Thrift banks face costly digital leap as BSP levels playing field

By Derco Rosal

Philippine thrift banks are bracing for a “very expensive” transition to digitalization as the Bangko Sentral ng Pilipinas (BSP) prepares to issue new digital centricity guidelines designed to ensure a level playing field between conventional and digital-first banks.

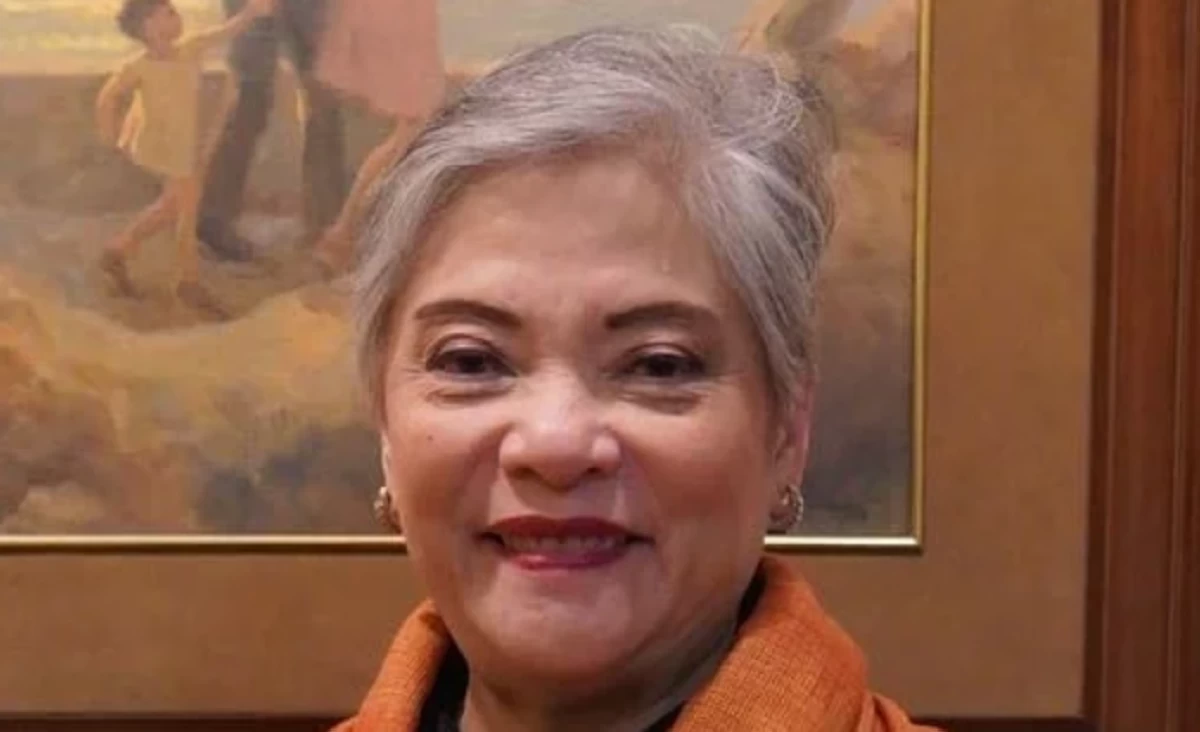

On the sidelines of the the annual convention of thrift banks on Tuesday, July 15, Chamber of Thrift Banks (CTB) President Mary Jane A. Perreras noted that while the transition is underway and unavoidable, the cost will be significant.

Perreras added that cost estimates vary depending on the specific digital solutions prioritized by each bank, such as mobile banking, and the involvement of fintech providers.

Perreras stressed that while specific figures are hard to pinpoint, digitalization will definitely necessitate a substantial budget.

BSP Deputy Governor Chuchi G. Fonacier said the new guidelines aim to establish indicators for assessing the digital centricity of thrift, rural, and cooperative banks, ensuring a proportionate application of prudential requirements.

Fonacier explained that the guidelines seek to level the playing field, as conventional banks are also becoming digitally centric.

As a result, those engaging in more digital operations will likely face higher capital requirements, with the guidelines subject to a phased implementation of stricter regulatory standards applicable to digital banks, as determined by the BSP.

In addition to the digital centricity guidelines, Fonacier noted that the central bank is also drafting guidelines on the ethical use of artificial intelligence (AI) in the financial sector.

These AI guidelines will focus on responsible deployment, improving accuracy in decision-making, and managing algorithmic bias, with bank management remaining responsible for decisions made based on AI-generated information while upholding data privacy and confidentiality.