Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona, Jr. has been awarded an “A-” rating in Global Finance magazine’s 2024 Central Banker Report Cards, marking him as one of the top central bank governors in world. In a statement on Monday, Aug. 26, the BSP announced that...

German financial services giant Deutsche Bank said that investment growth in the Philippines will likely remain constrained in the near term despite the upcoming easing of the central bank’s restrictive policies. In its Asia Macro Insights report published on Monday, Aug. 26, Deutsche Bank...

The Philippines through the Bangko Sentral ng Pilipinas (BSP) which is a member of the International Monetary Fund (IMF) in its own right, has renewed an estimated $750 million (special drawing rights or SDR540 million) commitment under the IMF’s Financial Transactions Plan (FTP) from August 2024...

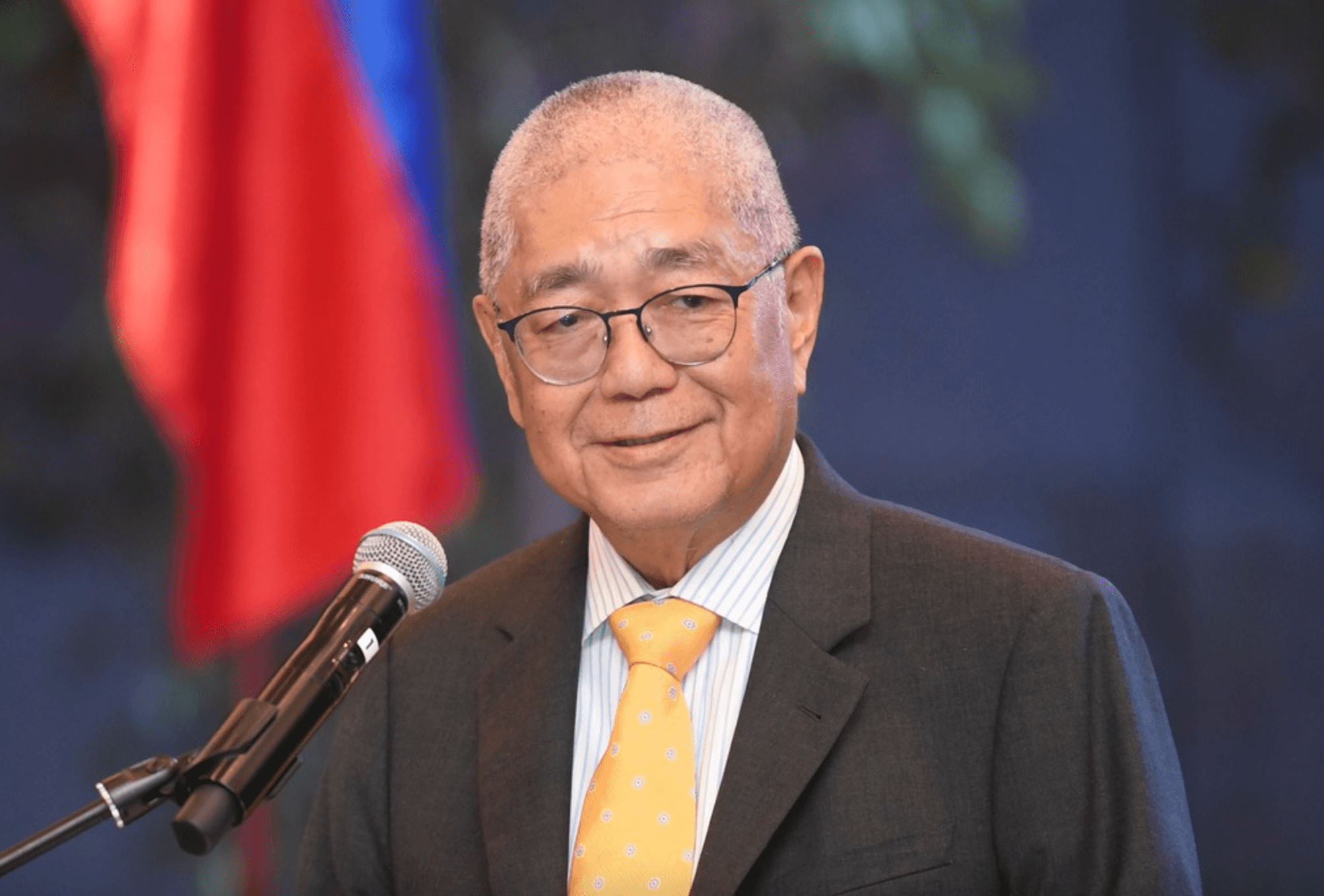

The Bangko Sentral ng Pilipinas (BSP) and the National Bank of Cambodia (NBC) agreed to fortify its cooperation and forge stronger bilateral ties in the areas of cybersecurity, payment systems, and digital innovation. In a ceremony held on 19 August 2024 in Siem Reap, Cambodia, Eli M. Remolona,...

As expected, the Bangko Sentral ng Pilipinas’ (BSP) Monetary Board has decided to reduce its target reverse repurchase (RRP) or policy rate by 25 basis points (bps) to 6.25 percent. The last time the BSP cut the benchmark rate was on Nov. 19, 2020, also by 25 bps from 2.25 percent to two percent....

Finance Secretary Ralph G. Recto stated on Wednesday, Aug. 7, that while the reduction of borrowing costs may still take place within the year, it is likely to happen later than August. During a press briefing at the Kapihan sa Manila Bay, Recto said that the decision to cut key policy rates by...

The Philippine financial markets ground to a halt Wednesday, July 24, as Malacañang suspended operations in government offices due to Typhoon Carina and the southwest monsoon. In the early morning of Wednesday, the Philippine Stock Exchange (PSE) announced a trading suspension, while the Bangko...

The Bangko Sentral ng Pilipinas (BSP) is on track to issuing its own central bank digital currency (CBDC) sooner than anticipated after announcing the conclusion of the proof-of-concept phase by the end of this year. When asked if he can reconfirm if the BSP will be able to launch the CBDC within...

In light of Malacañang’s decision to suspend work in government offices on Wednesday, July 24, the Bangko Sentral ng Pilipinas (BSP) has suspended dollar/peso trading and monetary operations. During this period, certain BSP services will remain operational: Bulk cash deposits, including...

The central bank said all eligible financial institutions (FIs) encountering timing mismatches in their transactions via the peso real-time gross settlement (RTGS) payment system can now avail of the fully-automated intraday settlement facility (ISF) to prevent gridlocks. The Bangko Sentral ng...

The Bangko Sentral ng Pilipinas (BSP) has approved the regulatory framework for merchant payment acceptance activities (MPAA) to widen the use of digital payments in the country. Merchants refer to physical or electronic retailers, service providers, billers and businesses that accept payments for...

The country’s external debt service burden as of April totaled $4.64 billion, 19.79 percent lower compared to the same time last year of $5.785 billion, with fewer prepayments from the public and private sectors. The debt service burden, which represents both principal and interest payments after...