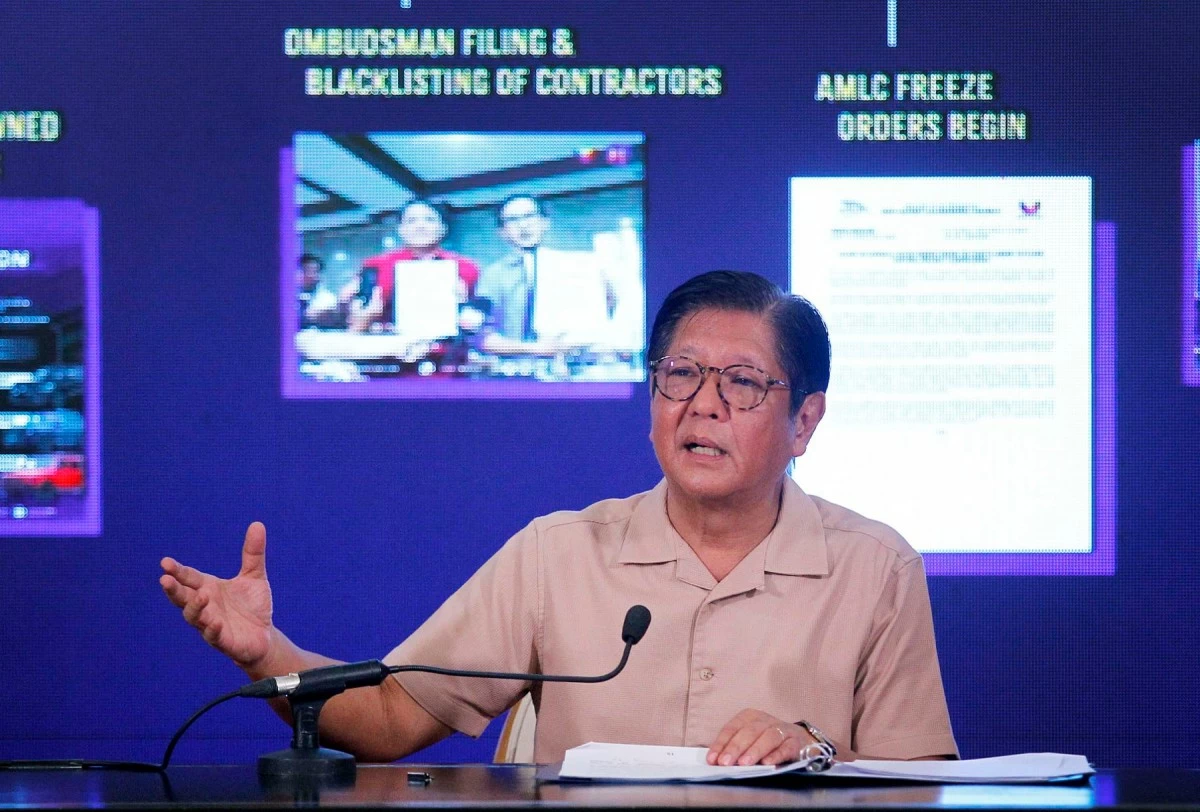

President Marcos attributed the country’s slower third-quarter economic growth to climate disruptions and global headwinds, assuring that a surge in public spending would help restore momentum before the year ends. Marcos said this as the peso hit a record low of P59.17 to the US dollar on...

Two global banking giants have flagged political and fiscal challenges posing near-term risks to the Philippine economy, especially in the aftermath of a corruption scandal involving massive public spending on ineffective flood control projects in recent years. While “there is a strong pipeline...

Singapore-based United Overseas Bank (UOB) expects lower interest rates to lift Philippine economic growth in the near term, despite lingering global challenges that would likely expand the domestic economy below the government’s goal for the year. In its Quarterly Global Outlook report for the...

Dutch financial giant ING said the Philippine peso is likely to continue losing ground against the United States (US) dollar as the Bangko Sentral ng Pilipinas (BSP) remains unfazed by its weakening and is expected to deliver substantial cuts in key borrowing rates. “Given our expectations of...

After performing among the worst of Asian currencies last week, the Philippine peso is still expected by Japanese financial giant MUFG Bank Ltd. to gradually appreciate and return to the ₱56:$1 level next year. “All Asian currencies depreciated against the United States (US) dollar [last] week,...

After experiencing a three-day appreciation streak against the United States (US) dollar, the Philippine peso weakened again by shedding almost half-a-peso on Friday, July 25, despite the fresh market optimism over the latest trade deal with the US. According to the Bankers Association of the...

With the Philippine peso emerging as an outperformer among Asian currencies following the United States’ (US) tariff hike, Japanese financial giant MUFG has maintained its forecast that the local currency will continue to strengthen in the fourth quarter of 2025 through next year. Last Friday,...

Germany-based Deutsche Bank stated that the Bangko Sentral ng Pilipinas’ (BSP) cumulative 1.25-percent interest rate reductions have been unable to lift lending growth, as lower borrowing costs were not enough to outweigh persistent economic uncertainty. This follows BSP Governor Eli M. Remolona...

With the return of United States (US) President Donald Trump’s tariffs on the horizon, the Philippine peso may be advantaged by the economy’s relatively less exposure to global trade, according to Japanese financial giant MUFG Bank Ltd. “We are most positive on the currencies of...

The Philippine peso is expected by Japanese financial giant MUFG Bank Ltd. to linger at the ₱56 level against the United States (US) dollar in the third quarter of 2025 before appreciating until early next year. In its latest Foreign Exchange Outlook report dated July 1, MUFG’s research arm...

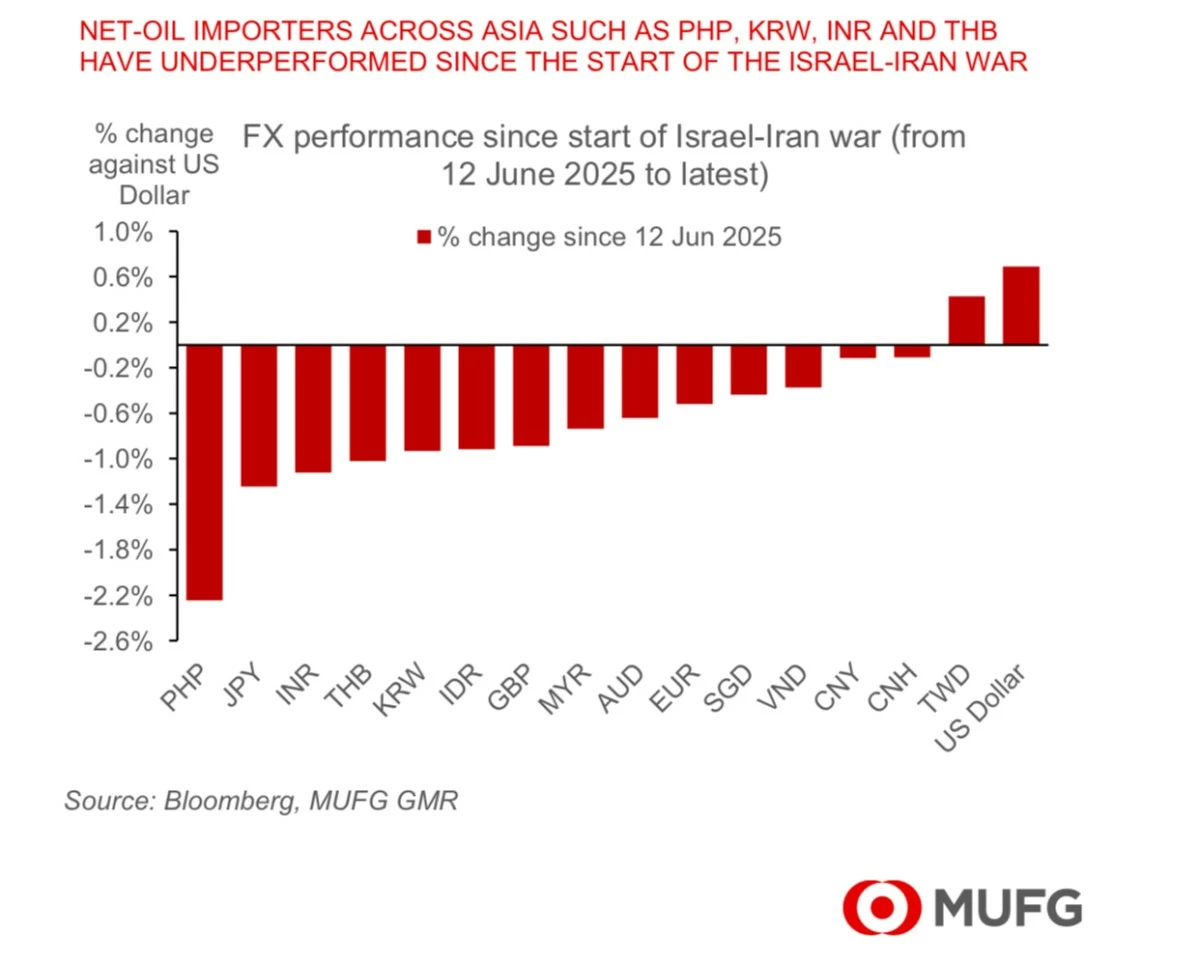

The Philippine peso continued to depreciate the worst among Asian currencies since the Israel-Iran war started, according to Japanese financial giant MUFG Bank Ltd. In a June 20 report, MUFG Global Markets Research noted that last week, “we saw a mild rebound of the United States (US) dollar (DXY...

The peso dropped to the ₱57 level against the United States (US) dollar on Thursday morning, June 19, ahead of the expected Bangko Sentral ng Pilipinas (BSP) interest rate cut later in the day. According to the Bankers Association of the Philippines (BAP), the local currency opened at ₱57.1,...