With the return of United States (US) President Donald Trump’s tariffs on the horizon, the Philippine peso may be advantaged by the economy’s relatively less exposure to global trade, according to Japanese financial giant MUFG Bank Ltd. “We are most positive on the currencies of...

Hotel101 Global Holdings Corporation, a subsidiary of tycoons Edgar Sia II and Tony Tancaktiong’s DoubleDragon Corporation, had a lackluster debut at the Nasdaq Stock Exchange with its share price falling 70 percent at the close of its first day of trading. Hotel101, trading under the ticker...

The Philippine peso is expected by Japanese financial giant MUFG Bank Ltd. to linger at the ₱56 level against the United States (US) dollar in the third quarter of 2025 before appreciating until early next year. In its latest Foreign Exchange Outlook report dated July 1, MUFG’s research arm...

DoubleDragon Corporation has achieved its goal of having its subsidiary, Hotel101 Global Holdings Corporation, with a deemed equity value of $2.3 billion, become the first Filipino corporation to be listed on the Nasdaq Stock Exchange. Hotel101, an asset-light, prop-tech hospitality platform...

A dovish Bangko Sentral ng Pilipinas (BSP) may be constrained by skyrocketing global oil prices, which would further weaken the peso and could force a pause from further interest rate cuts, foreign banks said. In a June 23 report, MUFG Global Markets Research said that if world oil prices rise...

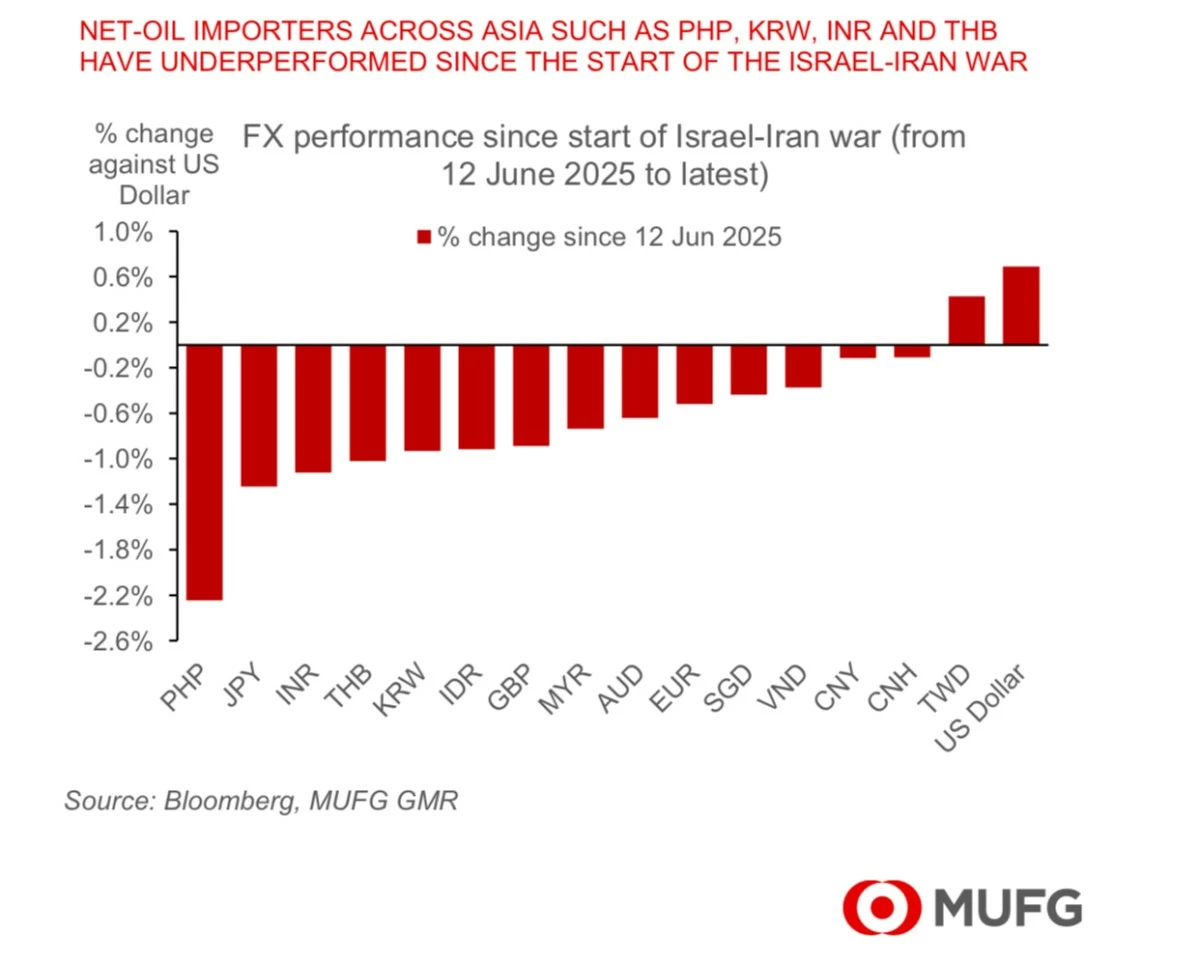

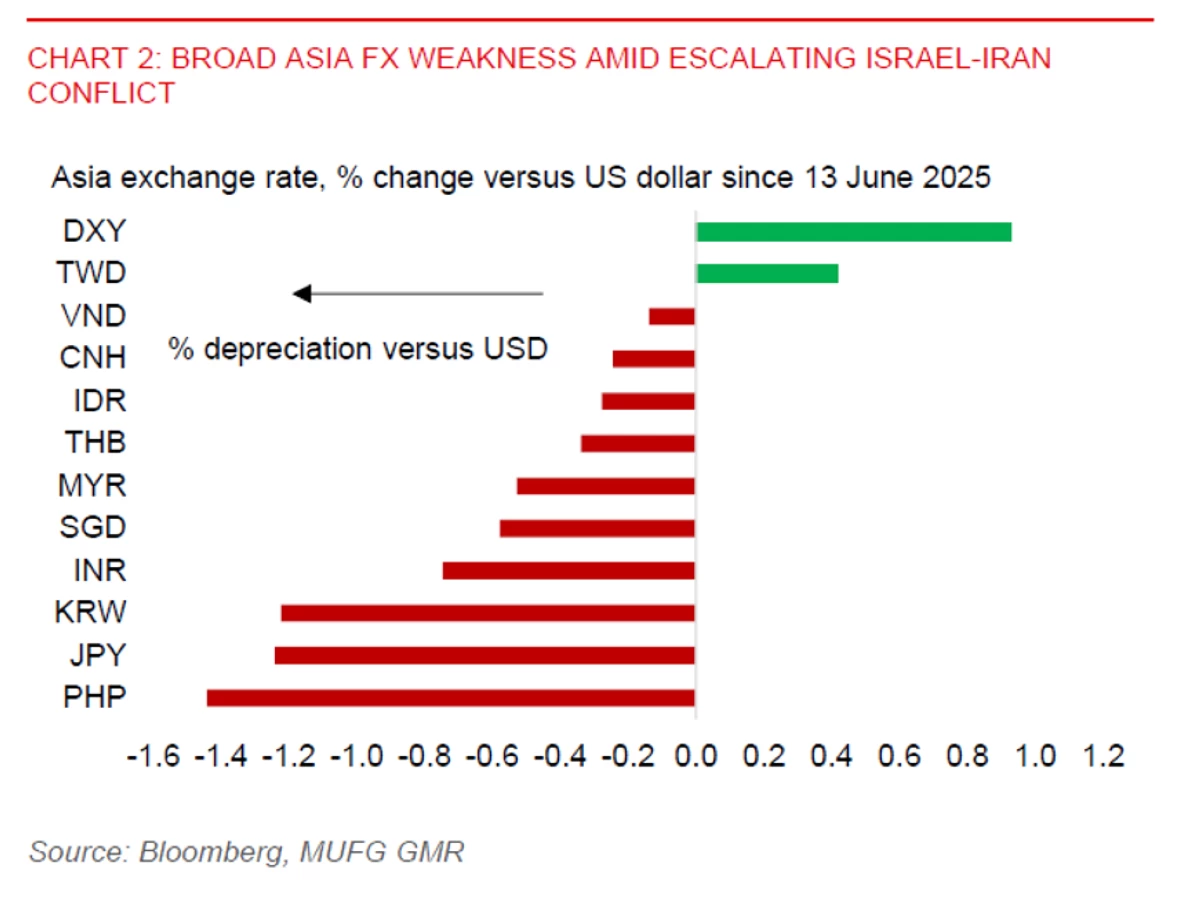

The Philippine peso continued to depreciate the worst among Asian currencies since the Israel-Iran war started, according to Japanese financial giant MUFG Bank Ltd. In a June 20 report, MUFG Global Markets Research noted that last week, “we saw a mild rebound of the United States (US) dollar (DXY...

While the Bangko Sentral ng Pilipinas (BSP) sees no need just yet to defend the Philippine peso amid global oil price risks, the plunging local currency may push monetary authorities into more cautious policy easing moving forward, economists said. Japanese financial giant MUFG Bank Ltd. said that...

The peso dropped to the ₱57 level against the United States (US) dollar on Thursday morning, June 19, ahead of the expected Bangko Sentral ng Pilipinas (BSP) interest rate cut later in the day. According to the Bankers Association of the Philippines (BAP), the local currency opened at ₱57.1,...

After a few months’ delay, DoubleDragon Corporation’s Hotel101 Global Holdings Corporation is finally listing at the Nasdaq Stock Exchange on June 27, 2025, the first Filipino-owned company to be listed and traded in the US bourse. To be listed with an equity value of $2.3 billion, Hotel101...

The Philippines is facing a growing deficit in its net dollar earnings or current account, placing it in the middle of the pack in the latest macro risk assessment of 27 key emerging markets (EMs) by DBS Bank Ltd. In a June 17 report authored by DBS senior economist Han Teng Chua and data analytics...

The Philippine peso has depreciated the most among regional currencies against the safe haven United States (US) dollar so far since Israel attacked Iran and heightened global oil price risks. A June 18 report by Japanese financial giant MUFG Bank Ltd. showed that since June 13, the peso weakened...

Two-and-a-half-year-old Salmon Group Ltd, a Manila-based financial technology (fintech) firm, has raised $88 million to expand its efforts in delivering modern financial solutions and improving credit access across Southeast Asia. The funding includes a $60 million drawdown from a three-year, $150...