A bill supported by United States (US) President Donald Trump, currently pending approval in the US Senate, would likely only minimally reduce remittances to the Philippines as more Filipinos who used to work overseas have returned home, according to Deutsche Bank Research. In a June 20 report,...

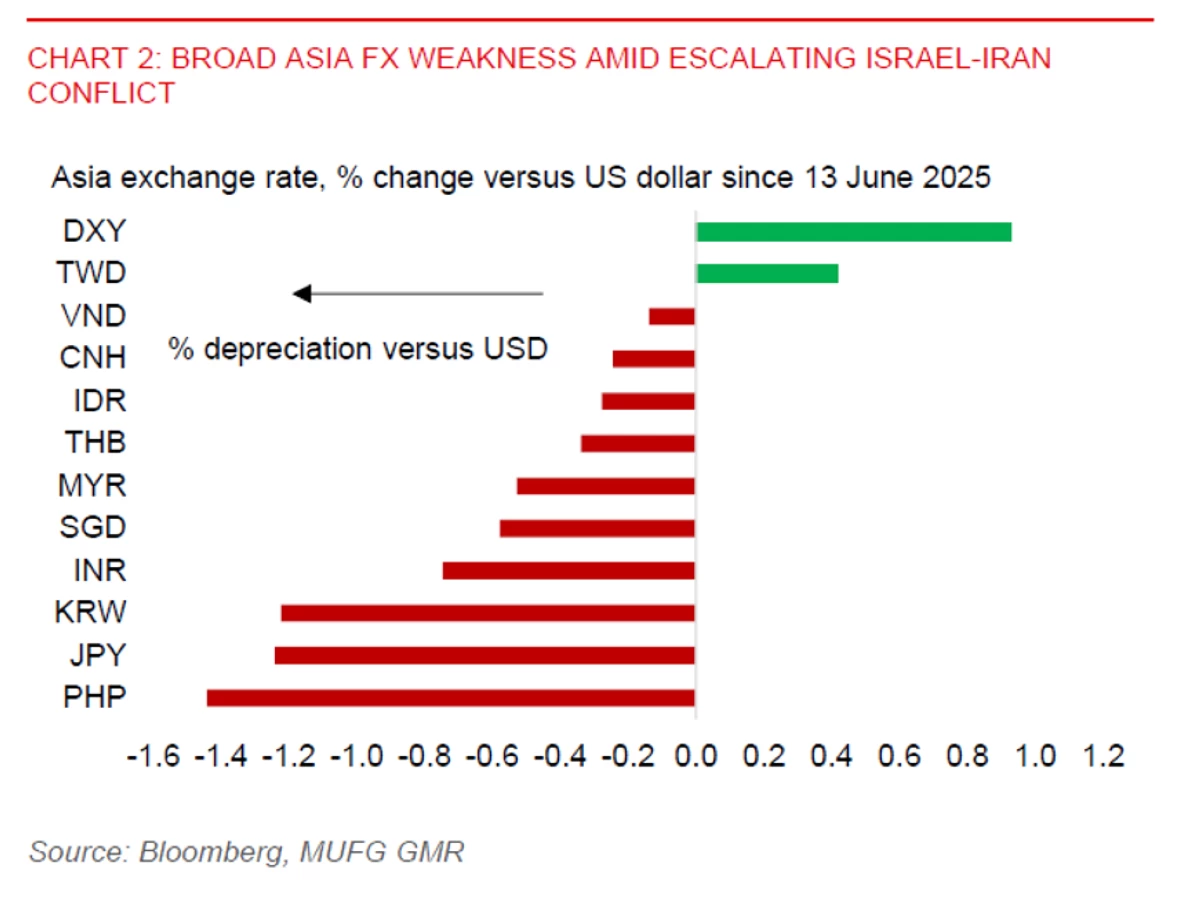

A dovish Bangko Sentral ng Pilipinas (BSP) may be constrained by skyrocketing global oil prices, which would further weaken the peso and could force a pause from further interest rate cuts, foreign banks said. In a June 23 report, MUFG Global Markets Research said that if world oil prices rise...

Debt watcher Moody’s Ratings said that the Bangko Sentral ng Pilipinas’ (BSP) continued easing of key borrowing costs would cushion the local economy amid a challenging external environment, driven especially by the persisting crossfire between Israel and Iran. “Continued monetary easing will...

The real estate exposure of banks and their trust units at end-March, fell to 19.41 percent of the total loan portfolio, excluding interbank loans, down from 20.31 percent the previous year. Based on the latest data from the Bangko Sentral ng Pilipinas (BSP), the overall property exposure ratio has...

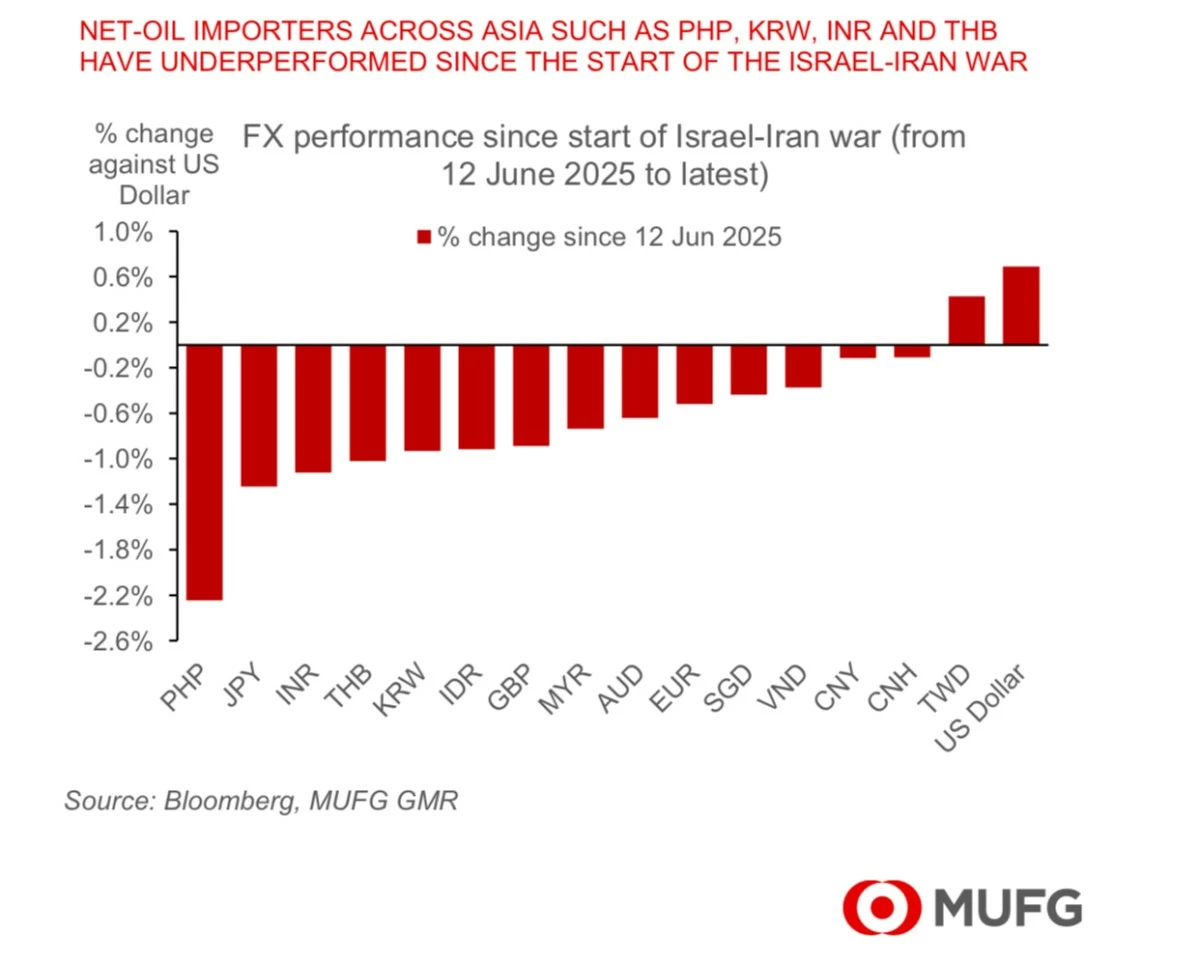

The Philippine peso continued to depreciate the worst among Asian currencies since the Israel-Iran war started, according to Japanese financial giant MUFG Bank Ltd. In a June 20 report, MUFG Global Markets Research noted that last week, “we saw a mild rebound of the United States (US) dollar (DXY...

While private-sector economists project further cuts by year-end, the escalating tensions between Israel and Iran have posed challenges for the Bangko Sentral ng Pilipinas (BSP) in its future policy stance, given the lingering threats to inflation and the peso. Bank of the Philippine Islands (BPI)...

The Philippines’ balance of payments (BOP) swung to a $298-million deficit in May, a reversal from the billion-dollar surplus a year ago, as the government drew down its dollar reserves to pay foreign debts. Data from the Bangko Sentral ng Pilipinas (BSP) showed that the country’s BOP, which...

Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona Jr. warned that rising global oil prices and the peso’s depreciation streak could push inflation above five percent, a level last seen nearly two years ago. “We do scenario analysis today [Friday] in which we focus on particular risks....

While the Bangko Sentral ng Pilipinas (BSP) sees no need just yet to defend the Philippine peso amid global oil price risks, the plunging local currency may push monetary authorities into more cautious policy easing moving forward, economists said. Japanese financial giant MUFG Bank Ltd. said that...

The peso dropped to the ₱57 level against the United States (US) dollar on Thursday morning, June 19, ahead of the expected Bangko Sentral ng Pilipinas (BSP) interest rate cut later in the day. According to the Bankers Association of the Philippines (BAP), the local currency opened at ₱57.1,...

While several digital banks are interested in securing banking licenses from the Bangko Sentral ng Pilipinas (BSP), only one foreign digital bank has formally submitted an application, offering to plug the credit scoring and other gaps in existing entities. BSP Deputy Governor Chuchi G. Fonacier...

The Philippine peso has depreciated the most among regional currencies against the safe haven United States (US) dollar so far since Israel attacked Iran and heightened global oil price risks. A June 18 report by Japanese financial giant MUFG Bank Ltd. showed that since June 13, the peso weakened...