). From Nov. 16, 2018 to Dec. 17, 2019, Green Cross paid excise taxes amounting to...