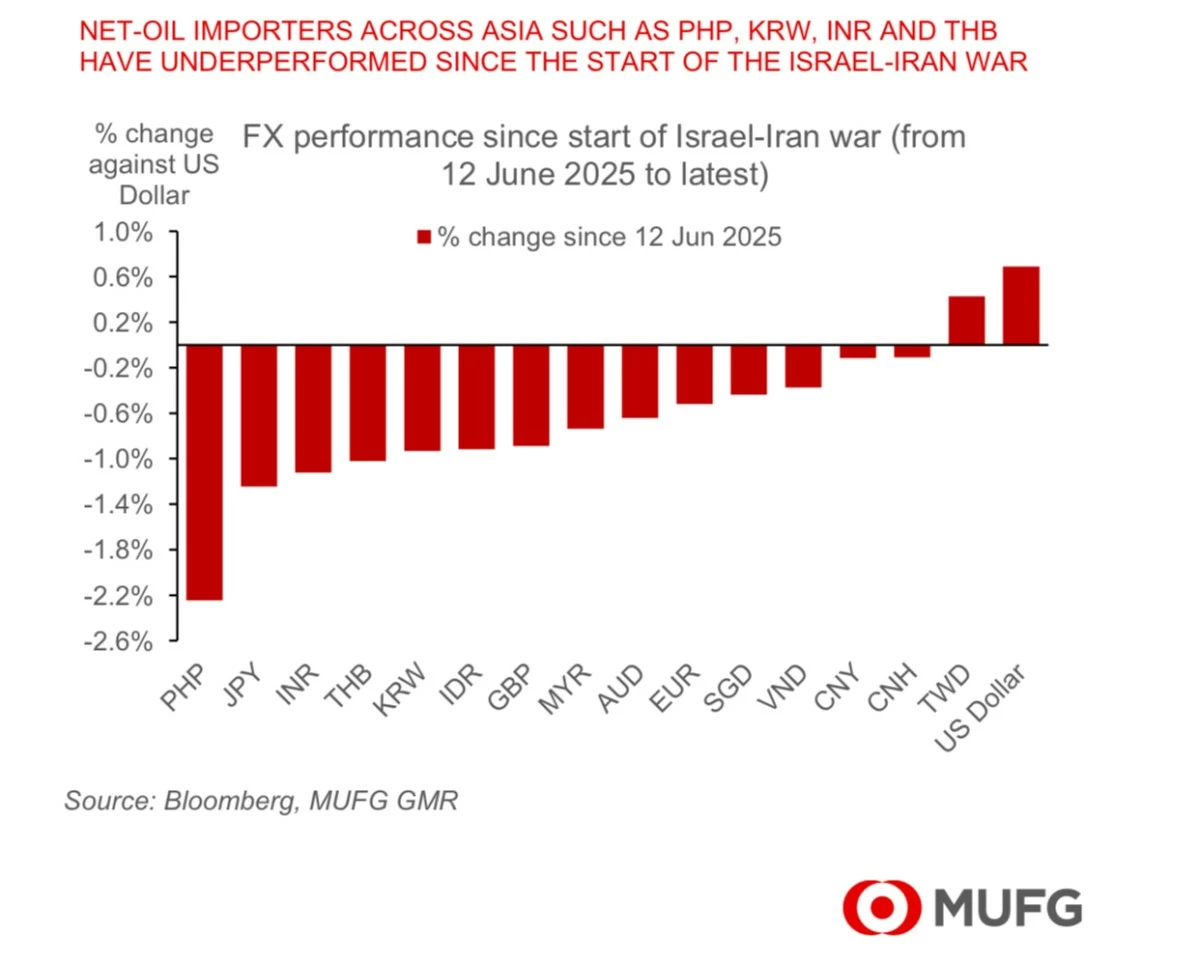

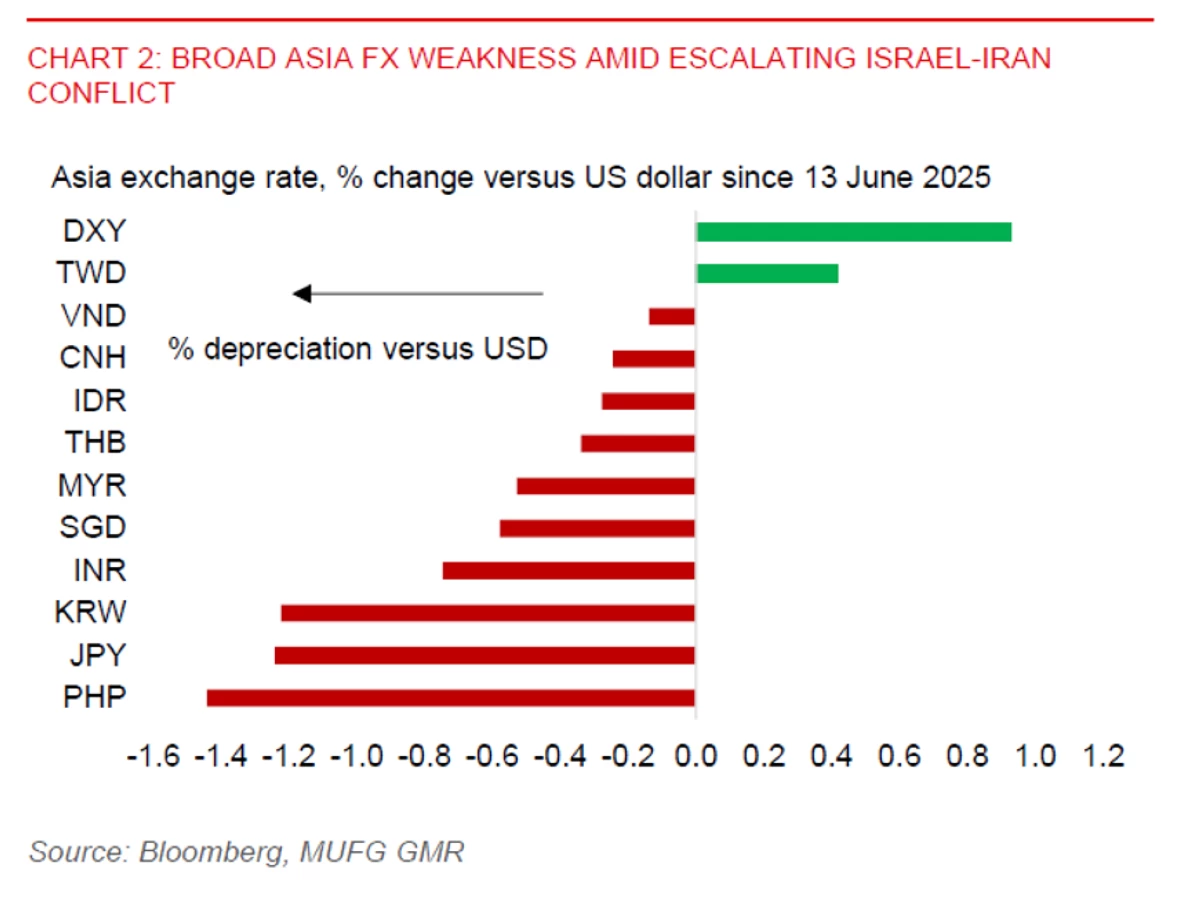

The Philippine peso continued to depreciate the worst among Asian currencies since the Israel-Iran war started, according to Japanese financial giant MUFG Bank Ltd. In a June 20 report, MUFG Global Markets Research noted that last week, “we saw a mild rebound of the United States (US) dollar (DXY...

While the Bangko Sentral ng Pilipinas (BSP) sees no need just yet to defend the Philippine peso amid global oil price risks, the plunging local currency may push monetary authorities into more cautious policy easing moving forward, economists said. Japanese financial giant MUFG Bank Ltd. said that...

The peso dropped to the ₱57 level against the United States (US) dollar on Thursday morning, June 19, ahead of the expected Bangko Sentral ng Pilipinas (BSP) interest rate cut later in the day. According to the Bankers Association of the Philippines (BAP), the local currency opened at ₱57.1,...

The Philippine peso has depreciated the most among regional currencies against the safe haven United States (US) dollar so far since Israel attacked Iran and heightened global oil price risks. A June 18 report by Japanese financial giant MUFG Bank Ltd. showed that since June 13, the peso weakened...

Israel 's attack on Iran may pause monetary policy easing by the Bangko Sentral ng Pilipinas (BSP) while also weakening the peso, according to foreign banks. “We think that the spike in oil prices on June 13 due to the Israel-Iran conflict is unlikely to derail the BSP 's decision to...

Even as the Philippine peso depreciated against the United States (US) dollar at a pace that was among the worst among emerging market (EM) currencies last week, the Bangko Sentral ng Pilipinas (BSP) is still expected to cut interest rates this week. Data from the Bankers Association of the...

Japanese financial giant MUFG Bank Ltd. sees t he peso 's appreciation streak against the United States (US) dollar being sustained until early 2026. "We continue to forecast the Philippine peso to strengthen against the US dollar, reflecting low inflation, continued space for rate cuts, FDI...

A "steady" Philippine economy would allow the peso to further strengthen to the ₱54:$1 level before year-end, despite lingering downside risks from local politics as well as external economic and financial developments, according to Japanese financial giant MUFG Bank Ltd. In a May 27 report...

The Philippine peso is seen likely maintaining its relative strength against the United States (US) dollar for the rest of this year until early next year, as the greenback struggles amid US economic policy uncertainty, according to Japanese financial giant MUFG Bank Ltd. "We maintain our view for...

The peso gained a hefty 19 centavos against the United States (US) dollar on Monday, April 21, closing at ₱56.61 from ₱56.8 last April 16. Philippine markets were closed during the observance of Holy Week. The local currency hit an intraday high of ₱56.48 and a low of ₱56.65 after opening...

The tariff exemption on electronic products ordered by United States (US) President Donald Trump would provide the Philippines' top export commodity some relief, according to Japanese financial giant MUFG Bank Ltd. This will reinforce the Philippines' position among the emerging markets relatively...

While the Philippines would be insulated from the tariff wars initiated by United States (US) President Donald Trump, it cannot reap the potential benefits from the supply chain restructuring of affected businesses in targeted countries. This highlights the need for the Philippines to enhance the...