Infra-fueled trade deficit to temporarily hit Philippines but to lift economic growth, peso over time

By Derco Rosal

At A Glance

- While several big-ticket government projects in the pipeline threaten to widen the Philippines' current account deficit and put pressure on the trade balance, Germany-based Deutsche Bank said this could ultimately benefit the country's economic growth and strengthen the peso in the long run.

While several big-ticket government projects in the pipeline threaten to widen the Philippines’ current account deficit and put pressure on the trade balance, Germany-based Deutsche Bank said this could ultimately benefit the country’s economic growth and strengthen the peso in the long run.

“With [the Department of Economy, Planning, and Development’s (DEPDev)] list showing a pipeline of projects ahead, the period of elevated import demand is likely to sustain for several years ahead,” Deutsche Bank Research said in its Asia corporate newsletter for the third quarter of 2025, released on Monday, July 14.

It noted that the Philippines’ current account deficit “has been widening” as infrastructure spending picks up, leading to a surge in imports of capital goods. Big-ticket projects including the Metro Manila Subway, North-South Commuter Railway, and New Manila Airport are already under construction.

For Deutsche Bank Research, accelerating investments is a positive move which could benefit both the country’s economic growth and the local currency over time.

“We are certainly strongly supportive of accelerating investments as it improves productivity and long-term prospects of both the country and the currency,” Deutsche Bank Research said.

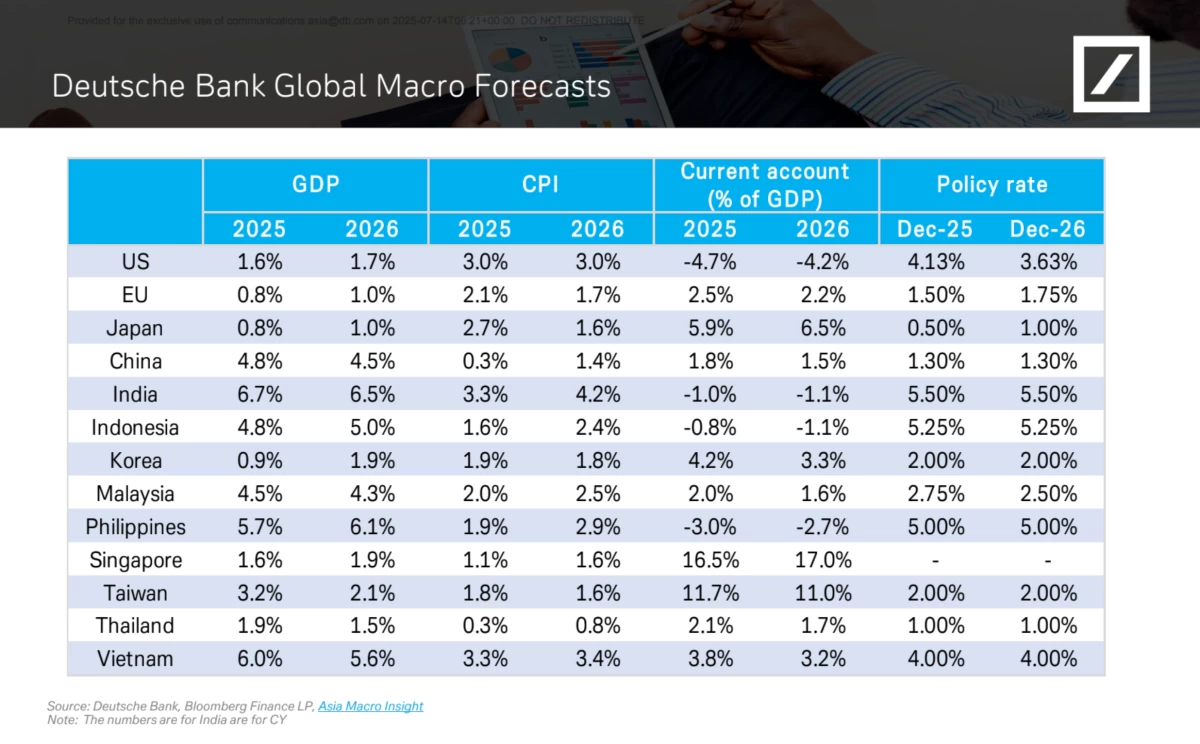

For this year, Deutsche Bank has projected the Philippine economy to expand by 5.7 percent, unchanged from the lower-than-expected gross domestic product (GDP) growth rate last year. This would fall comfortably within the downscaled growth target of 5.5 to six percent for the year.

Further, Deutsche Bank sees the local economy breaching the six-percent growth level by next year, at 6.1 percent.

According to the latest data from the Bangko Sentral ng Pilipinas (BSP), the country’s current account deficit doubled to $4.2 billion in the first three months of 2025 from $2.1 billion a year earlier.

The BSP said this reflects the growing trade gap, with imports rising faster than exports. The current account, which tracks the country’s net dollar earnings, includes trade in goods and services, income from overseas Filipino workers (OFWs), and other external income sources.

Last year, the deficit stood at $17.5 billion, or 3.8 percent of GDP—larger than the $12.4 billion, or 2.8 percent of GDP, in 2023.

The BSP had earlier projected the current account deficit would further widen to $19.8 billion, or 3.9 percent of GDP, this year. In contrast, Deutsche Bank expects this gap to narrow to just three percent of the country’s GDP this year, and to further decline to 2.7 percent by 2026.

“One key balance of payments (BOP) factor to consider, though, is the funding profile of the projects: which appears to be from overseas development financing and/or overseas FX [foreign exchange] bonds. Therefore, the basic BOP deficit should not widen as much as the current account deficit will,” Deutsche Bank Research said, referring to the loans from bilateral partners and multilateral lenders as well as offshore fund-raising by the government.

It also expects the central bank to cut its key interest rate by another 25 basis points (bps) to five percent by the end of the year, from the current rate of 5.25 percent.

Meanwhile, “near-term FX pressure is likely to show up, with the BSP already signaling another two rate cuts later in the year,” Deutsche Bank Research said.

It noted that the peso has been performing better than what the country’s economic fundamentals would suggest, mainly because traders have been riding the currency’s recent upward momentum.

“However, recent reversal in the currency’s momentum profile—and higher tariff rates proposed by the US at 20 percent in the July 9 letter than even the ‘Liberation Day’ rate of 17 percent—likely portends this period coming to an end,” it said.