The European Chamber of Commerce of the Philippines (ECCP), composed of foreign business chambers representing EU and European firms’ interest in the country, has urged the government that the planned zero tariff on the importation of electric vehicles (EVs) should cover all other types of EVs,...

The Court of Tax Appeals (CTA) has rejected the petition of a popular online seller of goods to nullify the P21.8 million deficiency business tax imposed by the Makati City government. Instead, the court's Special Third Division reduced the tax liabilities of Lazada E-Services Philippines, Inc. to...

The House Committee on Ways and Means began on Monday, Nov. 28 the initial deliberations on measures seeking to amend Republic Act (RA) No.10863 or the Customs Modernization and Tariff Act (CMTA). (Ellson Quismorio/ MANILA BULLETIN) Raised and discussed by the Albay 2nd district Rep.Joey...

The Department of Finance (DOF) lauded the decision of the House of Representatives to approve on final reading a proposed measure seeking to impose taxes on single-use plastics. In a statement, Finance Secretary Benjamin E. Diokno said the swift approval of House Bill (HB) 4102 or the Single-use...

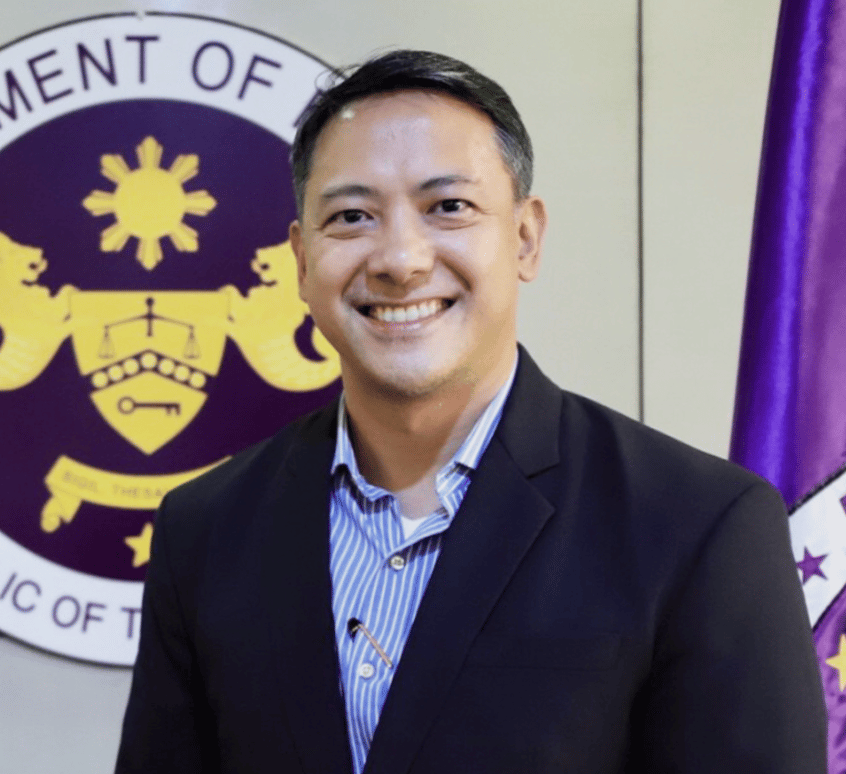

FROM THE MARGINS The President has appointed a new tax chief. Atty. Romeo Lumagui, Jr., tax lawyer and former Deputy Commissioner for Operations, recently took his oath, assuming leadership of the Bureau of Internal Revenue (BIR) amidst many challenges. With global inflation and an economy bearing...

Illicit cigarette trade in the country worsened amid the pandemic, allowing smugglers to amass huge profits and depriving the government of much needed tax revenues. At the recent Anti-Illicit Trade Conference “Plugging Revenue Leakage by Curbing Illicit Tobacco Trade,” authorities reported...

The newly-minted chief of the Bureau of the Internal Revenue (BIR) has ordered the resumption of audit and mission order issuances to run after suspected tax evaders. In a revenue memorandum circular dated Nov. 21, 2022, BIR Commissioner Romeo D. Lumagui Jr. lifted the suspension of field audits to...

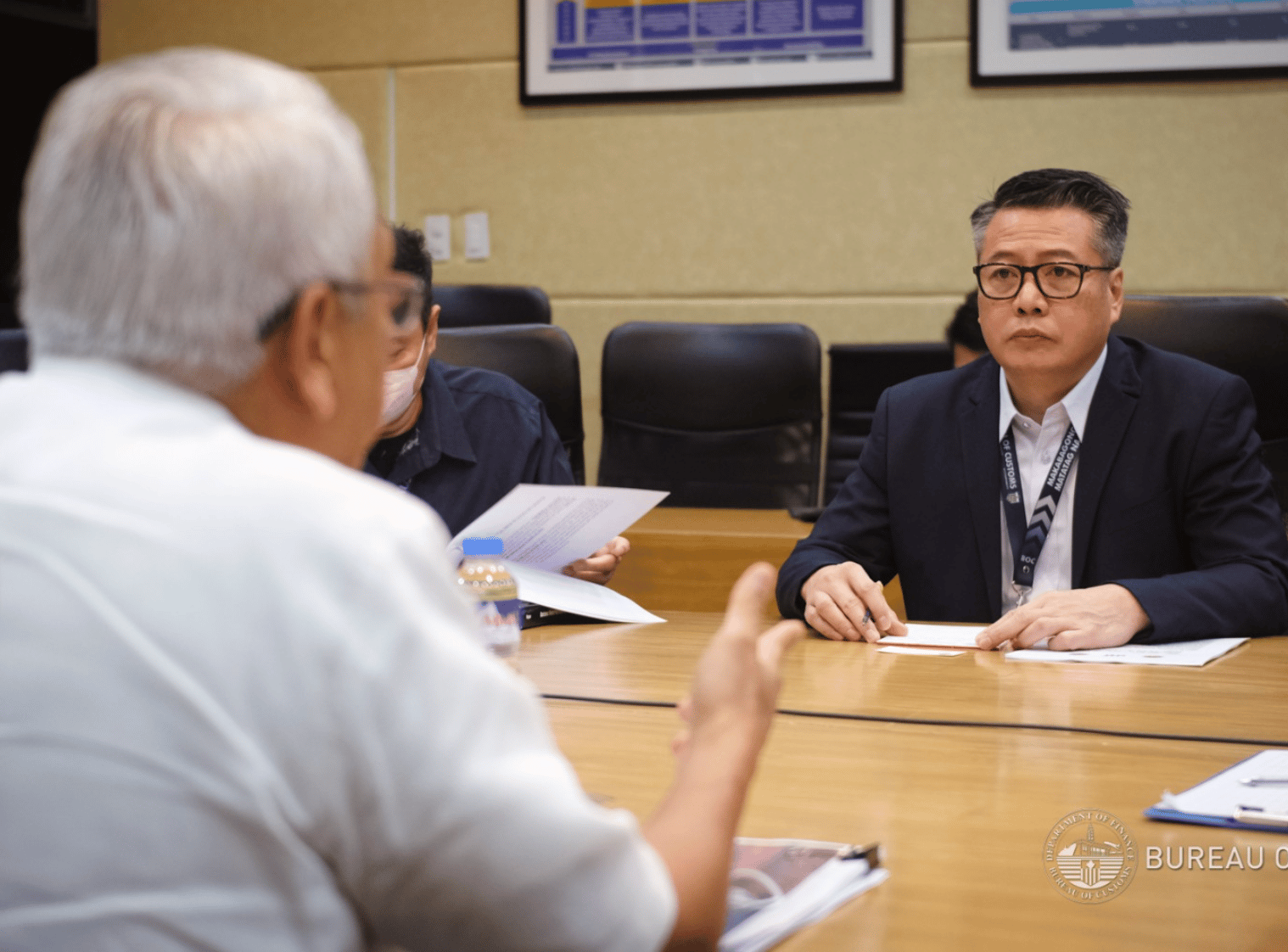

Following the higher than expected revenue haul this year, Customs Commissioner Yogi Filemon Ruiz said he was looking at P1 trillion as his aspirational target for the government’s second largest tax agency. On the sidelines of the the Manila Bulletin Hotseat interview on Tuesday, Nov. 22, Ruiz...

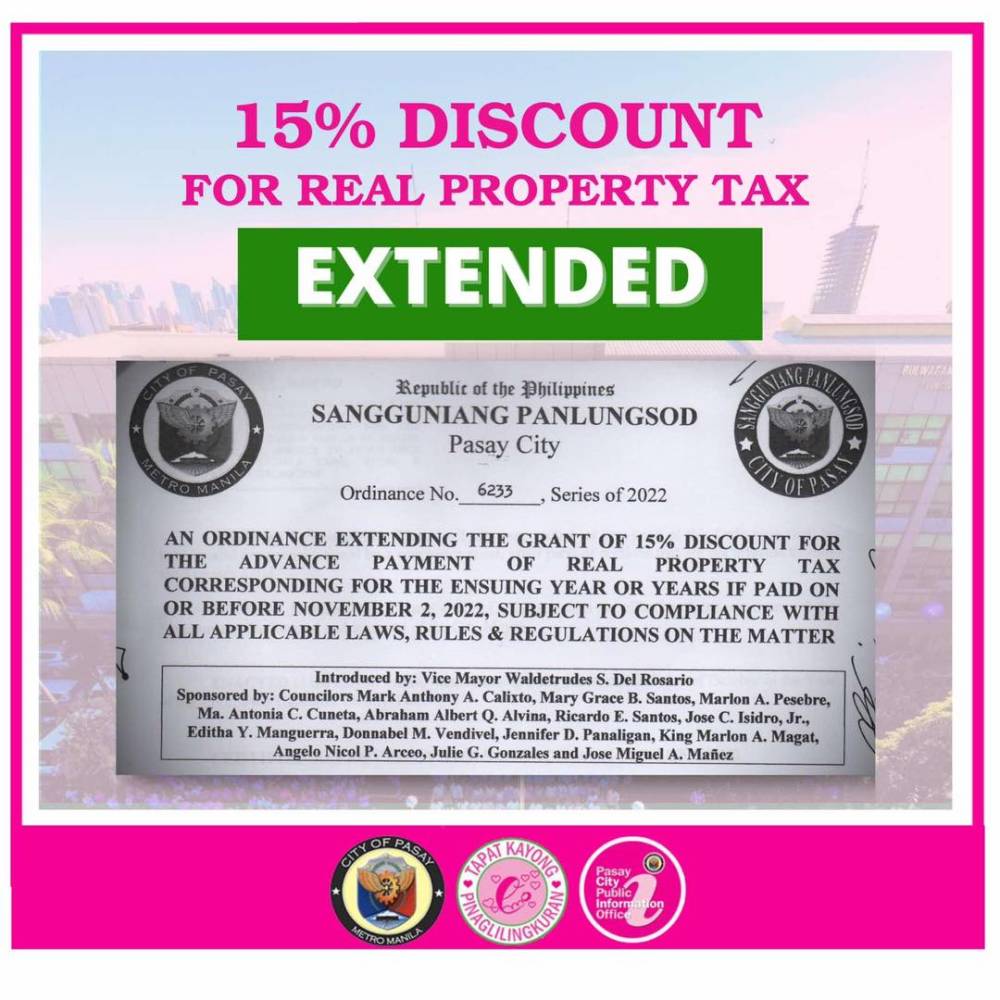

The Pasay City government is offering 15 percent discount to those who will pay in advance their real property tax based on City Ordinance No.6233. Mayor Emi Calixto-Rubiano said she asked the City Council to pass and approve an ordinance extending the grant of 15% discount for the advance payment...

The Bureau of Internal Revenue (BIR) has increased the excise tax rates of vaporized and heated cigarettes as well as the novel tobacco products. (File photo) The new tax schedules are contained in Revenue Regulations No. 14-2022 which was signed by Department of Finance (DOF) Secretary Benjamin E....

The Bureau of Internal Revenue (BIR) has issued its guidelines for the implementation of the Vape Law that also set the floor price for heated, vapor, and other tobacco products. On Thursday, Nov. 17, the BIR published Revenue Regulations No. 14-2022, which serves as its implementing rules and...

The government needs to impose tougher penalties against tobacco smuggling to address the multibillion peso tax losses incurred due to illicit trade, a lawmaker said. PBA Rep. Margarita Nograles said the government is losing an estimated P26 billion annually because of smuggled, unregistered, and...