United States-imposed (US) reciprocal tariffs, a three-month pause of which is concluding 10 days from now, caused a decline in the confidence index of businesses in the second quarter of the year, while Filipino consumers’ confidence was deeply hurt by the insufficient income and fewer jobs...

Prices for housing units in the Philippines rose at a much slower pace in the first three months of the year, although costs in Metro Manila posted a double-digit surge. Data from the Bangko Sentral ng Pilipinas (BSP) showed on Friday, June 27, that the nationwide Residential Property Price Index...

Exactly 34 days from now, a change in the stewardship of the Bangko Sentral ng Pilipinas ' (BSP) Financial Supervision Sector (FSS) is upon us, as its current head reaches the mandatory retirement age. It feels like just yesterday she walked into the corridors of what was then known as the...

Downward inflation across the region would allow Asian central banks, including the Bangko Sentral ng Pilipinas (BSP), to cut interest rates further until year-end, according to the think tank Oxford Economics. “Inflation in Asia is approaching or has already fallen below the lower bound of...

Philippine economic growth would likely further slow in the next two years to remain below the government’s more ambitious annual targets amid a global deceleration fueled by trade and geopolitical tensions, according to the Washington-based Institute of International Finance (IIF). A June 25...

The Bangko Sentral ng Pilipinas (BSP) is calling for targeted anti-counterfeiting campaigns in shopping malls, supermarkets, and wet markets after these locations emerged as the main sources of fake banknotes and coins recovered last year. Data from the 2024 BSP annual report published in June...

The Economist Intelligence Unit (EIU) still expects jumbo interest rate cuts by the Bangko Sentral ng Pilipinas (BSP) for the rest of 2025 as monetary authorities are seen prolonging the easing cycle. “We expect the BSP to continue cutting rates at each of its remaining meetings this year in...

A bill supported by United States (US) President Donald Trump, currently pending approval in the US Senate, would likely only minimally reduce remittances to the Philippines as more Filipinos who used to work overseas have returned home, according to Deutsche Bank Research. In a June 20 report,...

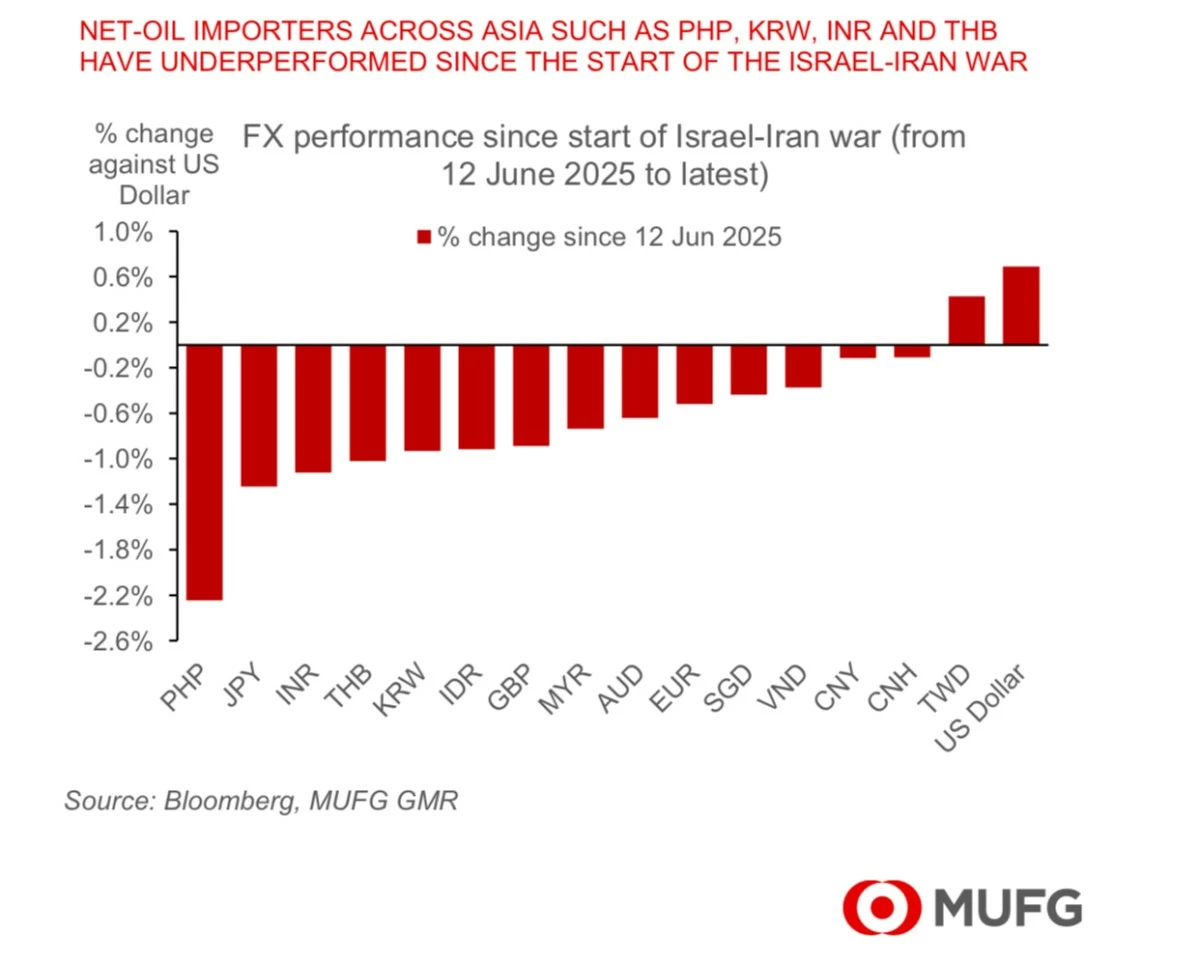

A dovish Bangko Sentral ng Pilipinas (BSP) may be constrained by skyrocketing global oil prices, which would further weaken the peso and could force a pause from further interest rate cuts, foreign banks said. In a June 23 report, MUFG Global Markets Research said that if world oil prices rise...

Debt watcher Moody’s Ratings said that the Bangko Sentral ng Pilipinas’ (BSP) continued easing of key borrowing costs would cushion the local economy amid a challenging external environment, driven especially by the persisting crossfire between Israel and Iran. “Continued monetary easing will...

The real estate exposure of banks and their trust units at end-March, fell to 19.41 percent of the total loan portfolio, excluding interbank loans, down from 20.31 percent the previous year. Based on the latest data from the Bangko Sentral ng Pilipinas (BSP), the overall property exposure ratio has...

The Philippine peso continued to depreciate the worst among Asian currencies since the Israel-Iran war started, according to Japanese financial giant MUFG Bank Ltd. In a June 20 report, MUFG Global Markets Research noted that last week, “we saw a mild rebound of the United States (US) dollar (DXY...