With a protectionist Trump 2.0 administration expected to increase inflation and interest rates in the US, forecasts indicate that the Philippine peso could weaken to P62:$1 by 2025, according to Capital Economics. The London-based think tank released new foreign exchange (FX) forecasts on November...

Low-cost Asian manufacturers may benefit from Donald Trump's forthcoming return to White House, despite the likelihood of weaker Asian currencies, including the Philippine peso, according to the think tank Capital Economics. “Asian currencies have depreciated against the US dollar since the...

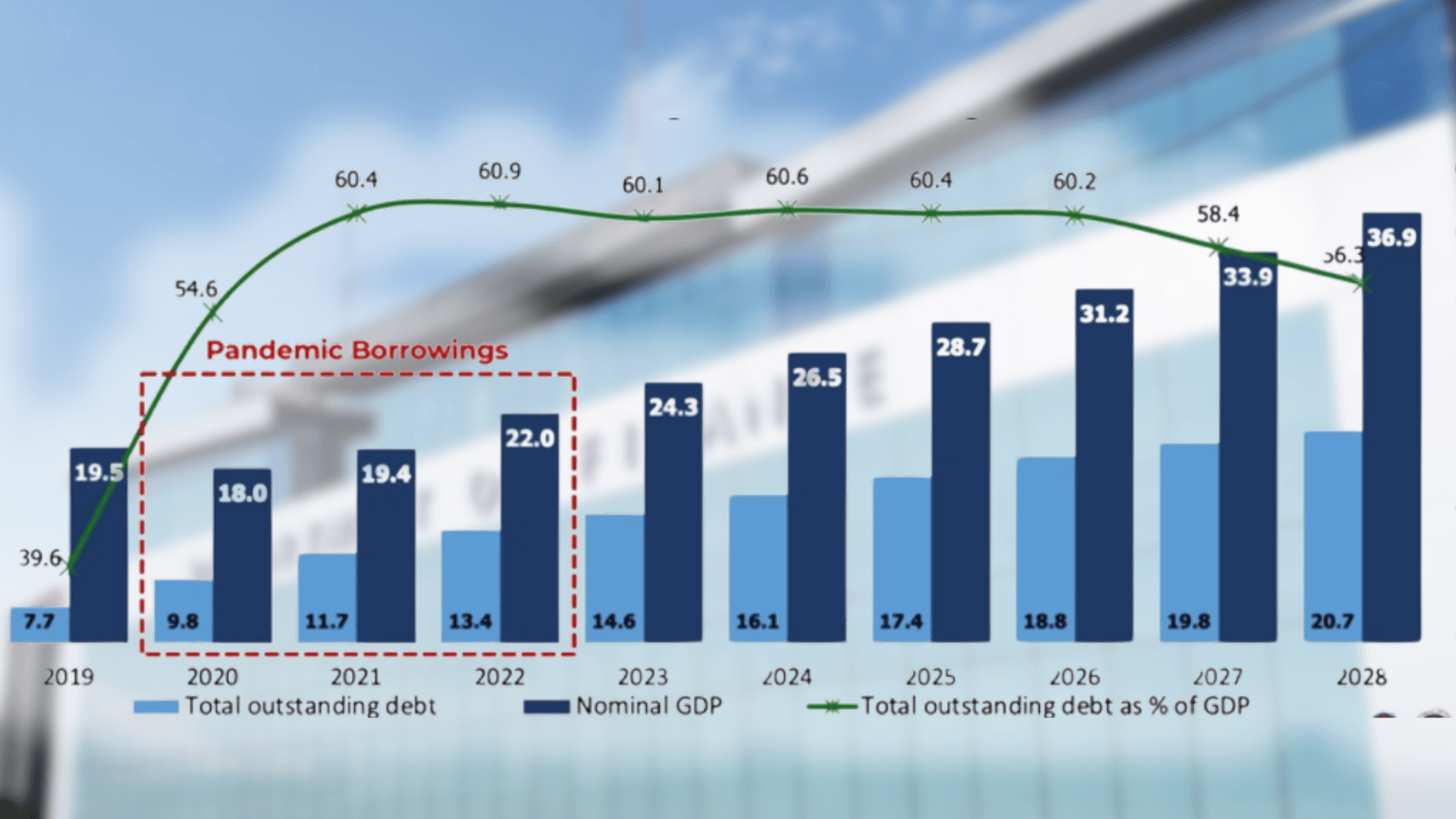

Soaring interest payments, especially for debts that piled up to fight the Covid-19 pandemic, may slow down fiscal consolidation or budget-deficit reduction in the Philippines, according to the think tank Oxford Economics. "Because government deficits have ballooned quickly in the last few years, a...

By DERCO ROSAL London-based Capital Economics expects that Southeast Asian central banks, including the Bangko Sentral ng Pilipinas (BSP), will likely continue lowering interest rates in the coming months due to anticipated sluggish economic growth and continued low inflation. “With GDP [gross...

Think tank Capital Economics has flagged potential risks to Asian currencies, including the Philippine peso, should Donald Trump secure victory in the upcoming US presidential election. In a report, Capital Economics said that Trump's protectionist policies could exert depreciation pressures...

Central banks in emerging Asian economies like the Philippines are expected to further lower interest rates despite expectations of slower monetary easing if the protectionist former US president Donald J. Trump returns to the White House, according to two economic think tanks. In an Oct. 21...

Economic think tanks look forward to more interest rate cuts by the Bangko Sentral ng Pilipinas (BSP) following its second-straight 25-basis point (bp) reduction in the policy rate on Wednesday, Oct. 16. Capital Economics assistant economist Harry Chambers noted in a report that after the BSP again...

The Bangko Sentral ng Pilipinas' (BSP) monetary policy easing cycle is expected to extend until the first half of 2025, to slash the key interest rate to 4.75 percent, according to the think tank Capital Economics. "The central bank [BSP] cut interest rates at its August meeting. With growth set to...

More and more businesses across the globe are worried about a possible second coming of Republican candidate Donald J. Trump as president of the United States, according to Oxford Economics. "Fears over the potential fall-out from a Trump presidency have increased for the third consecutive survey,"...

Downward inflation augurs well for the Bangko Sentral ng Pilipinas' (BSP) monetary policy easing ahead of the US Federal Reserve, according to the think tank Capital Economics. In a Sept. 13 report, Capital Economics senior Asia economist Gareth Leather and assistant economist Harry Chambers noted...

As inflation falls, the Bangko Sentral ng Pilipinas (BSP) will further lower key interest rates at its next monetary policy stance meeting in October, according to the think tank Capital Economics. "The past week has brought more encouraging news on inflation, with August data showing that...

Lower interest rates as the Bangko Sentral ng Pilipinas (BSP) eases monetary policy would aid consumers battered by slowing economic growth across Asia-Pacific, according to the think tank Oxford Economics. The BSP's rate cuts "will help household balance sheets, especially as debt levels rose over...