The Philippines’ current account deficit widened to $9.18 billion in the first half of 2025, a 13.6 percent increase from $8.08 billion in the same period a year earlier. According to the latest data from the Bangko Sentral ng Pilipinas (BSP), the deficit was driven by imports outpacing exports...

While several big-ticket government projects in the pipeline threaten to widen the Philippines’ current account deficit and put pressure on the trade balance, Germany-based Deutsche Bank said this could ultimately benefit the country’s economic growth and strengthen the peso in the long run....

The Philippines is facing a growing deficit in its net dollar earnings or current account, placing it in the middle of the pack in the latest macro risk assessment of 27 key emerging markets (EMs) by DBS Bank Ltd. In a June 17 report authored by DBS senior economist Han Teng Chua and data analytics...

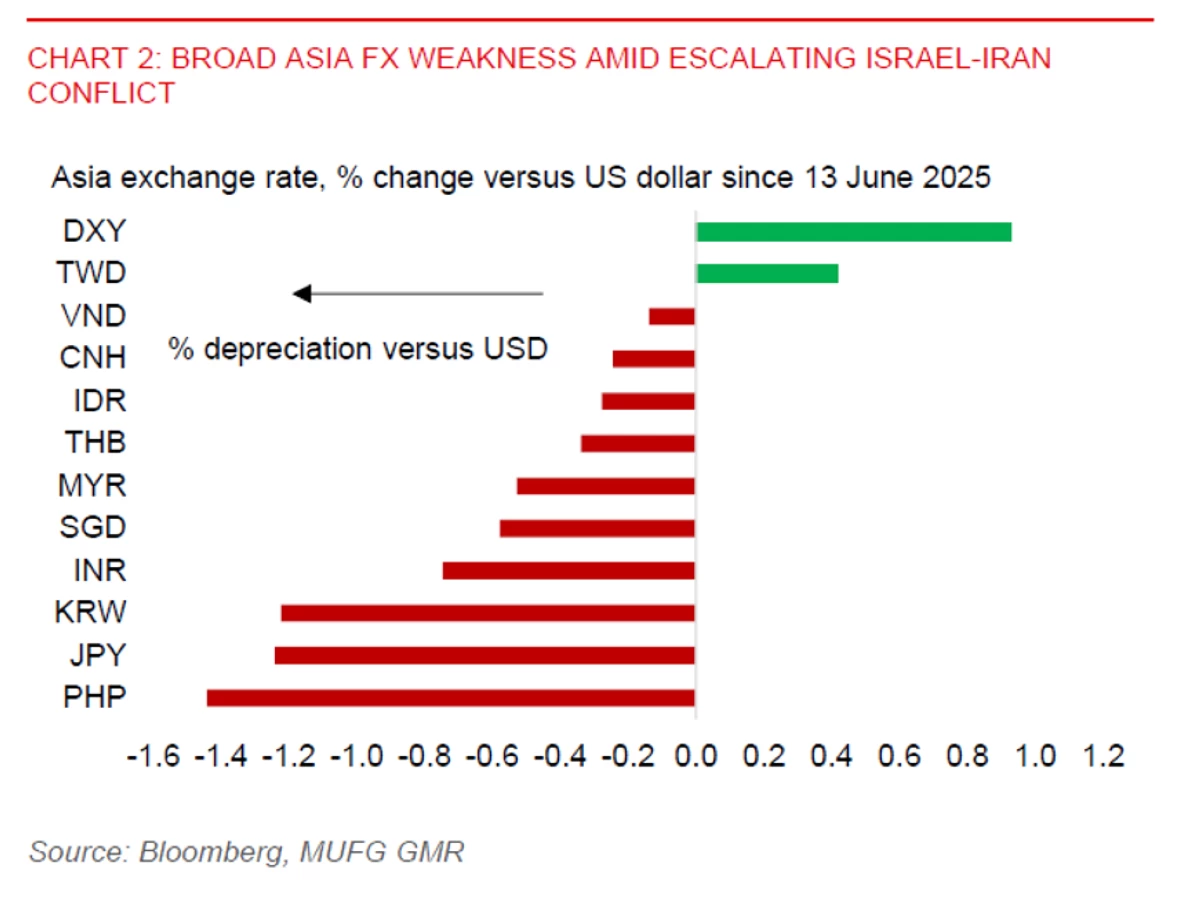

The Philippine peso has depreciated the most among regional currencies against the safe haven United States (US) dollar so far since Israel attacked Iran and heightened global oil price risks. A June 18 report by Japanese financial giant MUFG Bank Ltd. showed that since June 13, the peso weakened...

A wider current account deficit drove the Philippines’ balance of payments (BOP) position from a $238-million surplus in the first quarter of 2024 to a $3-billion deficit in the same period this year, according to the central bank. For the January-to-March period, the country’s current account...

The Philippines' economic growth would fall below expectations in the next two years as the threat of a global trade war intensifies, according to the International Monetary Fund (IMF). In its April 2025 World Economic Outlook (WEO) report, published on Tuesday night, April 22 (Philippine time),...

Dutch financial giant ING expects the Philippine peso to depreciate against the United States (US) dollar in the near term as the US President Donald Trump-led global trade war rages on and the domestic economy weakens. "We look for the Singapore dollar and Philippine peso to underperform in a...

A weaker peso, caused by United States (US) tariffs lifting the US dollar and the Philippines' wider current account deficit, may delay further interest rate cuts by the Bangko Sentral ng Pilipinas (BSP), according to Japanese banking giant MUFG Bank Ltd. "We forecast the BSP to cut rates by...

The Philippines’ current account deficit shrank by 38.6 percent to $11.2 billion last year (equivalent to -2.6 percent of the country’s gross domestic product) from P$18.3 billion in 2022 (equivalent to -4.5 percent of the country’s GDP) The Bangko Sentral ng Pilipinas said “The lower...

The country’s current account surplus reached an all-time high of $12.979 billion in 2020, reversing the $3.047 billion shortfall in 2019, based on Bangko Sentral ng Pilipinas (BSP) data. The current account surplus – which is a record high based on BPM6-series and not comparable to older...

The country’s current account surplus improved to $4.4 billion in the first six months of the year, reversing the $2.6 billion deficit reported same time in 2019, the Bangko Sentral ng Pilipinas (BSP) said Friday. BSP Deputy Governor Francisco G. Dakila Jr. said the better-than-expected current...