With the implementation of a law aimed at simplifying tax payments, the Bureau of Internal Revenue (BIR) has announced that it will no longer require business taxpayers to pay the annual registration fee (ARF). In a notice posted on its website and signed by BIR Commissioner Romeo D. Lumagui, Jr.,...

Senators on Monday, January 8, welcomed the signing of the Ease of Payment Taxes Act saying the new law would help foster transparency in the business processes and further boost the country’s economic development. “The signing of the Ease of Paying Taxes Act stands as a resounding...

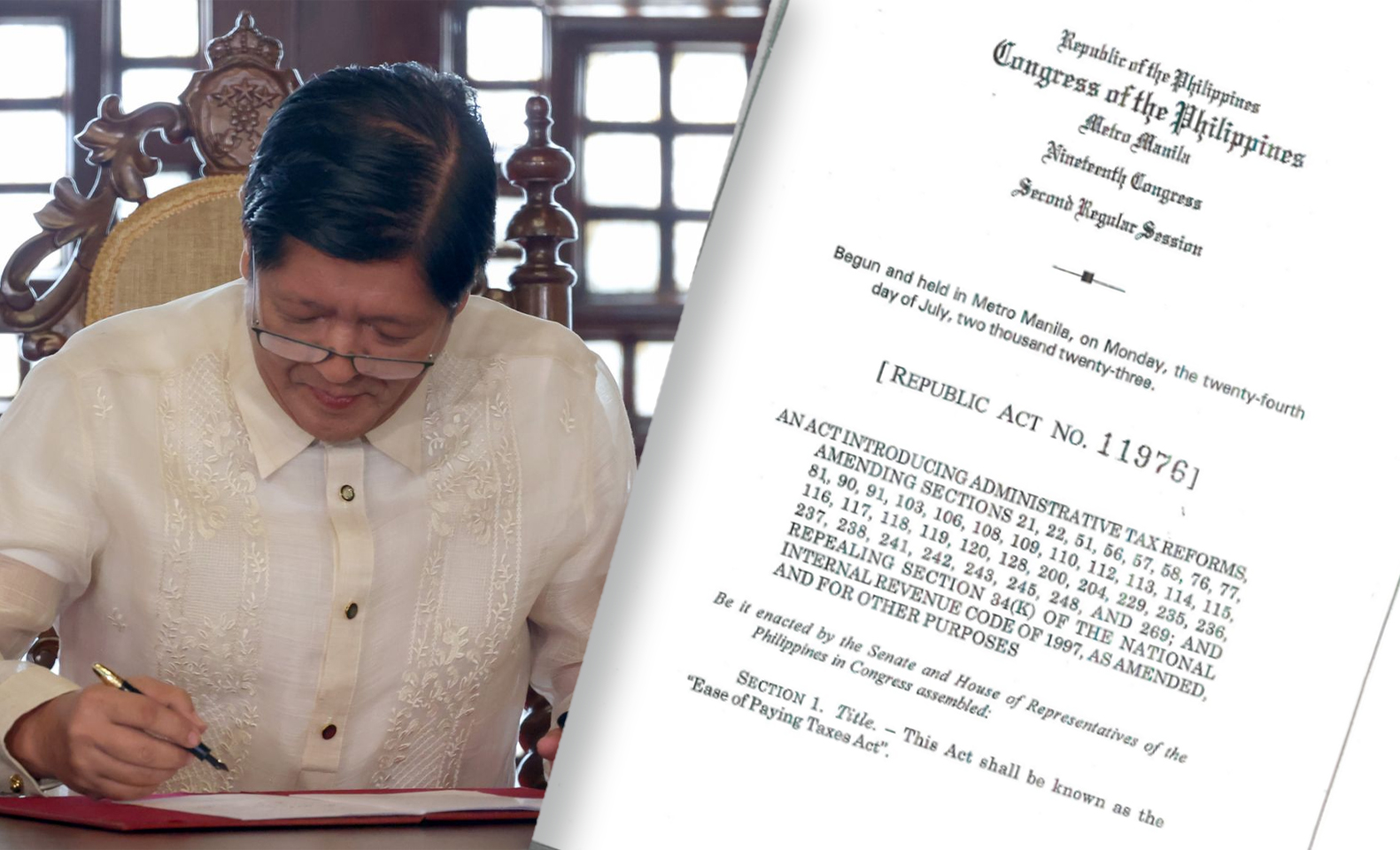

President Marcos has signed the Ease of Paying Taxes (EOPT) Act, also known as Republic Act No. (RA) 11976, last Jan. 5, marking a significant step in the modernization of the Philippine tax system and the reinforcement of taxpayer rights. Here, the Department of Finance outlined the...

Albay 2nd district Rep. Joey Salceda (left) and President Ferdinand "Bongbong" Marcos Jr. (Facebook) The modernizer of long-stagnating systems. This was the new moniker given by Albay 2nd district Rep. Joey Salceda to President Marcos after the...

President Marcos has signed Republic Act (RA) No. 11976, or the Ease of Paying Taxes Act, to boost the economy and safeguard taxpayer rights while improving revenue collection through digitalization initiatives. File photos Marcos signed the measure on Friday, Jan. 5. It was one of his priority...

Malacañang has turned down provisions in the Ease of Paying Taxes (EOPT) law that aimed to exempt small businesses from deducting withholding taxes. In a letter dated Jan. 5, 2024, addressed to the House of Representatives, President Marcos said he was “constrained to veto Section 8,” of...

The Court of Tax Appeals (CTA) has denied the petition of the National Food Authority (NFA) which challenged the real property tax (RPT) imposed by the municipality of Shariff Aguak in Maguindanao. The NFA questioned the municipality's RPT assessment against it as it argued that it is a government...

The Department of Energy (DOE) is batting for comprehensive review of the taxes being levied on petroleum products as well as those for electricity generation – with the end goal of scrapping taxes that are being imposed on other taxes. Energy Secretary Raphael P.M. Lotilla primarily indicated...

The Senate has ratified the bicameral conference committee report on the disagreeing provisions of Senate Bill No. 2224 and House Bill No. 4125 or the proposed Ease of Paying Taxes Act. The bill primarily seeks to amend provisions of the National Internal Revenue Code of 1997 to simplify the...

The government plans to impose new and revised taxes to generate nearly P500 billion over the next three years, data from the Department of Finance (DOF) showed. Based on the DOF list of revenue measures submitted to Congress, the government has proposed eight tax initiatives that, once approved,...

Senator Sherwin Gatchalian said the government should address illicit trade in order to generate higher revenue collection and provide some relief for its limited fiscal space. Gatchalian made the appeal during the recent Development Budget Coordination Committee (DBCC) briefing in the...