President Marcos met with Bangko Sentral ng Pilipinas (BSP) Governor Eli Remolona Jr. in Malacañang to discuss the central bank’s recent interest rate cut and the country’s near- to medium-term economic outlook. During the meeting on Tuesday, Jan. 20, Remolona briefed the President on the...

President Marcos expressed confidence that the Philippines is on track for recovery by next year as he met with Bangko Sentral ng Pilipinas (BSP) Governor Eli Remolona to discuss the latest monetary policy decision and the country’s economic trajectory. This came as the administration continues...

If trade shocks are left unchecked, they could potentially inflict greater damage on Philippine growth, compromising the country’s significant progress in recent years, according to a top official of the Bangko Sentral ng Pilipinas (BSP). “In particular, trade shocks affect the capital stock of...

The Washington-based International Monetary Fund (IMF) has reaffirmed its positive outlook on the Philippines, projecting steady economy growth in the coming years and signaling that the Bangko Sentral ng Pilipinas (BSP) has room to ease interest rates further amid falling inflation. In a statement...

Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona Jr. said the central bank has plenty of room to cut key interest rates on the back of softer inflation, signaling a potential 50-basis-point (bp) cut by year-end. “So far, the hard data says we have plenty of room to cut, especially...

Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona Jr. expects President Ferdinand Marcos Jr. to reject the resignations of the economic team, arguing that the President’s dissatisfaction was not directed at the team, which he says operates very professionally. This came after the...

Bangko Sentral ng Pilipinas (BSP) Governor Eli Remolona Jr. has warned that trade shocks are more damaging than supply shocks—as they can shrink the country’s capital stock and slow growth—which monetary policy is not equipped to address. Remolona said at the International Monetary Fund (IMF)...

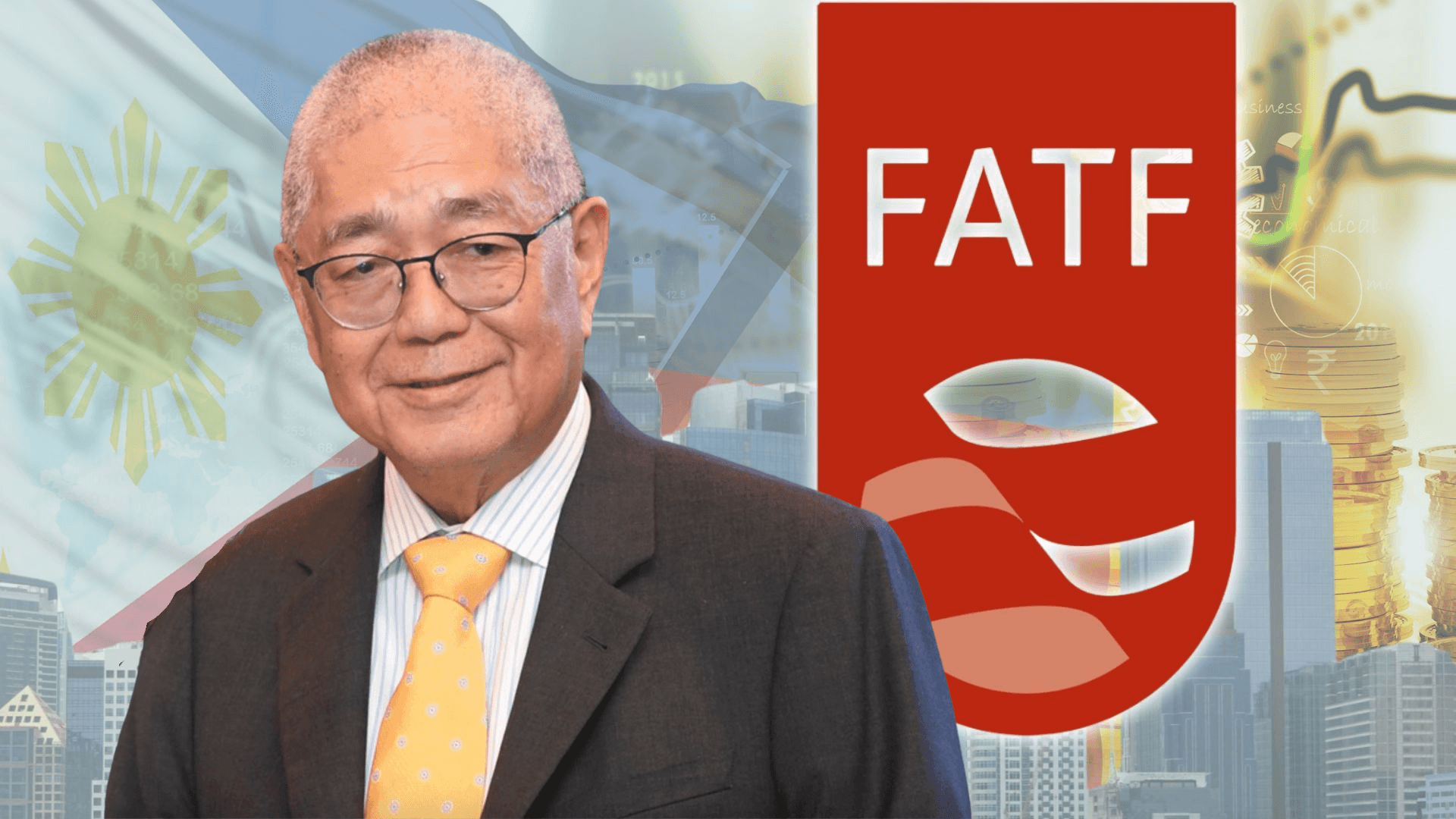

Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona Jr. revealed that the global anti-money laundering watchdog has recognized the Philippines as a regional leader in combating financial crimes and terrorism financing, even tapping the country to assist others in strengthening their...

The Monetary Board (MB) has announced a second reduction in policy rates by 25 basis points for 2024 while noting that it will “maintain a measured approach in its easing cycle.” In a statement, the Bangko Sentral ng Pilipinas said the MB decided to reduce the Target Reverse Repurchase (RRP)...

Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona Jr. said Saturday, July 20, that the passage of Republic Act No. 12010 or the Anti-Financial Account Scamming Act (AFASA) will give the central bank more teeth in protecting financial consumers. AFASA is a law that will curb and combat...

The Bangko Sentral ng Pilipinas (BSP) has urged the public to be more vigilant against scams involving the use of artificial intelligence (AI) to create or manipulate fake videos and audio. In a statement on Friday, July 12, the BSP said that these AI-manipulated contents are being used to...

BSP forges partnership with BAIPHIL By JAMES A. LOYOLA The Bangko Sentral ng Pilipinas (BSP) and the Bankers Institute of the Philippines (BAIPHIL) have formalized their longstanding partnership with the signing of a memorandum of understanding (MOU). “The collaboration of BSP and BAIPHIL will go...