The national government slashed the amount of subsidy it extended to government-owned and controlled corporations (GOCCs) to around 18 percent last year, but bulk of it went to the Philippine Health Insurance Corp. (Philhealth). Financial support extended to the state-owned companies plunged to...

The Marcos administration's budget surplus nearly doubled in the first month of the year due to strong revenues generated by the government's two main tax agencies. The Bureau of the Treasury reported that the national government posted a fiscal surplus of P88 billion last January, a significant...

President Marcos has appointed Sharon P. Almanza as the new national treasurer following her tenure as the Officer-in-Charge of the Bureau of the Treasury, the Department of Finance (DOF) announced. National Treasurer Sharon P. Almanza In a statement on Monday, March 11, the DOF said that Almanza...

The Bureau of the Treasury successfully raised P15 billion from the auction of Treasury bills (T-bills) as yields declined after 11 consecutive weeks of increase. The national government on Monday, March 11, made a full award of all its short-term debt papers as demands totaled P50.708 billion,...

The government's share of the Philippine Amusement and Gaming Corp. (Pagcor) income remained below its pre-pandemic levels last year, data from the Bureau of the Treasury indicated. According to the Treasury report, the national government received P33.85 billion from Pagcor's income from January...

The Bureau of the Treasury borrowed P15 billion from the local debt market through its successful auction of Treasury bills (T-bills) on Monday, March 4. Averages rates continued to move up during the auction, with all the tenors fetching slightly higher rates. Robust investor demand also marked...

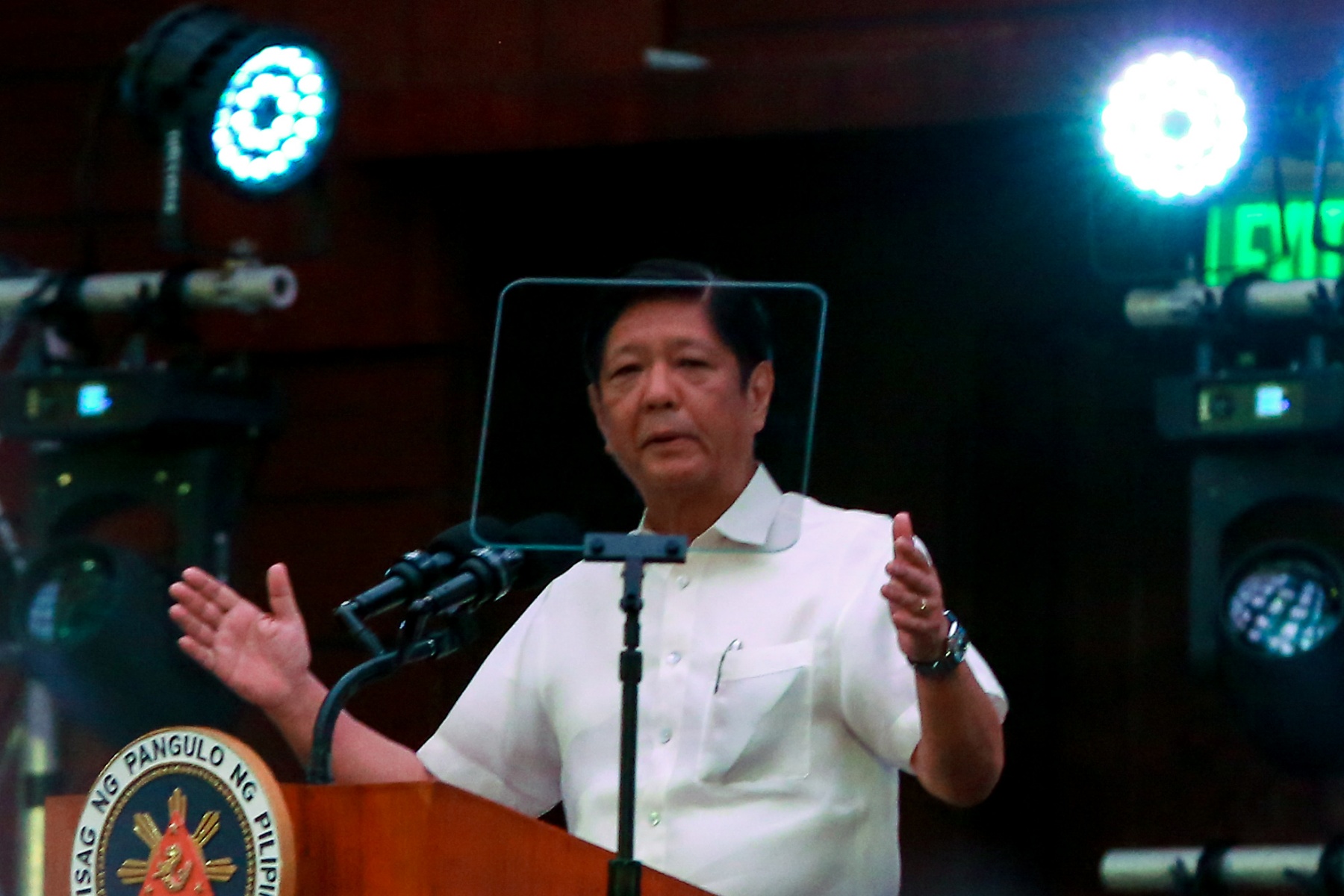

President Marcos took out slightly more loans last year to finance the government's operations and projects. Based on the Bureau of the Treasury's data, the national government's gross borrowings increased by 1.4 percent to P2.193 trillion between January and December 2023 from P2.163 trillion in...

The national government's debt is edging closer to the P15 trillion mark, fueled by increased borrowing to cover the budget deficit, data from the Bureau of the Treasury showed. In January 2024, the government's total debt rose by eight percent to P14.79 trillion from P13.698 trillion in the same...

The Marcos administration registered a reduction in the budget deficit last year, with revenues growing significantly faster than expenditures, data from the Bureau of the Treasury showed. In 2023, the national government's fiscal deficit stood at P1.512 trillion, a 6.3 percent decrease from the...

The national government fell short anew in making a full award of the short-term debt papers following the record-high P585 billion retail treasury bond issuance. The Bureau of the Treasury during an auction on Monday, February 26, partially borrowed P14.8 billion through the sale of Treasury bills...

Small Filipino investors swarmed the government's retail treasury bond (RTB) sale, reaching another record driven by the attractive interest rate being offered. The Bureau of the Treasury announced that the national government raised a total of P584.86 billion through the sale of five-year RTBs,...

The government sold some short-term loans to Filipino investors, even though interest rates were up and there were fewer takers. During the auction on Monday, Feb. 19, the Bureau of the Treasury raised P14.5 billion through the sale of Treasury bills (T-bills), below the P15 billion program. ...