The Department of Finance (DOF) has stated that the expected revenue from the "refined" five tax reform proposals will fall short of the initial projections made by the agency. Finance Secretary Ralph G. Recto said late Friday, Jan. 26, that the projected revenue gain of P213 billion from the...

The Department of Finance (DOF) plans to push for approval of five pending tax measures in Congress within this year to raise around P213 billion by the end of President Marcos' term. In the absence of new tax proposals, Finance Secretary Ralph G. Recto said the DOF will continue to push for the...

E-cigarette and vape manufacturers and distributors in the country are in favor of the Department of Finance's (DOF) efforts to improve tax collection efficiency and pursue tax evaders, including those involved in the vapor products sector. In a statement, Joey Dulay, Philippine E-cigarette...

The Bureau of Internal Revenue (BIR) is intensifying its tax efficiency by actively reaching out to business owners to discuss their tax responsibilities, with the goal of enhancing its collection performance for the year. The Nationwide Tax Compliance Verification Drive (TCVD), which runs from...

Bureau of Internal Revenue (BIR) Commissioner Romeo Lumagui Jr. said that imposing withholding tax on online transactions will not increase the price of goods in online marketplaces. As per the BIR Revenue Regulations No. 16-2023, withholding tax will be imposed on one percent of the gross...

The Department of Finance (DOF) has reported that the law providing tax relief for eligible companies has resulted in the creation of over 100,000 jobs for Filipinos since its implementation two years ago. Data from the DOF showed that total approved investments under the Corporate Recovery and Tax...

The Department of Finance (DOF) has stressed the importance of determining the most efficient and economically viable approach to carbon taxation before introducing it in the Philippines. Finance Secretary Ralph G. Recto said on Tuesday, Jan. 16, that it is vital to find the most suitable way to...

President Marcos’ newly appointed finance secretary, Ralph G. Recto, said he would ensure that the Maharlika Investment Fund (MIF) will “operate in fidelity with the law and fulfill its intended objectives.” The MIF, which is the country’s first wealth fund, is managed by the Maharlika...

ILOILO CITY – The Iloilo City Council has approved a 40 percent reduction in real property tax (RPT) for a two-year period. The Iloilo City Council approved this week the ordinance authored by Councilor Rex Marcus Sarabia that imposes 60 percent RPT payment for the years 2024 and 2025. THE Iloilo...

ILOILO CITY – In response to the clamor of the business sector, the Iloilo City government reduced real property tax (RPT) here by 40 percent for fiscal years 2024 and 2025. “This is in view of the many inquiries we are getting on the increase in RPT,” said Mayor Jerry Treñas here. THE...

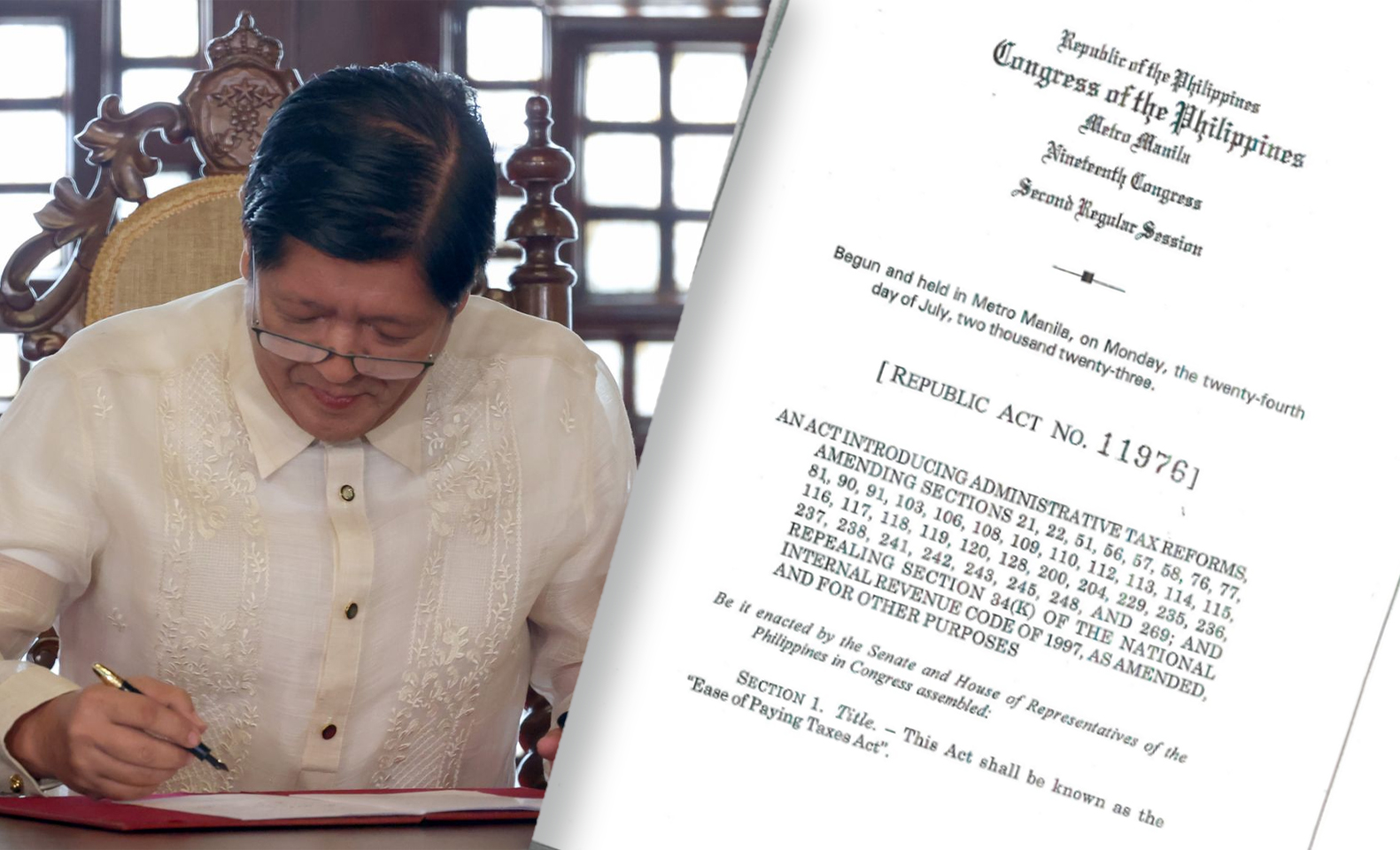

President Marcos has signed Republic Act (RA) No. 11976, or the Ease of Paying Taxes Act, to boost the economy and safeguard taxpayer rights while improving revenue collection through digitalization initiatives. File photos Marcos signed the measure on Friday, Jan. 5. It was one of his priority...

Malacañang has turned down provisions in the Ease of Paying Taxes (EOPT) law that aimed to exempt small businesses from deducting withholding taxes. In a letter dated Jan. 5, 2024, addressed to the House of Representatives, President Marcos said he was “constrained to veto Section 8,” of...