Government spending related to the May 12 midterm elections—frontloaded expenditures prior to the polls as well as the resumption of delayed projects due to the election ban—would likely spill over into the second quarter and support first-half economic growth, economists said. "While the...

Another 25-basis-point (bp) interest rate cut by the Bangko Sentral ng Pilipinas (BSP) is widely expected at its monetary policy meeting next month, as inflation slides and economic growth weakens. In a May 9 report, Deutsche Bank Research said the lower-than-expected 5.4-percent gross domestic...

The coast isn 't clear yet for domestic inflation, as Singapore-based United Overseas Bank (UOB) sees looming United States (US) tariffs as a global price risk for an economy like the Philippines, which imports the bulk of the goods it consumes. "The US reciprocal tariffs after the 90-day...

The Bangko Sentral ng Pilipinas (BSP) is expected to finally push through with its much-awaited reduction in key interest rates to protect the economy from the likelihood of a wider negative outlook gap, no thanks to United States (US) President Donald Trump's reciprocal tariffs. In an April 4...

The Philippines would buck the trend of weak growth prospects in emerging markets (EMs) amid the United States' (US) tariffs threat, according to the think tank Capital Economics. "In all, aggregate EM GDP growth is likely to slow in the coming quarters... we think growth will generally fall short...

US President Donald J. Trump's protectionist policies remain the top risk to Philippine economic prospects this year, according to the think tank Capital Economics. "A key uncertainty over the coming year is whether and to what extent Donald Trump follows through with his threats to impose tariffs...

Department of Finance (DOF) Secretary Ralph G. Recto said that key borrowing costs are unlikely to drop to pre-pandemic level amid expectations that the US Federal Reserve (Fed) will slow down its policy rate reduction. According to the finance chief, the market expectation for 2025 is for...

President Marcos' chief economic manager expects further appreciation of the peso against the US dollar, driven by increased remittance inflows during the upcoming holiday season. In a briefing on Tuesday, Sept. 24, Finance Secretary Ralph G. Recto explained that the local currency typically...

The Bangko Sentral ng Pilipinas' (BSP) monetary policy easing cycle is expected to extend until the first half of 2025, to slash the key interest rate to 4.75 percent, according to the think tank Capital Economics. "The central bank [BSP] cut interest rates at its August meeting. With growth set to...

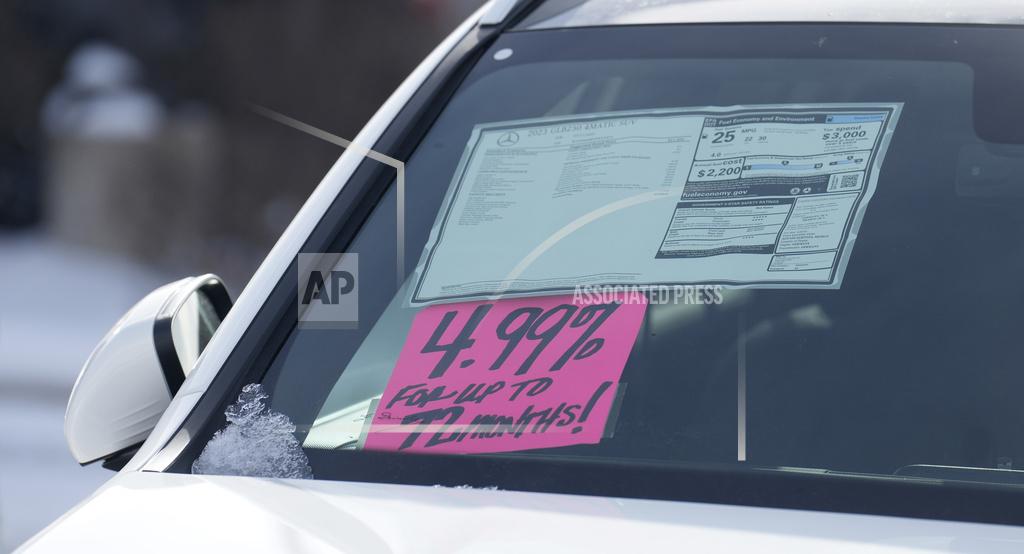

NEW YORK — Mortgage rates, credit card rates, auto loan rates, and business loans with variable rates will all likely maintain their highs, with consequences for consumer spending, after the Federal Reserve indicated Wednesday that it doesn't plan to cut interest rates until it has "greater...

WASHINGTON — The Federal Reserve on Wednesday emphasized that inflation has remained stubbornly high in recent months and said it doesn't plan to cut interest rates until it has "greater confidence" that price increases are slowing sustainably to its 2% target. The Fed issued its decision in...

Filipinos looking to take out loans for major expenses can find some relief, as the Department of Finance (DOF) expects that interest rates are likely to remain steady or even decrease in the latter half of the year. On the sidelines of the Bureau of Internal Revenue’s National Tax Campaign...