The Bureau of Internal Revenue (BIR) has no plan to extend the deadline for the filing of annual income tax return (AITR) due to its possible impact on funding programs of the government. In a statement, BIR Commissioner Romeo D. Lumagui, Jr. said deadline for the payment and filing of 2022 AITR...

As the deadline for the filing and payment of the 2022 Annual Income Tax Return (AITR) approaches, the Presidential Communications Office (PCO) has reminded the public to maximize the Bureau of Internal Revenue (BIR)'s "File and Pay Anywhere" setup. *Presidential Communications Office / Facebook* In...

The Department of Justice (DOJ) dismissed tax evasion case filed by the Bureau of Internal Revenue (BIR) against businessman Joseph Calata, and agriculture products retailer Agri Phil Corp. In a resolution dated Feb. 27, 2023, a copy of which was obtained by reporters on Wednesday, March 29, the DOJ...

The Bureau of Internal Revenue (BIR) is now focusing its target audit on business establishments suspected to be issuing bogus receipts and invoices to their customers. BIR Commissioner Romeo D. Lumagui, Jr. said such modus has been causing the government to lose billions of pesos annually....

The Bureau of Internal Revenue (BIR) should go after the third party auditor for the Philippine Offshore Gaming Operators (POGO) and their service providers to hold them accountable for tax liabilities. Sen. Sherwin Gatchalian, chairman of the Senate Committee on Ways and Means, said this is...

The Bureau of Internal Revenue (BIR) has warned accountants against tax dodging, urging them to ensure their clients are paying the correct taxes to the government. In a statement Tuesday, March 21, BIR Commissioner Romeo D. Lumagui, Jr. said the bureau’s enforcement activities will be...

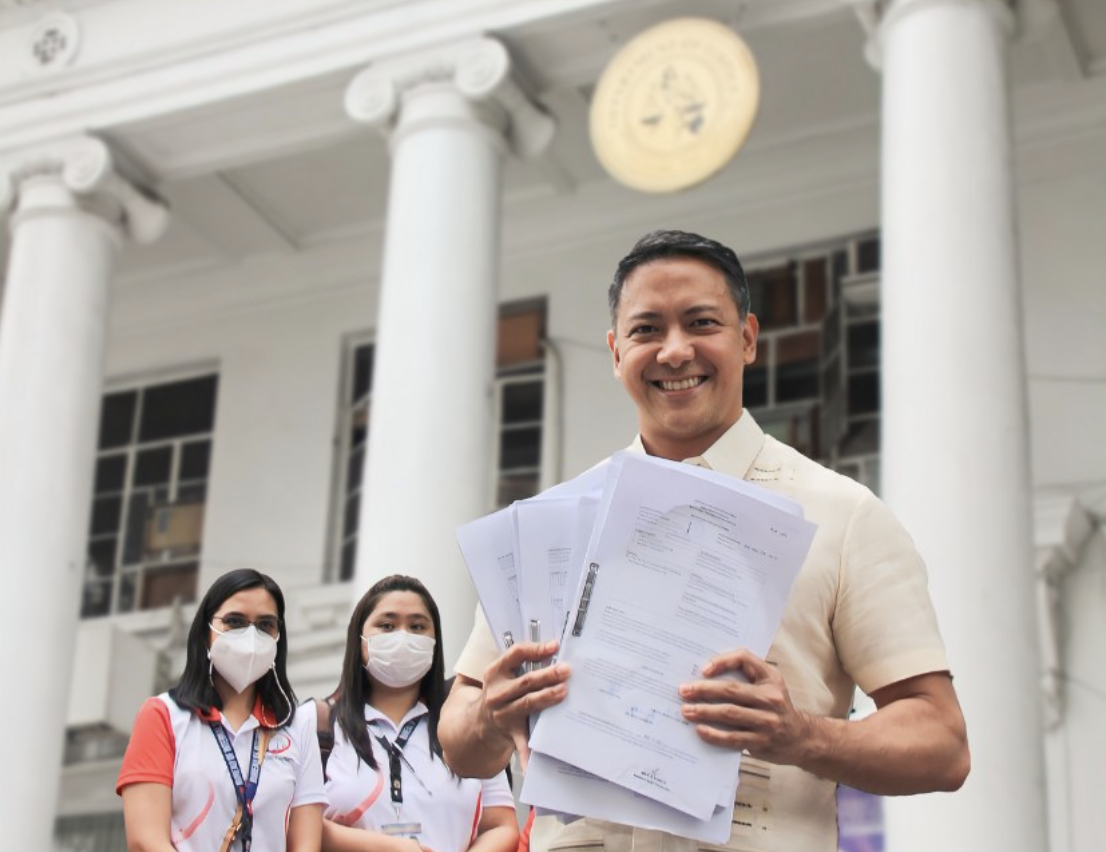

Albay 2nd district Rep. Joey Salceda wants to outlaw tax racketeering and at the same time make it a non-bailable offense. For this purpose, the House Committee on Ways and Means chairman penned and filed House Bill (HB) No.7653, or the proposed Act defining the crime of tax racketeering. The...

The Bureau of Internal Revenue (BIR), the government’s main tax agency, is leaving no stone unturned to catch taxpayers and businesses that are using fictitious receipts. BIR Commissioner Romeo D. Lumagui, Jr. said Thursday, March 16, that taxpayers and businesses caught with illegal receipts...

If House Speaker Martin Romualdez would have his way, he would impose a one-strike policy against collectors of the Bureau of Internal Revenue (BIR) and Bureau of Customs (BOC) who fail to meet their target revenues. President Ferdinand "Bongbong" Marcos Jr. (left) and House Speaker Martin...

Newly installed BIR Commissioner Romeo D. Lumagui, Jr. has finally lifted the ban on the issuance of Letters of Authority (LAs) to investigate individual and business taxpayers suspected of under declaring earnings to reduce tax payments. Lumagui decided to resume the audit apparently to reduce the...

The Bureau of Internal Revenue (BIR) said single parents can now claim 10 percent discount and value-added tax exemption for purchases of goods for their children aged six years old and below. This, after BIR Commissioner Romeo D. Lumagui, Jr. signed Revenue Regulations (RR) 1-2023 implementing the...

The hardline stand of the Bureau of Internal Revenue (BIR) against tax evasion racket has been boosted with the full support extended by the Department of Justice (DOJ) in the prosecution of negligent taxpayers. (L-R) BIR Commissioner Romeo D. Lumagui Jr. and DOJ Secretary Jesus Crispin...