President Marcos is expected to soon announce the appointment of two bankers to the highest policy-making body of the Bangko Sentral ng Pilipinas (BSP). Walter C. Wassmer Insiders told Manila Bulletin that Walter C. Wassmer, a veteran executive from BDO Unibank Inc., will likely join...

A combination of easing inflation pressures and slowing economic growth will allow the Bangko Sentral ng Pilipinas (BSP) to cut interest rates beginning the third quarter, think tank Capital Economics said. Across emerging Asian economies, "central banks have recently started to sound more dovish,...

The Bangko Sentral ng Pilipinas (BSP) will likely keep the policy rate at 6.5 percent next week while the central bank navigates around a weak peso and a hawkish US Federal Reserve, global banks said. "Another central bank that may be under pressure to review its rate stance next week is the...

The Bangko Sentral ng Pilipinas (BSP) wants its supervised financial institutions to set down the policy on the filing of legal cases against erring personnel to curb the incidence of misbehaving directors, officers and employees. In a proposed circular, the BSP laid down what to do in terms of...

Moody’s Analytics said the Bangko Sentral ng Pilipinas (BSP) is expected to hold its key rate steady at 6.5 percent during its monetary policy meeting on Thursday, May 16. In its latest Economic View: Asia Pacific commentary, the global credit rating agency noted that with the inflation...

Big banks’ outstanding loans grew by 9.4 percent year-on-year in March, higher than the growth in February of 8.6 percent, according to the Bangko Sentral ng Pilipinas (BSP). In a statement Friday, May 10, the BSP said this data is net of reverse repurchase (RRP) placements with the central...

The banking sector’s gross non-performing loans (NPL) or bad loans ratio dropped to 3.39 percent in March versus 3.44 percent in February, the lowest so far for the year, based on Bangko Sentral ng Pilipinas (BSP) data. The current bad loans ratio is, however, higher compared to same period last...

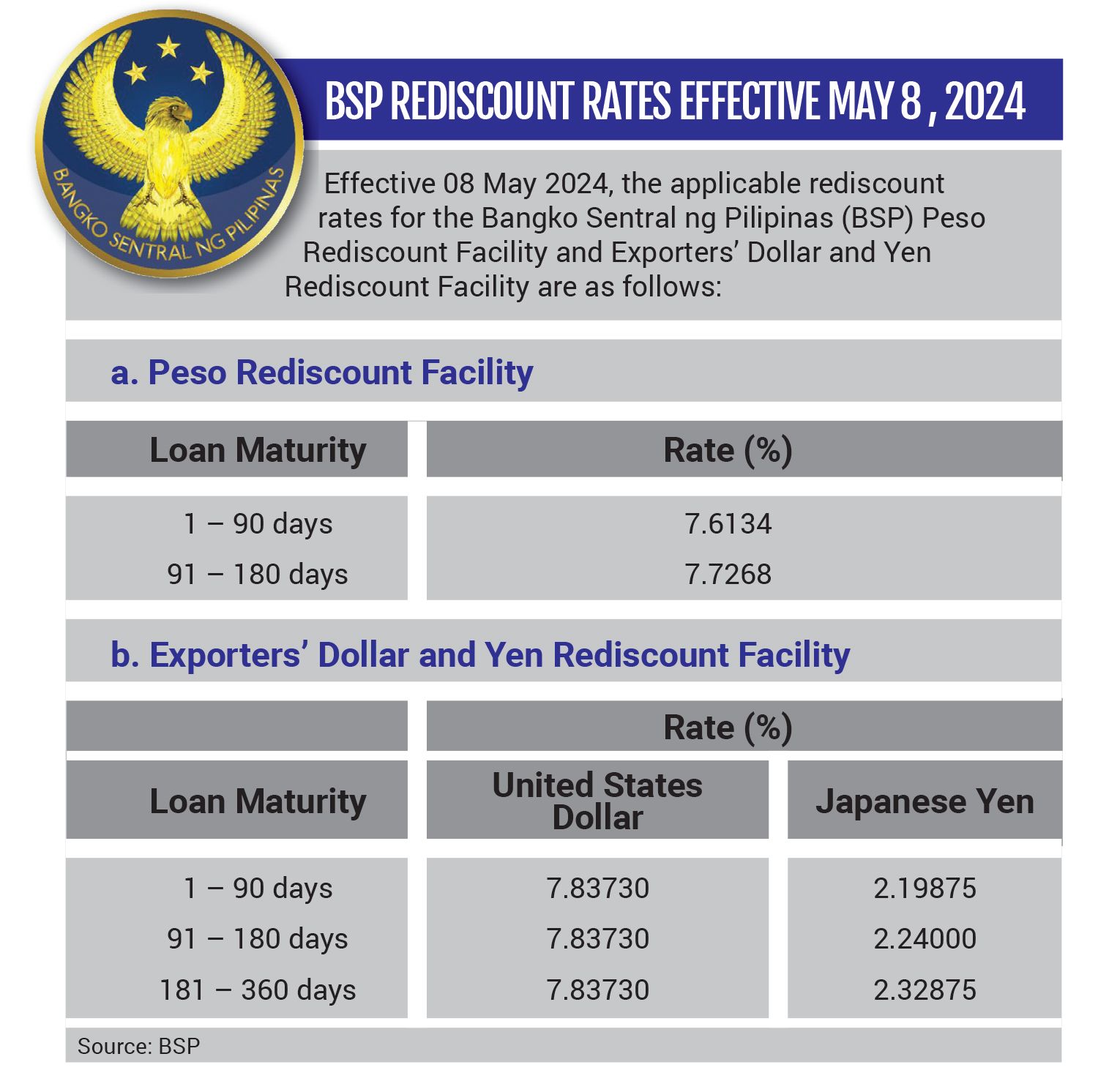

The Bangko Sentral ng Pilipinas (BSP) has lowered the rates on its Peso Rediscounting Facility effective Wednesday, May 8, for all tenors. Rediscounting is a standing credit facility provided by the BSP to qualified banks with active rediscounting lines help banks meet temporary liquidity needs by...

Philippines’ stock of US dollars dropped by $630 million to $103.437 billion as of end-April compared to end-March’s $104.067 billion after the government withdrew foreign currency from the Bangko Sentral ng Pilipinas (BSP) to pay for maturing loans and to fund expenditures. Despite the...

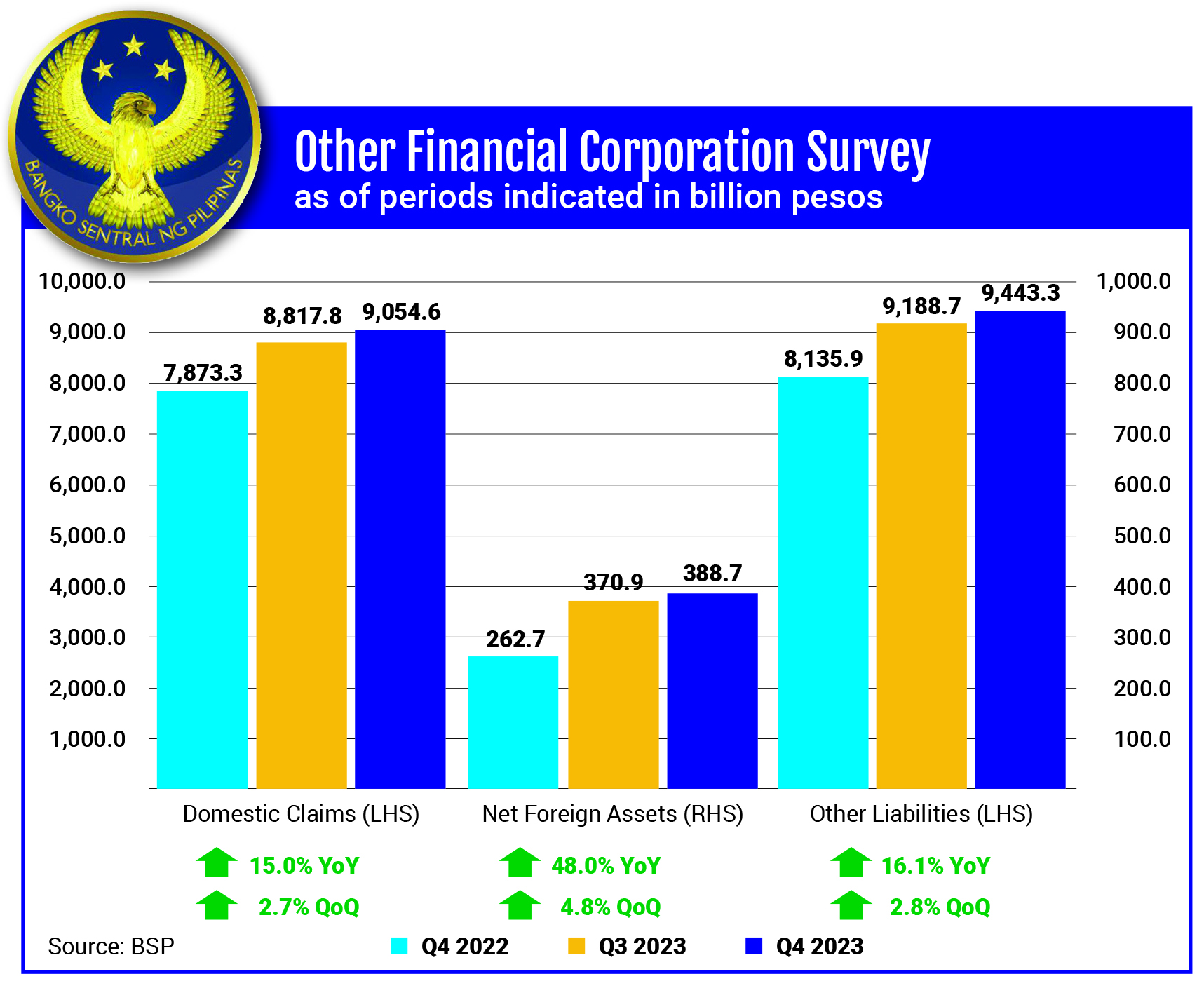

The domestic claims of non-bank or other financial corporations (OFCs) grew by 15 percent year-on-year in 2023 to P9.054 trillion from P7.873 trillion, according to the Bangko Sentral ng Pilipinas’ (BSP) Other Financial Corporations Survey (OFCS). The quarterly OFCS is basically an analytical...

NEW YORK — U.S. stocks swung to a mixed finish on Wednesday after the head of the Federal Reserve said the cuts to interest rates that Wall Street craves so much are still likely, even if they're delayed because of stubbornly high inflation. The S&P 500 fell 17.30 points, or 0.3%, to...

WASHINGTON — The Federal Reserve on Wednesday emphasized that inflation has remained stubbornly high in recent months and said it doesn't plan to cut interest rates until it has "greater confidence" that price increases are slowing sustainably to its 2% target. The Fed issued its decision in...