S&P Global reported that credit growth across emerging markets (EMs) in Asia has generally softened in the first six months of the year, except in the Philippines and Vietnam, where lending has notably picked up pace. According to debt watcher S&P Global, loans from major banks, including universal...

As part of a shared mission to make financial education accessible to more Filipinos, the Bangko Sentral ng Pilipinas (BSP) and BDO Foundation launched six new financial education e-learning modules. These modules complete the target of both organizations to produce a total of nine that are...

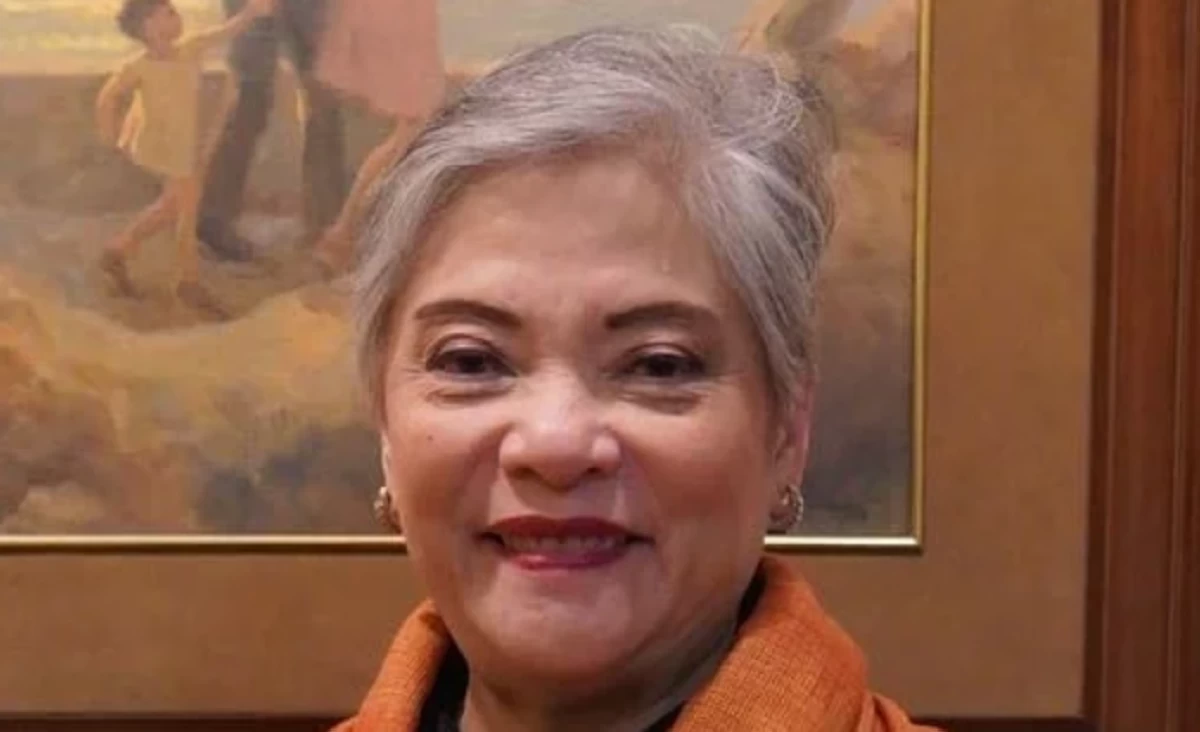

Citing still favorable inflation data, President Marcos’ chief economic manager said the Bangko Sentral ng Pilipinas (BSP) could proceed with delivering two quarter-point cuts in the key interest rate by year-end even if the United States (US) Federal Reserve (Fed) decides to pause its easing...

Digital payment transactions via PESONet and InstaPay increased by 51.5 percent to ₱2 trillion in June this year, from ₱1.32 trillion in the same month last year, the Bangko Sentral ng Pilipinas (BSP) reported. This represents a ₱680-billion increase from June 2024, according to the BSP data....

Shari’ah-compliant bond issuances are being pushed by top stakeholders of the financial market as more offerings of such debt instruments could bolster the country’ diversified financial market, according to the Bangko Sentral ng Pilipinas (BSP) “Sukuk issuances will spur the further growth...

The reversal of the Philippines’ balance of payments (BOP) position to a surplus in June brought down the country’s BOP deficit by 3.5 percent to $5.6 billion in the first six months of 2025. Data from the Bangko Sentral ng Pilipinas (BSP) showed that the BOP, which reflects the country’s ...

Citing serious and persistent violations of anti-money laundering (AML) regulations, the Bangko Sentral ng Pilipinas’ (BSP) Monetary Board (MB) has revoked the licenses of three money changer firms. Based on the BSP’s statement released on Wednesday, July 16, the three firms are the Prince...

Philippine thrift banks are bracing for a “very expensive” transition to digitalization as the Bangko Sentral ng Pilipinas (BSP) prepares to issue new digital centricity guidelines designed to ensure a level playing field between conventional and digital-first banks. On the sidelines of the the...

Cash sent home by Filipinos working and living overseas continued to increase in May on the back of sustained inflows from both land- and sea-based workers, according to the Bangko Sentral ng Pilipinas (BSP). Money sent through banks by overseas Filipinos (OFs) increased by 2.9 percent to $2.66...

While several big-ticket government projects in the pipeline threaten to widen the Philippines’ current account deficit and put pressure on the trade balance, Germany-based Deutsche Bank said this could ultimately benefit the country’s economic growth and strengthen the peso in the long run....

The Bangko Sentral ng Pilipinas (BSP) is seeking to implement stricter rules on online gambling payment services, including a ban on lending features and redirect links on payment platforms, to curb the social and financial risks linked to gambling. “It is imperative to ensure that digital...

With the Philippine peso emerging as an outperformer among Asian currencies following the United States’ (US) tariff hike, Japanese financial giant MUFG has maintained its forecast that the local currency will continue to strengthen in the fourth quarter of 2025 through next year. Last Friday,...