HONG KONG — Metro Pacific Investments Corp. (MPIC) may hold off on its planned divestment from Light Rail Manila Corp. (LRMC) after the government immediately opened talks to address its obligations to the company. LRMC President and Chief Executive Officer Enrico Benipayo told MPIC Chairman...

The Makati City local government was recognized by the Department of Finance 's (DOF) Bureau of Local Government Finance (BLGF) on Wednesday, Nov. 5, as one of the top-performing cities in the country for Finance Year 2024. Makati Mayor Nancy Binay said the city was ranked among the Top 10...

Despite the nearly two percent hike in foreign borrowings, the national government’s outstanding debt fell to ₱17.455 trillion in September, though officials warned that further reductions will depend heavily on the peso’s strength against the United States (US) dollar. National Treasurer...

The Department of Finance – Bureau of Local Government Finance (DOF-BLGF) recognized the San Juan City government for its outstanding performance for Fiscal Year (FY) 2024, San Juan City Mayor Francis Zamora announced on Sunday, Oct. 26. Zamora said the city was cited as one of the...

To account for rising consumer prices and living costs, the Department of Finance (DOF) and its attached agency, the Bureau of Internal Revenue (BIR), are seeking to raise the ceiling for tax-exempt benefits and allowances enjoyed by both private- and public-sector workers. “Under this proposal,...

While the Department of Finance (DOF) is pushing for the swift enactment of its priority tax measures in the 20th Congress, raising the already eye-sore 12-percent value-added tax (VAT) by three percentage points (ppt) next year is off the table. In a Facebook post, the DOF called out Cavite 4th...

President Marcos’ chief economic manager stated that reducing the current 12-percent value-added tax (VAT) rate could weaken the government’s ability to fund operating expenses, such as personnel wages, as it would result in lower tax collections. Finance Secretary Ralph G. Recto said in an...

Department of Finance (DOF) Secretary Ralph Recto on Tuesday, Oct. 14, said the Philippine economy may experience a temporary slowdown in the latter half of 2025 due to ongoing government reforms meant to ensure proper spending of taxpayers’ money, but he expressed optimism that growth will...

Department of Finance (DOF) Secretary Ralph Recto on Tuesday, Oct. 14, said corruption in government infrastructure programs, particularly flood control projects, has hampered the country’s economic growth and affected the government’s ability to meet its revenue targets. During the Senate...

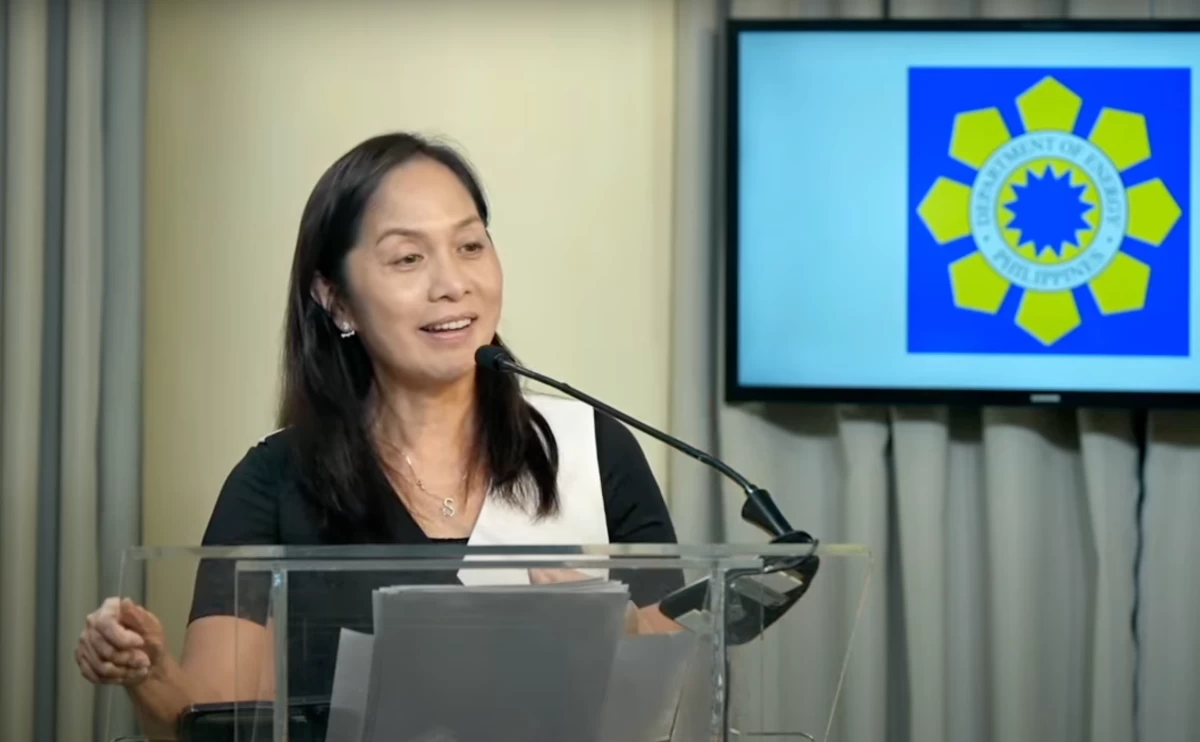

As the country reconsiders nuclear energy, the Department of Energy (DOE) is set to explore financing options in coordination with the Department of Finance (DOF), the Department of Economy, Planning and Development (DepDev), and the Maharlika Investment Corp. (MIC), among other agencies. In a...

State insurers Social Security System (SSS) and Government Service Insurance System (GSIS) have offered over ₱10 billion in calamity loans to extend financial aid to members in disaster-hit areas. This follows Department of Finance (DOF) Secretary Ralph G. Recto’s order to government financial...

Reducing the value-added tax (VAT) to 10 percent from the current 12 percent would erode the government’s fiscal consolidation, with total revenues expected to decline by an average of ₱330 billion annually, or one percent of the country’s economic output. “From our estimates, the reduction...