BIR files before DOJ P8.7-B tax evasion charges vs 'illicit importers, distributors' of vape products

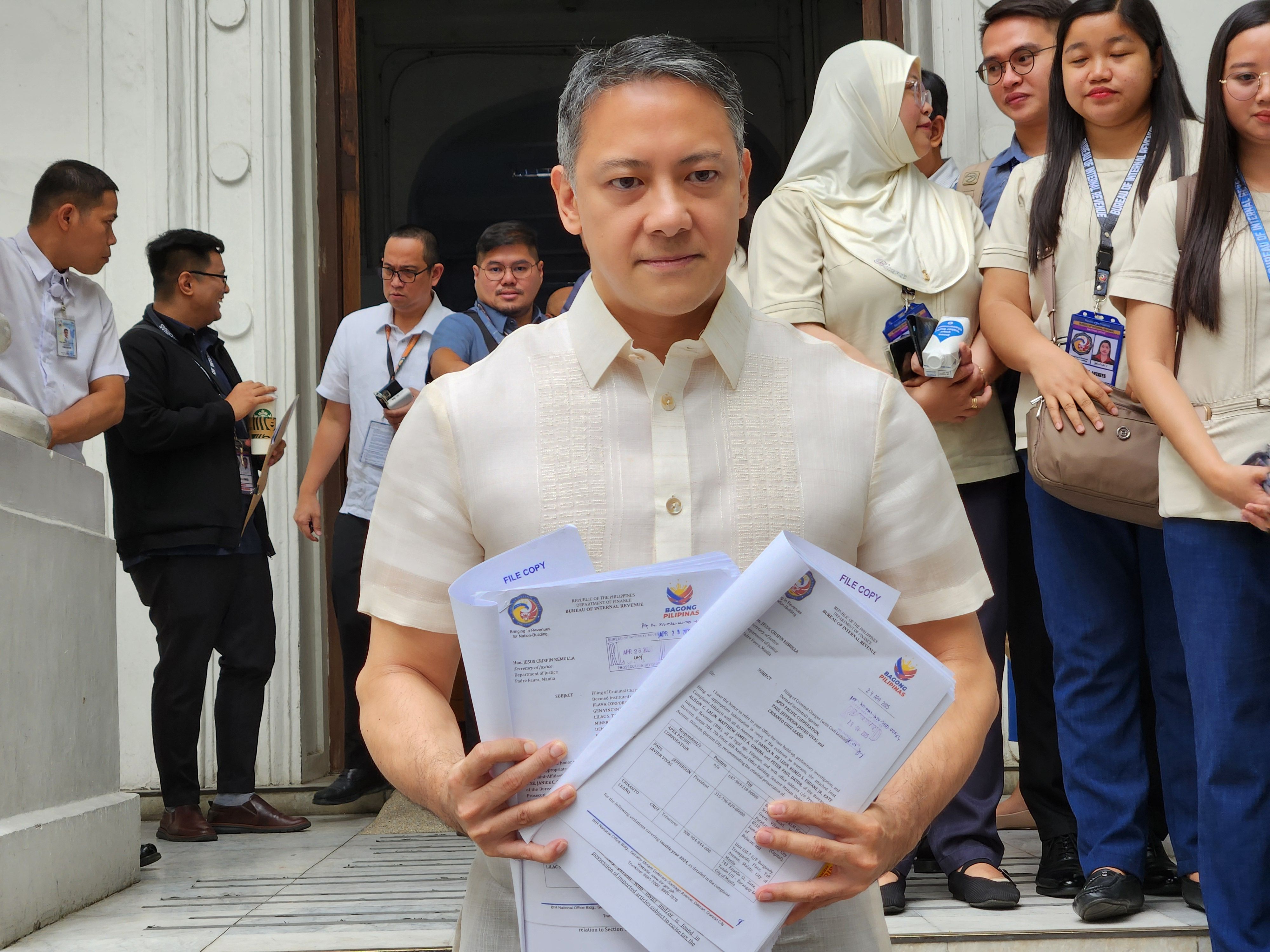

The Bureau of Internal Revenue (BIR) on Tuesday, April 29, filed before the Department of Justice (DOJ) tax evasion complaints involving P8.7 billion against unregistered importers and distributors of vape products in the country.

"We have warned all those who want to enter the vape industry to register with the BIR and pay proper taxes," declared BIR Commissioner Romeo D. Lumagui who led the filing of the complaints.

Lumagui said that those charged were the corporate officers of brand names Flava, Denkat, and Flare.

The charges filed were for violations of the National Internal Revenue Code of 1997 (NIRC), including unlawful possession of vape products without payment of excise tax under Section 263, tax evasion under Section 254, and failure to file excise tax returns under Section 255.

“Expect more criminal cases to be filed against illicit vape traders,” declared Lumagui.

“Whether your business is large or small, as long you sell illicit vape, you will be imprisoned,” he warned.

At the same time, Lumagui said that celebrities and influencers working with illicit vape traders will also not be spared from prosecution.

He reminded that promoters and advertiser should only promote legitimate and tax compliant products.

He then asked the public to report all stores with illicit vape products.