The Bureau of Internal Revenue (BIR) seized a vending machine openly selling illegal vape products near popular hangout spots for youth. In a Facebook post by BIR Commissioner Romeo D. Lumagui Jr., he said the vending machine in a public building housing several businesses was found to sell illegal...

CEBU CITY – Charges were filed against a woman for allegedly manufacturing and selling falsified Tax Identification Number (TIN) cards. NATIONAL Bureau of Investigation-Central Visayas Regional Director Renan Oliva (left) shows the mug shots of a woman who was arrested for allegedly selling...

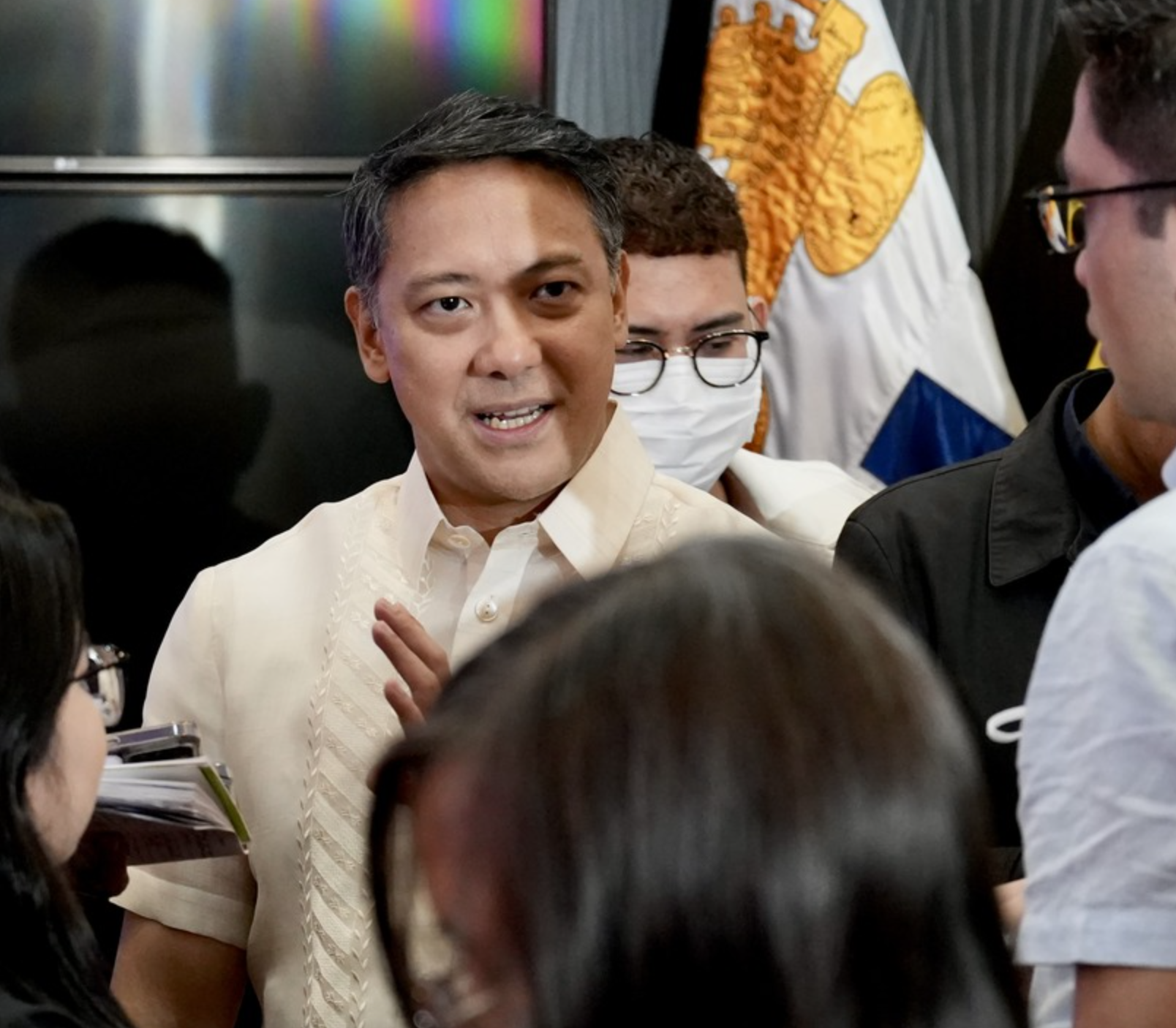

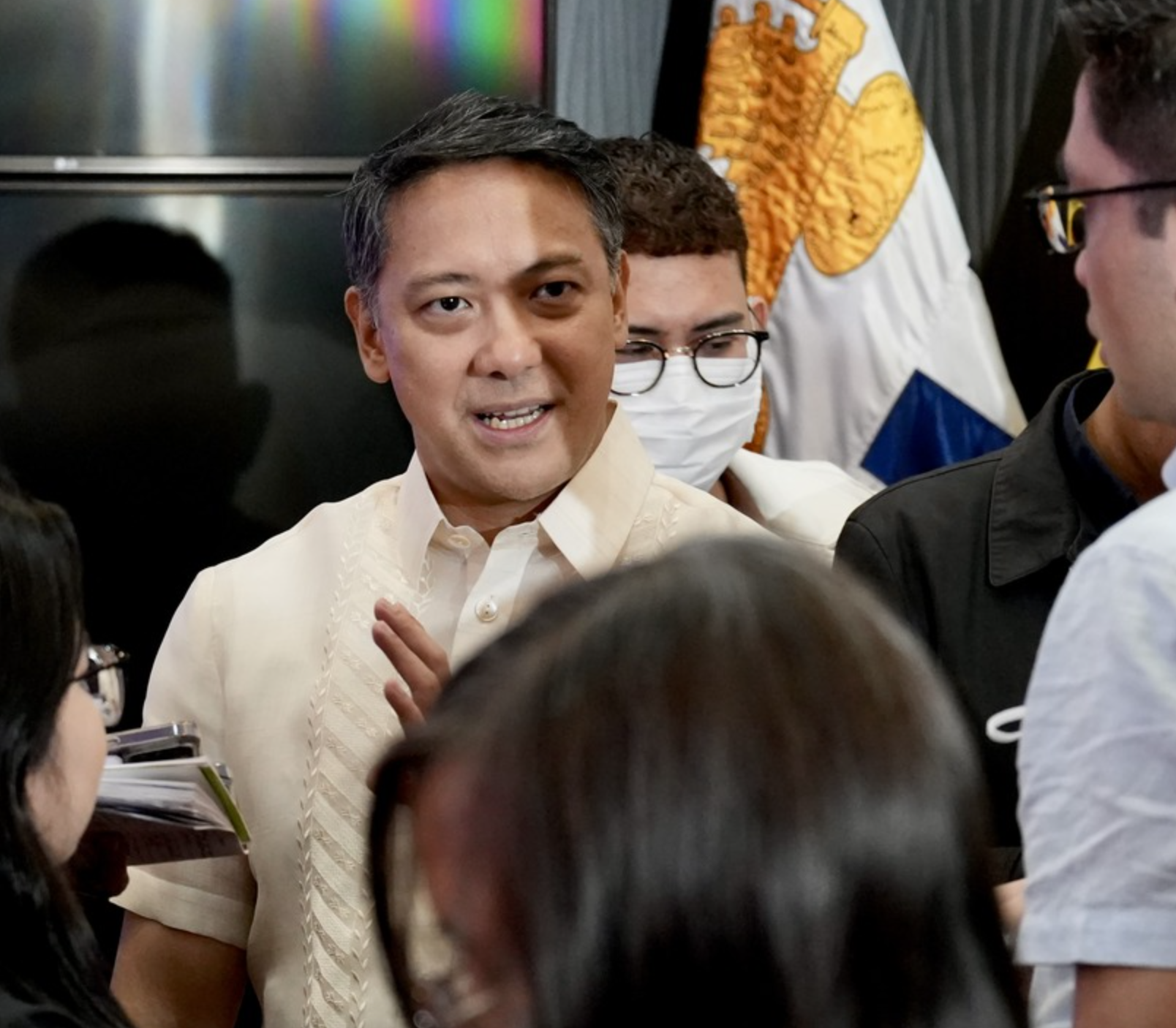

Online marketplaces like Facebook and Shopee may be shut down if unregistered online sellers are still able to sell on their platforms, Bureau of Internal Revenue (BIR) Commissioner Romeo D. Lumagui Jr. said. Lumagui told reporters on Wednesday, July 17, that online sellers whose businesses are not...

The Bureau of Internal Revenue (BIR) partnered with the Securities and Exchange Commission (SEC) to create an interagency data-sharing system to expedite the verification of registered businesses in the country. BIR Commissioner Romeo D. Lumagui Jr. and SEC Chairperson Emilio B. Aquino signed a...

The Bureau of Internal Revenue (BIR) has released a detailed guide on invoicing requirements under Revenue Memorandum Circular No. 77-2024. Titled "GABAY PARA SA INVOICING REQUIREMENTS," BIR Commissioner Romeo D. Lumagui Jr. offers businesses and taxpayers clear ways to adhere to proper...

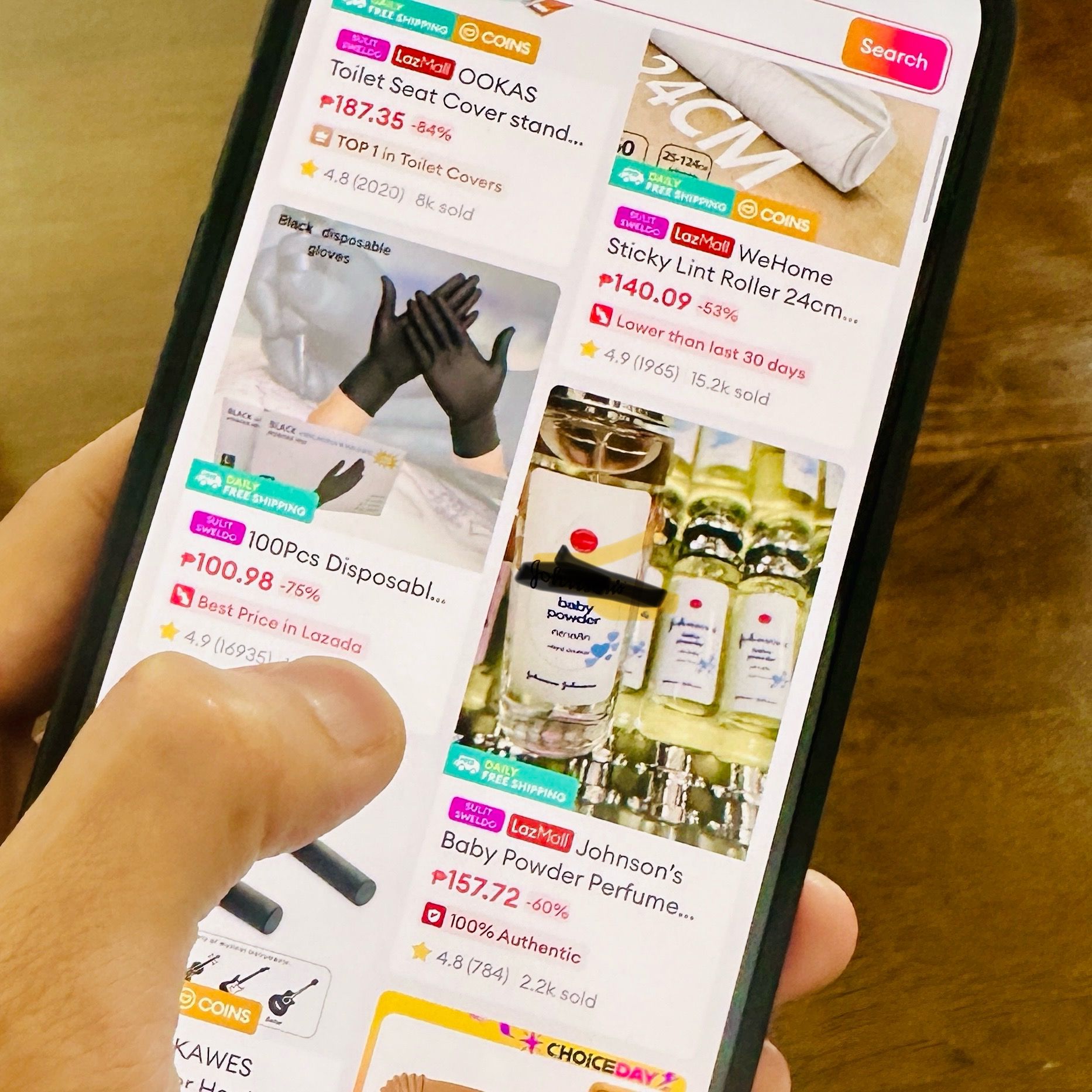

The Bureau of Internal Revenue (BIR) has started implementing the withholding tax requirement for online sellers who conduct business on electronic marketplaces like Lazada and Shopee. In a statement, BIR Commissioner Romeo D. Lumagui Jr. said there will be no further extensions for online...

The Bureau of Internal Revenue (BIR), the government’s main tax agency, fell short of its tax collection target for the first half of the year, data released by the Department of Finance (DOF) revealed. A report on the DOF’s official Facebook page showed that the BIR, responsible for generating...

Department of Finance Secretary Ralph G. Recto called on the government’s two main tax agencies to expedite their digitalization efforts to reach the P4.27 trillion target for this year. During a meeting on Wednesday, July 11, Recto discussed with the Bureau of Internal Revenue (BIR) and the...

The Department of Finance (DOF) announced that government revenues have already achieved half of the target for the year in the first semester, indicating a promising outlook for meeting the full-year goal. Finance Secretary Ralph G. Recto said that a total of P2.13 trillion in revenues was...

The Bureau of Internal Revenue (BIR) announced that the agency has removed the five-year validity period for electronic certificate authorizing registration (eCAR). In a Facebook post on Monday, June 24, BIR Commissioner Romeo D. Lumagui Jr. said that eCAR is now valid until its presentation...

The Bureau of Internal Revenue (BIR) has issued additional guidelines regarding registration procedures and invoicing requirements following the passage of the Ease of Paying Taxes (EOPT) Act. These new guidelines aim to provide relief to taxpayers in meeting the new invoicing requirements....

The Bureau of Internal Revenue (BIR) has instructed its employees to refrain from connecting government-issued laptops to public Wi-Fi networks. Under Revenue Memorandum Order (RMO) 22-2024, dated June 14, 2024, and signed by BIR Commissioner Romeo D. Lumagui Jr., the bureau said the directive is...