Surigao del Norte 2nd district Rep. Robert Ace Barbers (Screenshot from Zoom) A lawmaker in the House of Representatives has called on the Bureau of Internal Revenue (BIR) to file a tax evasion case against vape brand Flava Corporation, which allegedly has P728...

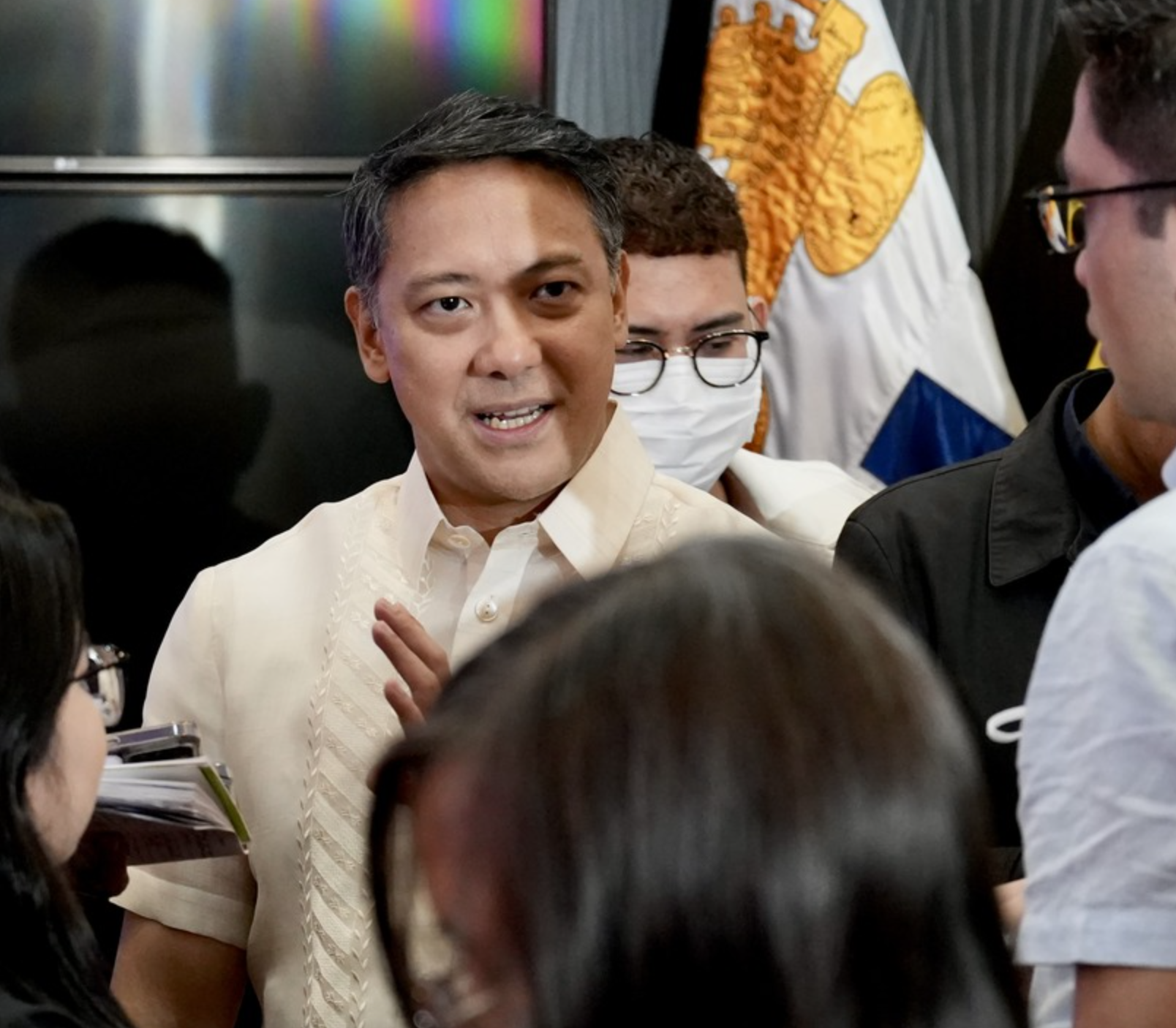

Sen. Francis Tolentino underscored on Monday, Feb. 12 how the crafting of Implementing Rules and Regulation (IRR) issued by administrative agencies has modified the intentions of laws enacted in Congress. During the deliberation of the proposed Passive Income and Financial Intermediary Taxation Act...

Finance Secretary Ralph G. Recto vowed to enhance government enforcement actions against tax evaders to provide support to the Bureau of Internal Revenue (BIR) in boosting its tax collections. At the BIR’s National Tax Campaign Kick-off event, Recto has assured the unwavering support of the...

Finance Secretary Ralph G. Recto is reminding Filipinos to fulfill their tax duties diligently, underscoring their crucial role in the country's development. At the Bureau of Internal Revenue’s (BIR) National Tax Campaign Kick-off event, Recto stressed the importance of both the tax agency and...

Vlogger and businesswoman Rosmar Tan has recently shared her encounters with the tax authorities, shedding light on her struggles with the Bureau of Internal Revenue (BIR) not once, but twice. Tan bravely admitted that her interactions with the BIR had been quite stressful before, particularly when...

The Bureau of Internal Revenue (BIR) posted a record-breaking collection of 2.5 trillion last year, but fell short of the target due to adjustments in value-added tax (VAT) filings and deadlines. On the sidelines of the national tax campaign kickoff on Thursday, Feb. 8, BIR Commissioner Romeo...

The Bureau of Internal Revenue (BIR) has announced that the agency has 1,518 job vacancies that urgently require staffing. According to BIR Commissioner Romeo Lumagui Jr., these positions span across various roles including administrative aides, statisticians, revenue and intelligence...

The Bureau of Internal Revenue (BIR) has added 21 medicines for conditions like diabetes and hypertension to the list of those exempt from value-added tax (VAT). BIR Commissioner Romeo Lumagui Jr. said that two cancer drugs, five for diabetes, two for high cholesterol, five for hypertension, four...

The Bureau of Internal Revenue (BIR) has clarified that not all online sellers are obligated to follow the government’s withholding tax regulations. In a statement, the BIR said that electronic marketplace operators and digital financial service providers, such as Lazada and Shopee, are required...

BIR Commissioner Romeo D. Lumagui Jr. received the prestigious "Business Enabler Award" from the Philippine Chamber of Commerce and Industry - Quezon City (PCCI-QC) last Jan. 25 during the latter's induction and turnover ceremovies. The award is given to Commissioner Lumagui for his significant...

The Bureau of Internal Revenue (BIR) has cautioned social media influencers considering tax evasion, emphasizing that the agency has mechanisms to accurately ascertain the earnings of all individuals involved. BIR Commissioner Romeo D. Lumagui Jr. said the bureau has various methods to effectively...

Finance Secretary Ralph G. Recto met with the government’s tax collectors to discuss strategic plans to achieve the Marcos administration's target of generating P4.3 trillion in revenues this year. On Tuesday, Jan. 23, Recto held a meeting with the Bureau of Internal Revenue's (BIR) management...