Camarines Sur 2nd district Rep. LRay Villafuerte (PPAB) Camarines Sur 2nd district Rep. LRay Villafuerte says generous tax incentives await businesses partnering with the government on the Enterprise-Based Education and Training...

The Court of Tax Appeals (CTA) has denied the P55-million tax refund sought from the Bureau of Internal Revenue (BIR) by a firm engaged in call center services. In a 20-page decision promulgated last Dec. 11 and penned by Presiding Justice Roman G. Del Rosario, the CTA's first division denied...

ILOILO CITY – This city has extended the 40 percent property real tax discount until 2026 amid a 300 percent increase in real property tax here. “Taxes remain the lifeblood of government operations. While this adjustment aims to ease the financial burden on taxpayers, we appeal to everyone to...

Photo from Pixabay The Food and Drug Administration (FDA) has issued an advisory announcing the inclusion of additional medicines for cancer, diabetes, and mental health in its list of products exempt from value-added tax (VAT). In its advisory released on Monday, Nov. 25, the FDA explained the new...

The Court of Tax Appeals (CTA) has acquitted five executives of a cigarette manufacturing company which was raided in 2020 in Angeles City in Pampanga where P14.08 million worth of tobacco products were seized. Acquitted were GB Bem Cigarette Co., Inc. president Gregory G. Lim, treasurer Benson G....

The Court of Tax Appeals (CTA) has dismissed the petition for P6 million tax refund sought by a firm that recruits qualified Filipino seafarers for employment by foreign shipping companies. Dismissed was the petition filed by BW Shipping Philippines, Inc. against the Bureau of Internal Revenue...

The Court of Tax Appeals (CTA) has ordered the Valenzuela City government to refund North Luzon Expressway Corporation (NLEX) P3.8 million in erronously collected taxes for taxable years 2012 to 2019. In a 34-page decision penned by Associate Justice Corazon G. Ferrer-Flores and promulgated last...

Senator Juan Miguel “Migz” Zubiri lauded the signing of the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act on Monday, Nov. 11, as it is expected to cut the bureaucratic red tape that has hampered the growth of the...

Senate President Francis “Chiz” Escudero on Sunday, November 10 said he expects the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act to generate new jobs domestically and attract more foreign investments in the...

The Philippines needs to keep pursuing tax reform measures pending in Congress en route to its plan to narrow its yawning budget deficit, according to the World Bank. In its Philippines Monthly Economic Developments report for October 2024, the World Bank noted that the fiscal deficit as a share of...

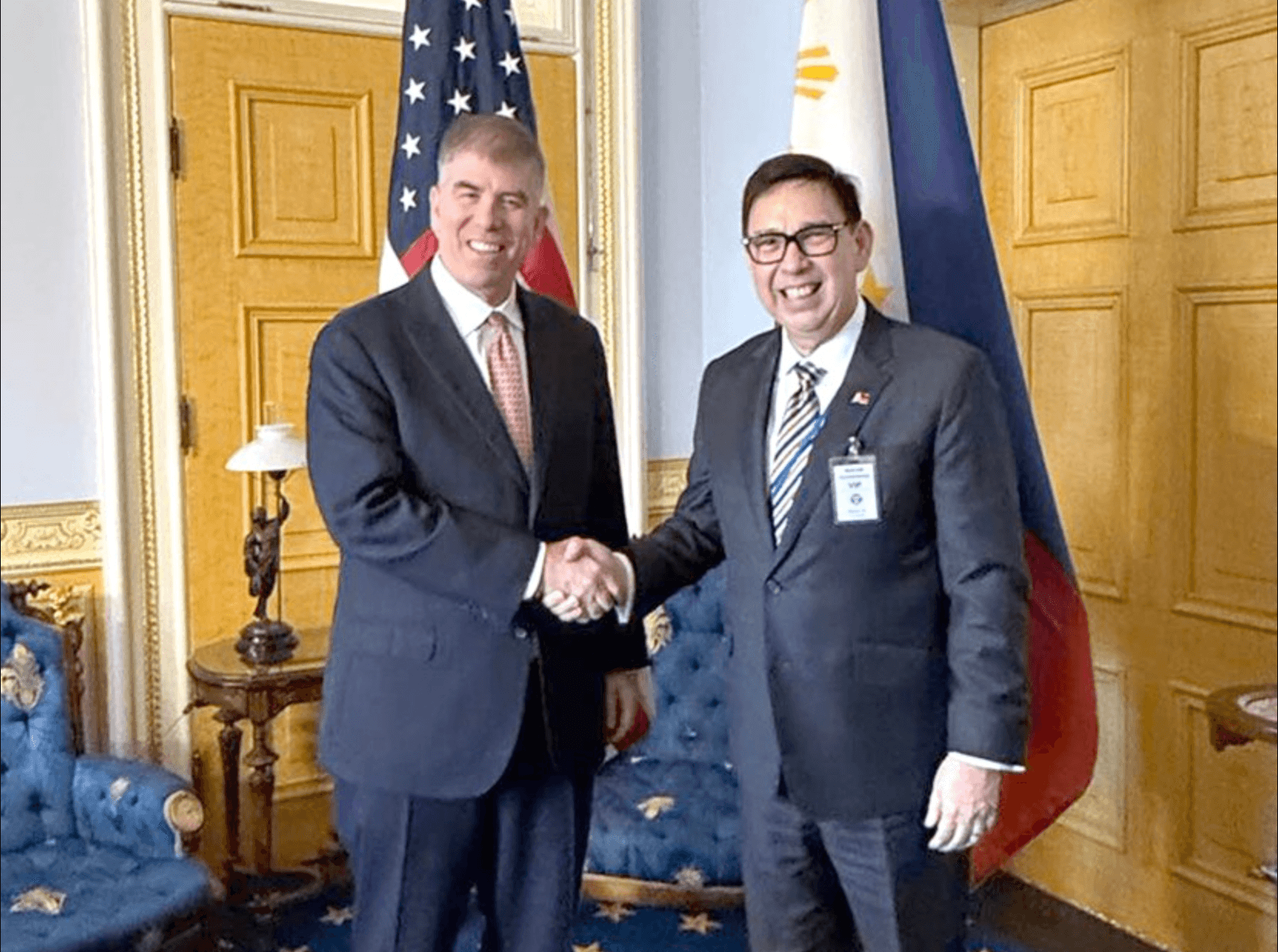

The Department of Finance (DOF) said that the US Department of the Treasury has vowed to support the country’s efforts to strengthen its tax and customs administration system. The DOF said the commitment was made by US Treasury Undersecretary Jay C. Shambaugh and other senior officials during a...

Taxes to protect and fund universal health care (UHC)—such as those slapped on so-called "sin" products like cigarettes, alcoholic drinks, and sweets—still have room for further increases, according to a global task force. "Health taxes continue to be underutilized despite the...