More heirs now have another chance to avail of the government’s estate tax amnesty program, Sen. Sherwin Gatchalian said. Gatchalian made the promise following the Senate’s approval on third and final reading of the proposed measure that seeks to extend the period of availment and simplify the...

House of Representatives (Ellson Quismorio/ MANILA BULLETIN) The measure extending the availment period of estate tax amnesty until June 14, 2025 no longer needs to undergo a Bicameral Conference Committee hearing, thereby hastening its potential enactment by Malacañang. This, after the House of...

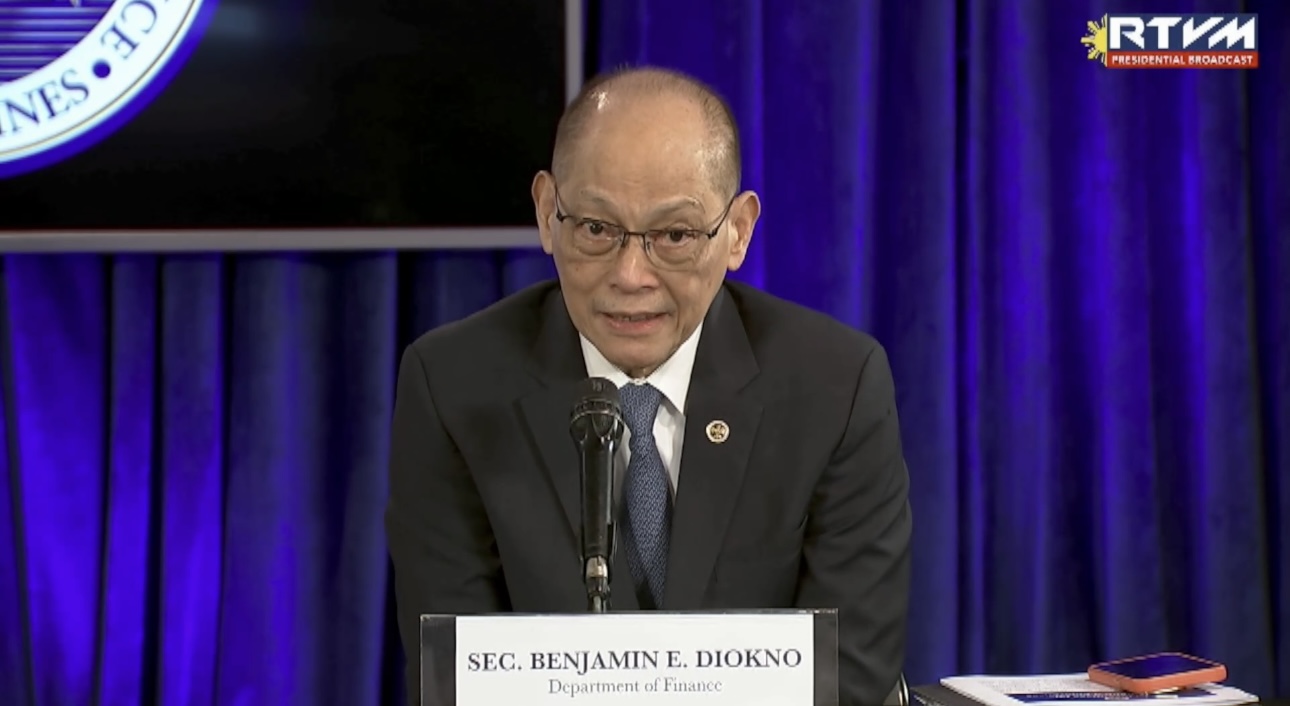

The Philippines is working with the International Monetary Fund (IMF) in conducting a study aimed at addressing the low value-added tax (VAT) efficiency in the country. DOF Secretary Benjamin Diokno (Noel B. Pabalate) Finance Secretary Benjamin Diokno disclosed this on Tuesday, May 30, following a...

Over a thousand companies inside special export processing zones (EPZs) will undergo a fiscal incentives review after the Department of Finance (DOF) found the incentives system being abused, Finance Secretary Benjamin Diokno said on Tuesday, May 30. Finance Secretary Benjamin Diokno at the Palace...

President Ferdinand "Bongbong" Marcos Jr. told the Department of Finance (DOF) to continue looking into the current tax system in the country and find ways to level the playing field between foreign and local businesses. President Ferdinand 'Bongbong' Marcos Jr. (Photo courtesy of KJ Rosales/PPA...

(MANILA BULLETIN) The lower chamber has unanimously approved on third and final reading the measure defining the new crime of tax racketeering and imposing heavy penalties on offenders. Passed during plenary session Monday afternoon, May 29 was House Bill (HB) No. 8144, which aims to amend Section...

The Senate has approved on third and final reading Senate Bill (SB) No. 2219 extending the period of availment of estate tax amnesty. "Narinig po natin ang panawagan ng ating mga taxpayers, at ito na po ang ating sagot sa kanila (We heard the call of our taxpayers and this is our answer to...

Senator Sherwin Gatchalian on Sunday, May 28 said he is keen on proposing a provision in the estate tax amnesty extension bill that would allow an installment payment feature to help more taxpayers avail of a tax reprieve. The suggestion, he said, stemmed from comments made by Tax Management...

Albay 2nd district Rep. Joey Salceda (Rep. Salceda's office) Albay 2nd district Rep. Joey Salceda knows a way to expedite the enactment of the proposed law extending the availment period of estate tax amnesty: skipping the bicam procedure. Salceda says he will recommend the adoption by the House...

Senators on Friday, May 19 urged the Bureau of Internal Revenue (BIR) to clarify if the various bills seeking to extend the availment of estate tax amnesty will benefit the family of President Ferdinand “Bongbong” Marcos Jr. From left to right: Vincent Marcos, Simon Marcos, Iloilo 1st...

Senator Jinggoy Ejercito Estrada has called on lawmakers to consider legislating a value-added tax (VAT) refund mechanism for foreign tourists to boost visitor arrivals in the Philippines. Estrada said granting a rebate of the 12 percent VAT on goods they bought from the country, similar to...

Senator Sherwin Gatchalian has filed a bill seeking to simplify and extend the government’s estate tax amnesty program for two more years in response to the clamor of taxpayers to avail of a tax reprieve. Gatchalian, chairman of the Senate Committee on Ways and Means, filed Senate Bill No. 2197...