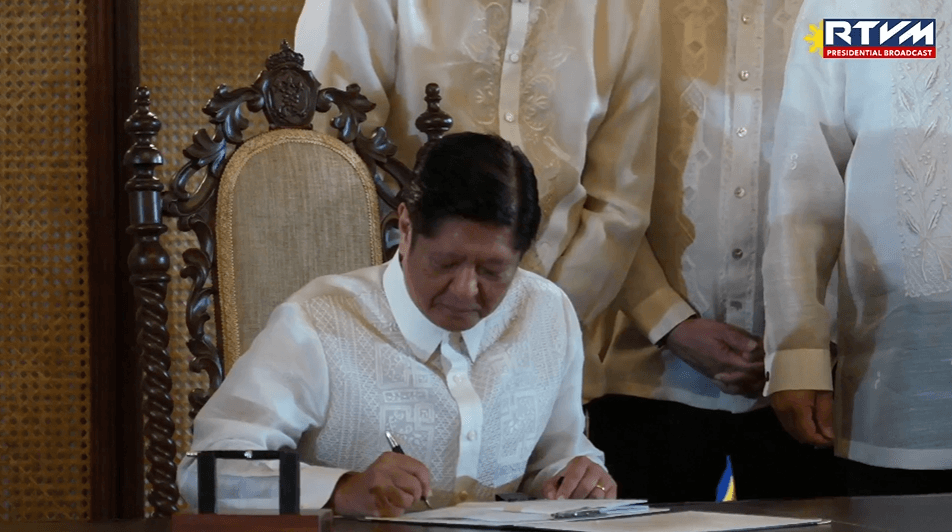

President Marcos signed on Monday, Nov. 11, the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act, stressing that it's "a decisive step" towards a globally competitive and investment-led Philippine economy. Marcos said...

Senate President Francis “Chiz” Escudero on Sunday, November 10 said he expects the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act to generate new jobs domestically and attract more foreign investments in the...

Senator Juan Miguel "Migz" Zubiri hailed Japanese companies' commitment to expanding their investments in the Philippines ahead of the anticipated passage of the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act. Senate...

The Department of Finance (DOF) has assured Singaporean investors that the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) law will simplify doing business in the Philippines, streamline processes and reduce red tape....

The work-from-home (WFH) model is on track to become a permanent component of the Philippine business landscape as the CREATE MORE bill—officially known as the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy—nears its final...

House of Representatives (Ellson Quismorio/ MANILA BULLETIN) The CREATE MORE bill--which seeks to make the country's tax regime both compliant with the minimum global tax and at the same time remain competitive--is now just President...

The proposed Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) will help attract more foreign direct investments (FDI) into the Philippines and enhance the country’s economic growth, Sen. Sherwin Gatchalian said. ...

Albay 2nd district Rep. Joey Salceda (Facebook) Albay 2nd district Rep. Joey Salceda is upbeat over the passage on second reading of the CREATE MORE (Maximize Opportunities for Reinvigorating the Economy) bill, his pet measure. As such, the House...

The young artists with their CREATE awards. Joining them are House Speaker Martin Romualdez (middle, bottom row) and Pangasinan 4th district Rep. Christopher “Toff” De Venecia (leftmost, upper row) (Speaker’s Office) The House of Representatives arts...

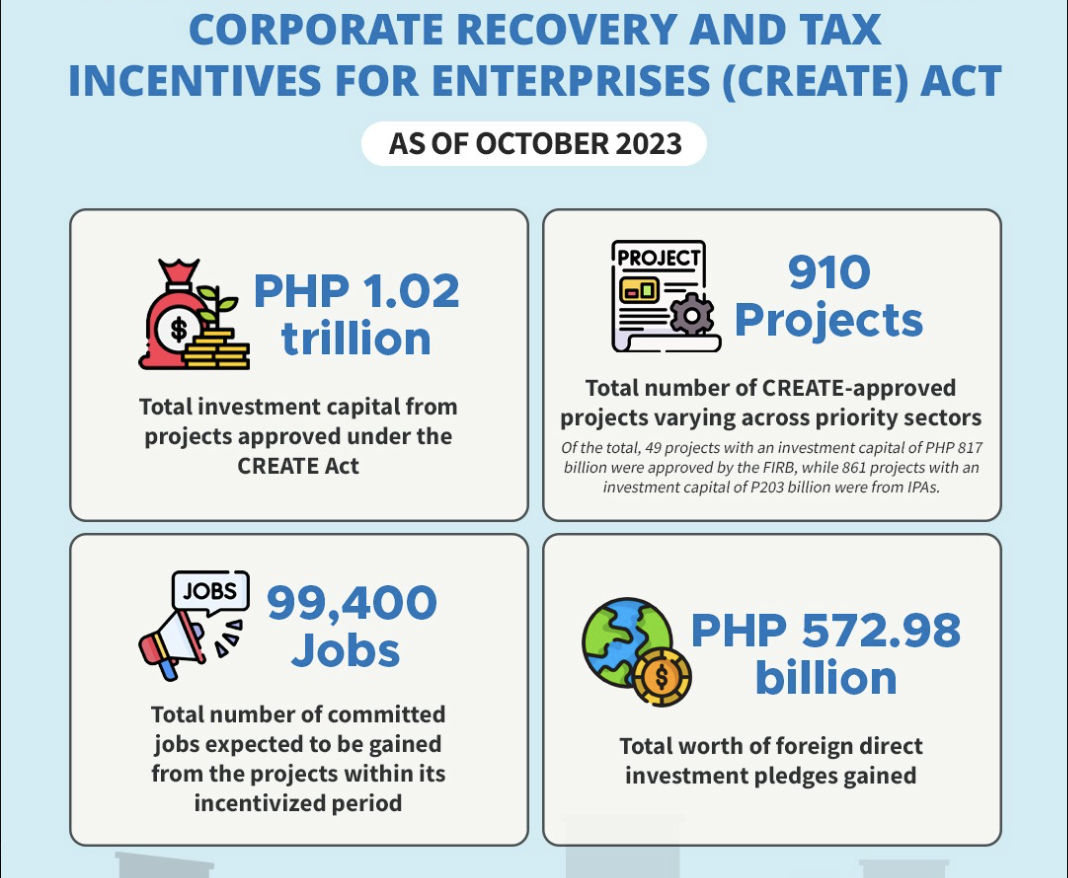

The Department of Finance (DOF) announced that the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act has already attracted over a trillion pesos in investment capital. According to a Facebook post by the DOF, projects approved under the CREATE Act, which aims to address...

The Department of Finance (DOF) has reported that the application for tax incentives for 45 projects, with a combined investment capital of P721.3 billion, has been approved by the Fiscal Incentives Review Board (FIRB). In a statement on Wednesday, Oct. 25, the DOF said these projects are...

The Department of Finance’s (DOF) threw its support behind the proposed amendments to the Corporate Recovery and Tax Incentives for Enterprises (CREATE) law to harness the Philippines’ potential as a global investment hub. In a statement on Wednesday, Oct. 25, Finance Secretary Benjamin E....