The advertising industry will be the clear winner when more casino operators try to jump on the online gaming bandwagon since these new players will have to spend billions of pesos monthly just to get a foot into the market and take some market share away from the first movers.

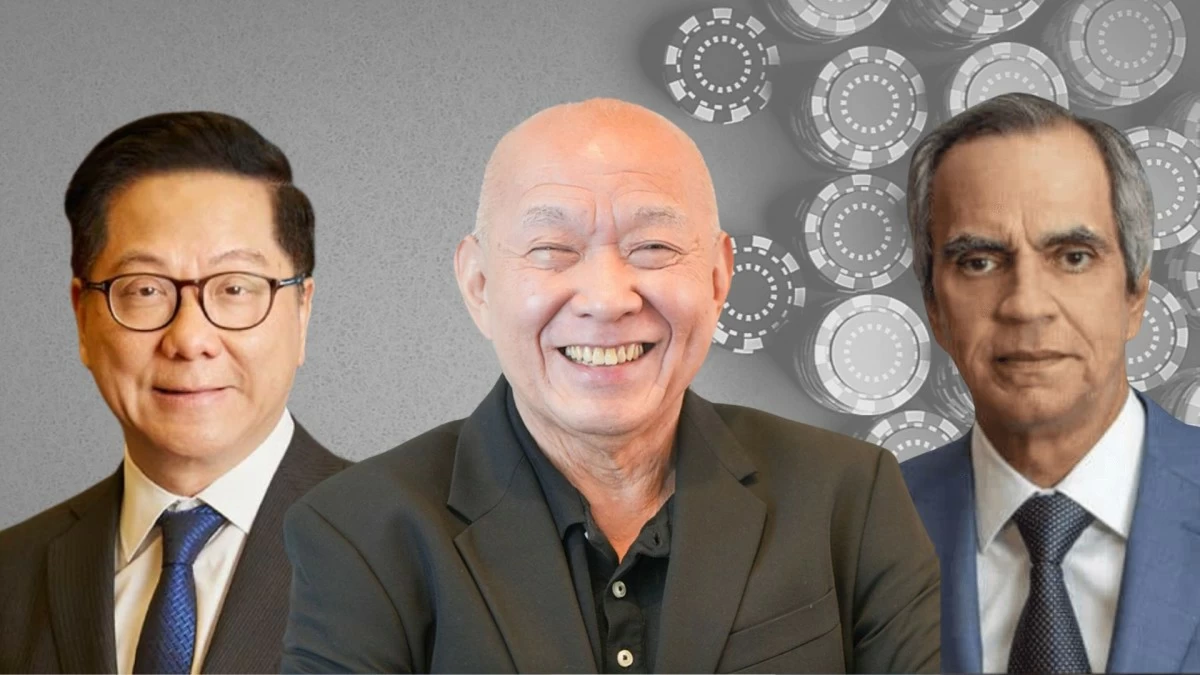

Online gaming war heats up as Bloomberry, Travellers brace for costly fight

Unicapital Securities Research Analyst Jeri R. Alfonso said Bloomberry Resorts Corp. of billionaire Enrique K. Razon Jr. will be launching its Megafunalo online gaming platform next month.

Abacus Securities Corp. said tycoon Andrew Tan’s Alliance Global Group Inc. will also be launching an online gaming platform, while Hann Holdings Inc. also revealed in its initial public offering (IPO) prospectus that it is also planning to enter the highly lucrative online gaming market.

It noted that, Bloomberry confirmed it will spend heavily, in the order of at least ₱1 billion to ₱2 billion per quarter just on advertising and promotions to help the online business get some traction.

Alfonso said Bloomberry has already reported higher operating expenses tied to its gaming app launch and “we think Travellers (AGI subsidiary Travellers International Hotel Group Inc.) is likely to follow the same cost trend as it gears up to go online.

“The bulk of these costs will come from customer acquisition efforts, with both companies aiming to close the gap with market leaders. Development-related expenses, especially for outsourced services, are also set to climb.”

Abacus said Bloomberry’s management has revealed that they have a third-party provider for the mobile app being developed who will then be entitled to a revenue sharing scheme which wasn't specified.

“While this mitigates the risk, Bloomberry won't fully enjoy the benefit if/when online does become profitable. In the near to medium term, the losses from this venture will likely be substantial and will probably drag into next year before it starts to contribute positively to the bottom line,” it said.

Meanwhile, Abacus pointed out that, “Digiplus Interactive Corp.’s spectacular rise and booming profits may have given the impression that it's all easy money and that Bloomberry can just waltz in and join the party."

“Truth is, Digiplus has had to spend more and more to acquire active users. Last year, the company spent three times as much as it did on advertising and promotion and it still actually lost a few percentage points of market share in terms of gross gaming revenue (GGR),” the brokerage said.

Digiplus Vice President for Investor Relations and Corporate Communications Celeste Jovenir said a "majority of our A&P spend is for promotion credits and digital ads."

Abacus explained that, “Unlike with physical goods or most other services, there are no price points (in the normal sense of the word) in e-gaming. In this case, therefore, the company may have to offer better odds and bigger prizes to gain traction. There will have to be heavy investment in customer service and technology as well.”

Alfonso also said that, “In our view, if Bloomberry and Travellers give out compelling payouts or jackpot prizes, they could pull users away from established platforms like Digiplus.”

However, Abacus said, “Current e-gaming operators are already well-established and are probably prepared for new competitors. And, the fact is, business literature is replete with anecdotal evidence that is much more expensive for a new play to try taking market share than it is for incumbents to defend theirs. And not only will it probably take two years (or longer) to turn a meaningful profit, medium-term earnings will take a hit.”