The Bureau of Internal Revenue (BIR) has introduced the Taxpayers Registration Related Application Portal (TRRAP), offering taxpayers an electronic avenue to submit registration-related applications to their respective revenue district offices (RDOs). Launched on Oct. 16, TRRAP encompasses a wide...

The Bureau of Internal Revenue (BIR) has stated that the Food and Drug Administration (FDA) lacks the authority to determine the taxation status of food products. BIR Commissioner Romeo D. Lumagui, Jr. clarified in Revenue Memorandum Circular 112-2023 that the FDA's role, according to its charter,...

The Bureau of Internal Revenue (BIR) has instructed importers, manufacturers, and distributors of perfumes, colognes, and toiletry products to settle an excise tax liabilities totaling over P604 million. Informed sources disclosed that Commissioner Romeo D. Lumagui Jr. issued this directive...

The United Registrar System (URS) of the International Standard Organization (ISO) has bestowed high accolades upon the Laguna-Quezon-Marinduque (La-Que-Mar) region of the Bureau of Internal Revenue for its exceptional professionalism and exemplary service to taxpayers. The regional office based in...

The Bureau of Internal Revenue (BIR) has been acknowledged by the Civil Service Commission (CSC) as one of seven government agencies that significantly improved their frontline services to the public throughout 2022. The CSC's Contact Center Ng Bayan has praised the BIR for its consistent...

The Bureau of Internal Revenue (BIR) has introduced a new exemption for certain agricultural producers with annual gross sales of less than P1 million, aimed at streamlining government transactions. According to Revenue Regulations No.12-2023, signed by Finance Secretary Benjamin E. Diokno and...

The Bureau of Internal Revenue (BIR) has embarked on a new approach to recover huge delinquent tax debts, using its electronic capabilities. BIR Commissioner Romeo D. Lumagui Jr. ordered regional directors and other collection officers to use e-mails in serving warrant of garnishments (WGs) to...

The Bureau of Internal Revenue (BIR) seized thousands of cartons of untaxed perfumes, colognes, and toiletries during a nationwide inspection of malls and retail outlets. The majority of these confiscated items were found in Metro Manila, with the largest seizure occurring at the facilities of...

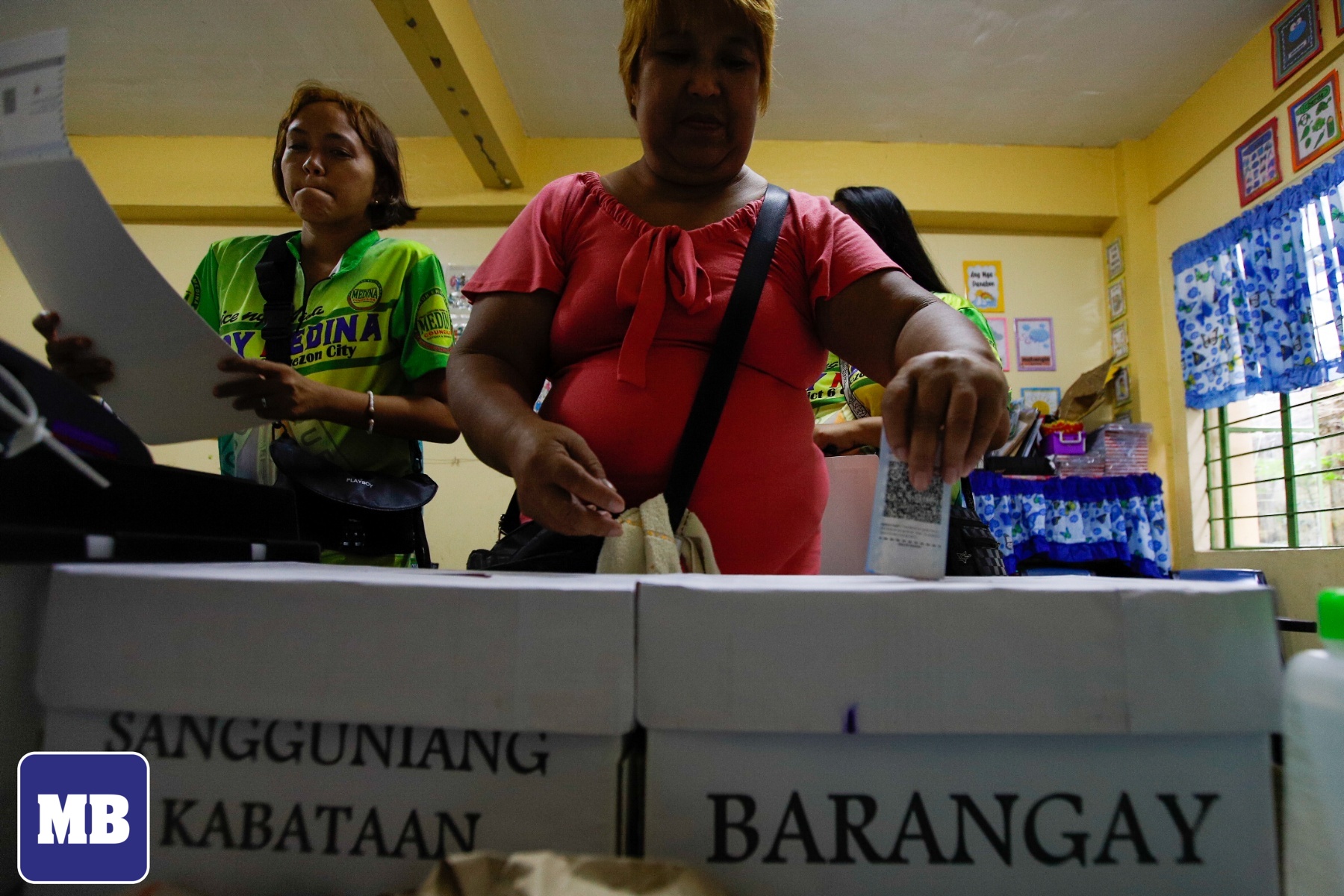

Candidates running for national and local elections, including barangay positions, no longer need to register with the Bureau of Internal Revenue (BIR). BIR Commissioner Romeo D. Lumagui, Jr. clarified in Revenue Memorandum Circular (RMC) No. 97-2023 that registration and registration fees are not...

The Bureau of Internal Revenue (BIR) has successfully addressed all complaints and inquiries forwarded by Malacañang during the initial seven months of this year. The 8888 Citizens' Complaint Center, affiliated with the Office of the President, conveyed a total of 842 concerns from January to...

The Bureau of Internal Revenue (BIR) has issued updated regulations for the new estate tax amnesty program to benefit more than one million heirs of the deceased. Finance Secretary Benjamin E. Diokno issued Revenue Regulations No. 10-2023 to implement these changes prescribed by Republic Act (RA)...

The Bureau of Internal Revenue (BIR) has issued Revenue Regulations (RR) introducing changes to the old RR Nos. 17-2011 and 2-2022, which pertain to the implementation of the Personal Equity and Retirement Account (PERA) Act of 2008. Under the new RR No. 7-2023, the maximum annual PERA...