Philippine peso leads regional losses vs. US dollar amid Israel-Iran tensions

The Philippine peso has depreciated the most among regional currencies against the safe haven United States (US) dollar so far since Israel attacked Iran and heightened global oil price risks.

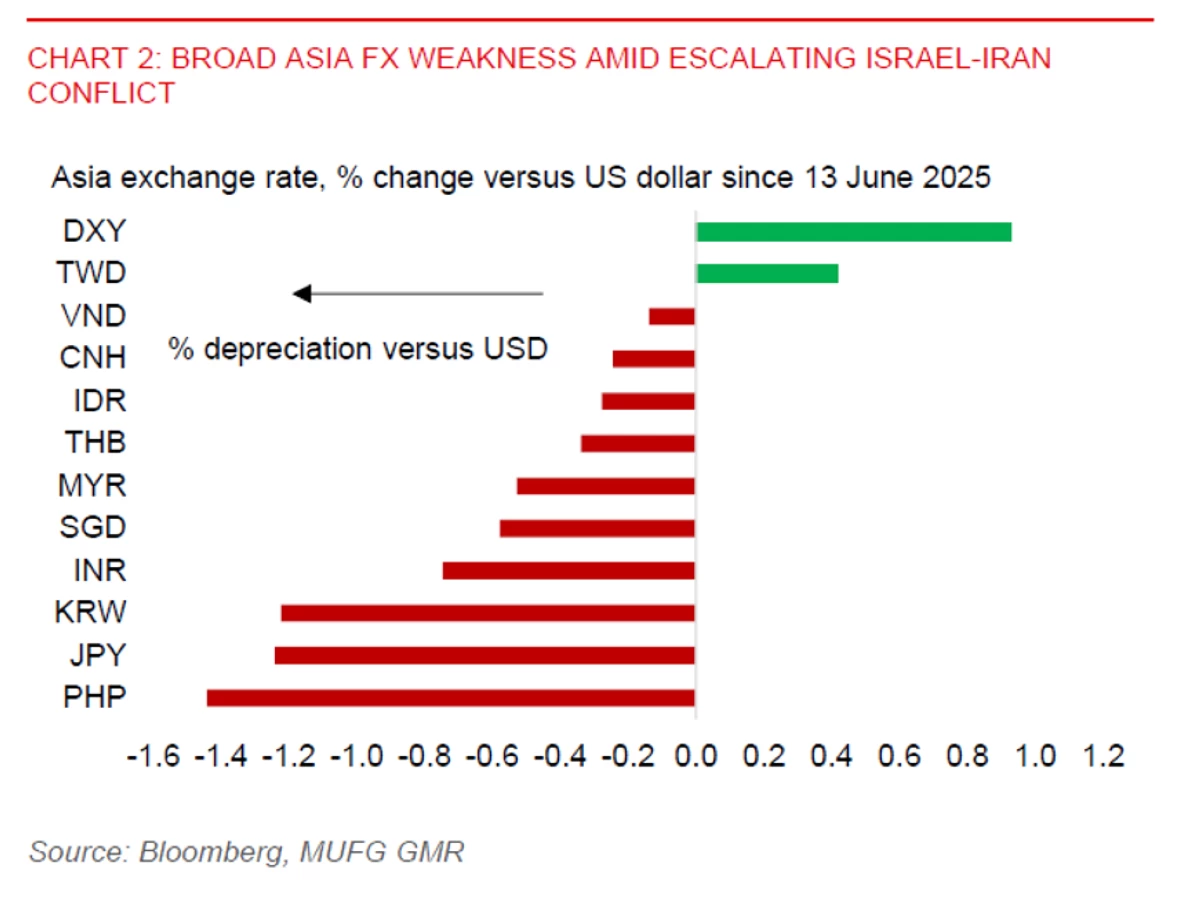

A June 18 report by Japanese financial giant MUFG Bank Ltd. showed that since June 13, the peso weakened versus the greenback by 1.4 percent, outpacing the depreciation of the Japanese yen, South Korean won, Indian rupee, Singaporean dollar, Malaysian ringgit, Thai baht, Indonesian rupiah, Chinese yuan in offshore markets (CNH), and Vietnamese dong.

MUFG Global Markets Research senior currency analyst Lloyd Chan said this broad weakening across most Asian currencies was “driven by risk aversion and rising oil prices.”

“Oil prices have surged by up to 10 percent, while a prolonged conflict in the Middle East could further hurt global risk sentiment,” Chan said.

On the other hand, Chan noted that “the US dollar has strengthened due to safe-haven flows following last Friday’s escalation, amid rising market concerns about potential direct US involvement in the Israel-Iran conflict.”

For Chan, “geopolitical developments in the Middle East region will continue to drive FX [foreign exchange] moves across Asia” moving forward.

On June 17, MUFG Global Markets Research senior currency analyst Michael Wan said that “the oil-sensitive Asian currencies with current account deficits such as the Indian rupee and Philippine peso have continued to underperform” at the start of the week, amid escalating tensions between Israel and Iran.

The latest Bangko Sentral ng Pilipinas (BSP) data released last week showed that the Philippines’ deficit in its current account, or net dollar earnings, doubled to $4.2 billion in the first quarter of 2025 from $2.1 billion a year ago, as goods imports growth outpaced the increase in export revenues.

The Philippines is a net importer of the goods it consumes. Economists are bracing for a surge of products coming from China—already the top source of Philippine imports for many years now—as Chinese exporters look for alternative markets other than the US amid renewed trade tensions between Beijing and Washington.

The government had partly blamed the dismal 5.4-percent year-on-year GDP growth in the first quarter to the “very sharp increase in the trade deficit.”

BSP data showed that the current account deficit’s share to gross domestic product (GDP) climbed to 3.7 percent at end-March from a year ago’s 1.9 percent.

The BSP had projected the current account deficit would further widen to $19.8 billion, or 3.9 percent of GDP, this year.

Last year, the deficit stood at $17.5 billion, or 3.8 percent of GDP—larger than the $12.4 billion, or 2.8 percent of GDP, in 2023.

Back in April, the World Bank said that the peso’s gains against the US dollar at the start of this year may be erased by the widening current account deficit amid declining net exports.

But while the Philippine peso is currently depreciating at a pace that’s among the worst among emerging market (EM) currencies, most economists believe that the BSP will still push through with the anticipated 25-basis point (bp) cut in key interest rates on Thursday, June 19.