The local stock market will be taking cues from several Philippine economic reports—including inflation, jobs, and gross domestic product (GDP)—as well as corporate earnings while the recent weakness of the peso and concern over United States (US) tariffs will continue to cast a shadow over...

With no economic news to be announced this week at the local front, stock market investors will be looking to the United States (US) for news on interest rates and tariffs as well as jobs and manufacturing data on Thursday, plus reports of early birds for the second-quarter earnings season. Online...

Local stock market investors are closely watching two key developments this week, updates on trade negotiations between the Philippines and the United States (U.S.) and the release of data on remittances from overseas Filipinos (OFs). “The US’ planned 20-percent tariffs against the Philippines...

The research heads of local stock brokers Abacus Securities Corporation and COL Financial have slashed their year-end forecasts for the Philippine Stock Exchange’s benchmark index because foreign investors (hot money and direct investments) continue to stay away, while corporate earnings growth...

Cautious trading is expected to prevail at the Philippine stock market this week as investors await developments following the July 9 deadline for United States trade negotiations. “We may see cautious sentiment as global trade uncertainties may take center stage again. This is as the US’ trade...

Shakey’s Pizza Asia Ventures Inc. (SPAVI) is making a bigger push to expand its operations in the United States (US), although this will be spearheaded by its snack brand Potato Corner instead of its flagship pizza restaurants. In a disclosure to the Philippine Stock Exchange (PSE), the firm said...

Top influencers of investor sentiment this week will be the possible rate cut by the Bangko Sentral ng Pilipinas, overseas Filipino remittances, US-China trade talks, and the increasing tension in the Middle East. “The local market managed to extend its climb last week, backed by optimism on...

The implementation of the reduced stock transaction tax next month could theoretically result in an 83 percent surge in value turnover in the Philippine Stock Exchange, although even a fraction of this growth will already be a big boost to the local bourse. Abacus Securities Corporation noted that...

Currently savoring the positive impact of its recently acquired Compose Coffee in South Korea, Asian food and beverage giant Jollibee Foods Corporation is reportedly acquiring Korean fried chicken chain owner Norang Food for $95 million in August this year. According to The Korea Times,...

Bloomberry Resorts Corp., billionaire Enrique K. Razon Jr.’s leisure and gaming business, has soft-launched its new online gaming platform MegaFUNalo, featuring free Viva movies as an added bonus to players. The firm took out full-page ads in major newspapers to announce the soft launch and its...

The Philippine stock market is expected to continue moving sideways this week after benign inflation failed to spur a rally, although some investors will take cues from data to be released by the Bangko Sentral ng Pilipinas, including foreign direct investment and balance of payment numbers....

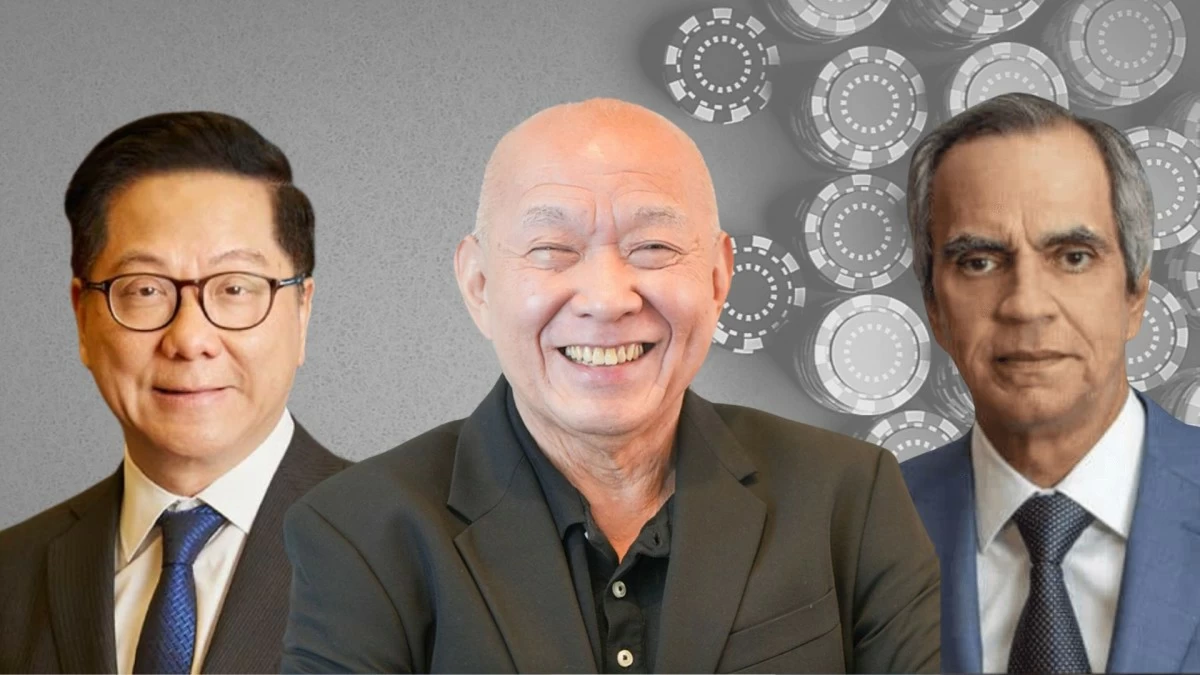

The advertising industry will be the clear winner when more casino operators try to jump on the online gaming bandwagon since these new players will have to spend billions of pesos monthly just to get a foot into the market and take some market share away from the first movers. Unicapital...