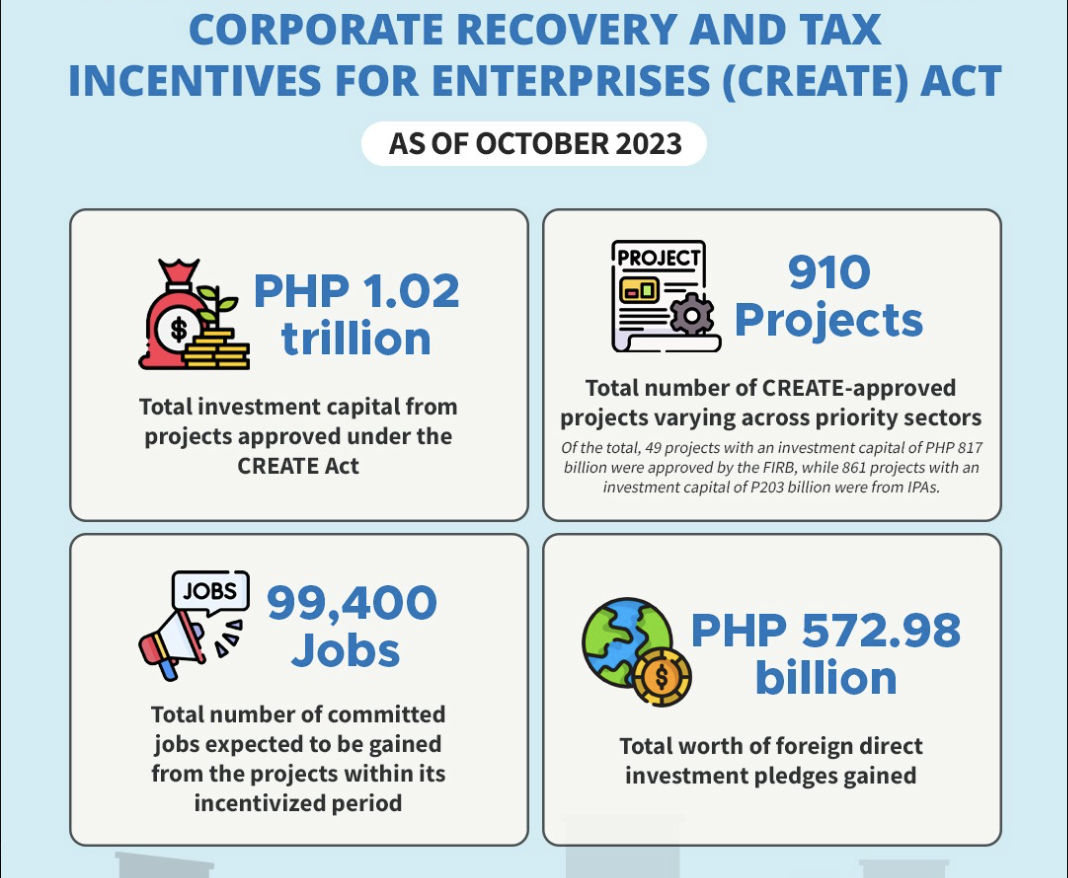

The Department of Finance (DOF) announced that the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act has already attracted over a trillion pesos in investment capital. According to a Facebook post by the DOF, projects approved under the CREATE Act, which aims to address...

The Court of Tax Appeals (CTA) has junked the petition filed by GHF PTY Ltd, a multinational corporation, which asked the Bureau of Internal Revenue (BIR) to refund P46.7 million in excess and unutilized creditable witholding taxes (CWT) paid in 2017. “Since taxes are the lifeblood of the...

Surigao del Norte 2nd district Rep. Robert Ace Barbers has filed a bill that would grant tax incentives to cremation facilities that would help law enforcement authorities in their effort to destroy seized illegal drugs faster. This is spelled out in...

The Court of Tax Appeals (CTA) has ordered Taguig City to refund Holcim Philippines, Inc. P8.1 million in erroneously collected local business tax (LBT) in 2018. In a decision issued by the CTA's special second division, the tax court reversed the May 6, 2022 ruling of the Taguig City regional...

The Court of Tax Appeals (CTA) has dismissed the petition filed by Arrow Freight Corporation (AFC) for a refund of P33.28 million in withholding taxes collected by the Bureau of Internal Revenue (BIR) for taxable year 2014. Instead, the CTA -- as a full court -- affirmed AFC's partial refund...

The Court of Tax Appeals (CTA) has dismissed the petition filed by Mactan Electric Company, Inc. (MECO) which challenged the P2.8 million real property taxes assessed by the municipality of Cordova in Cebu for taxable years 1992 to 2011. In 2012, MECO filed with the Cebu City regional trial court...

The Court of Tax Appeals (CTA) has denied the petition of the National Development Company (NDC) which sought a P42.6 million refund from the Bureau of Internal Revenue (BIR) for alleged erroneously collected value added tax (VAT) from second quarter of 2015 to third quarter of 2016. NDC, a...

The Court of Tax Appeals (CTA) has denied the petition filed by SL Harbor Bulk Terminal Corporation to compel the Bureau of Internal Revenue (BIR) to issue tax credit for P10.33 million as alleged erroneously paid taxes. SL Harbor filed its administrative claim for tax credit on June 26, 2020 for...

The Court of Tax Appeals (CTA) has denied the petition of the National Food Authority (NFA) which challenged the real property tax (RPT) imposed by the municipality of Shariff Aguak in Maguindanao. The NFA questioned the municipality's RPT assessment against it as it argued that it is a government...

Albay 2nd district Rep. Joey Salceda (Rep. Salceda's office) The House Committee on Ways and Means will soon hold an inquiry on what could end up as a P728-million tax evasion case involving the e-cigarette label FLAVA. This was announced Friday afternoon, Nov. 10...

The Court of Tax Appeals (CTA) has denied the petition filed by a firm engaged in outsourced call center services for a refund of P25.3 million in allegedly overpaid taxes in 2017. Denied was the petition filed by Foundever Philippines Corporation, formerly Sitel Philippines Corporation) against...