State-owned Government Service Insurance System (GSIS) has introduced a new housing program tailored for government employees featuring zero down payment. Wick Veloso, GSIS president and general manager, announced on Monday, July 15, that the launch of this new program, which enables borrowers to...

For borrowers to see real-time updates of their housing loan payments and individual loan accounts, the Social Security System (SSS) will require them to present a Payment Reference Number (PRN) for their payments starting this month. SSS President and Chief Executive Officer Rolando Ledesma...

The Government Service Insurance System (GSIS) has waived more than P1.6 billion in penalties and interest discounts to support housing borrowers facing financial difficulties. Wick Veloso, GSIS president and general manager, said the debt relief under the pension fund’s housing loan program...

The Government Service Insurance System (GSIS) has rolled out a debt relief program to aid borrowers currently facing payment challenges in its housing loan program. In a statement on Wednesday, May 8, Wick Veloso, GSIS president and general manager, said that the program is designed to...

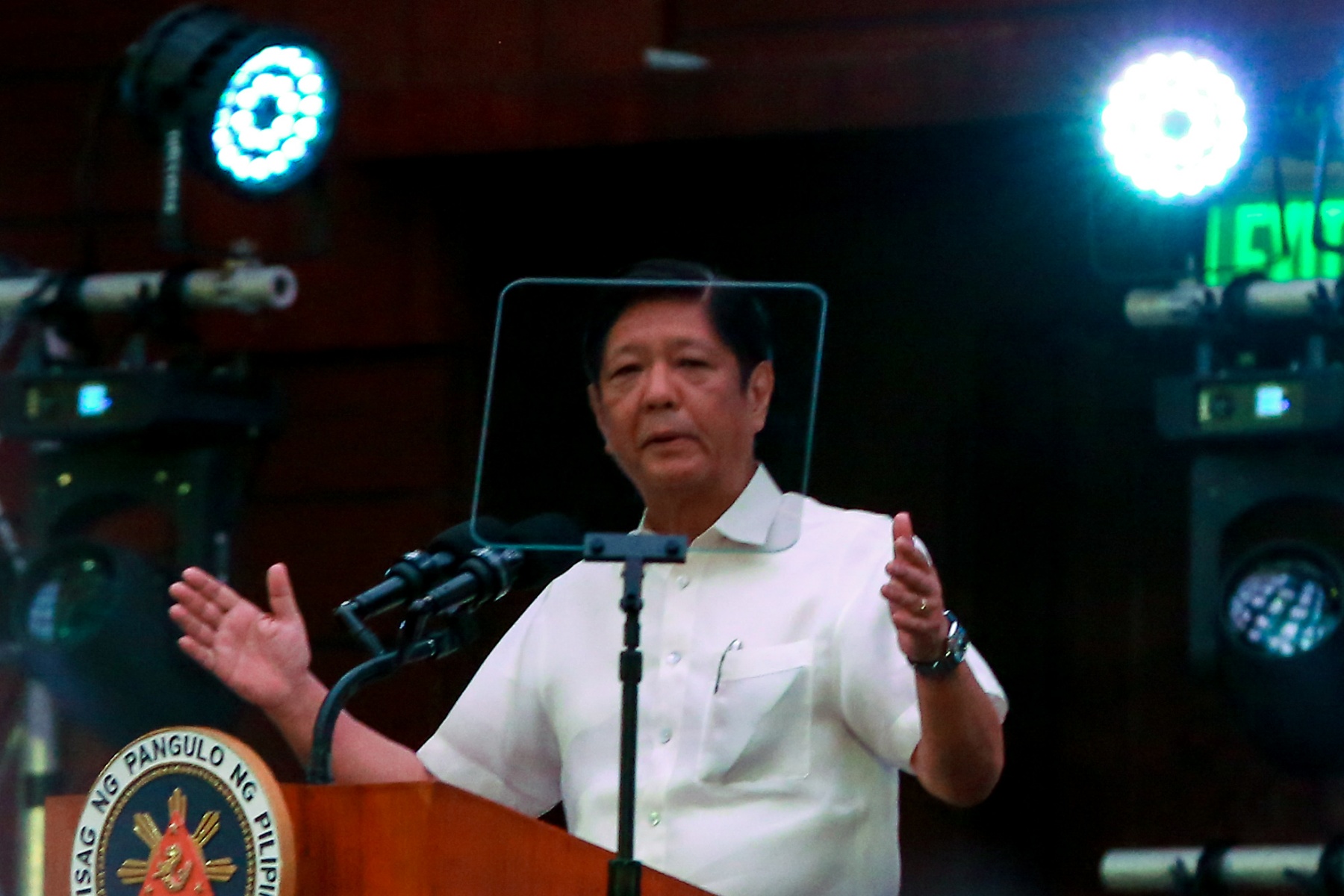

President Marcos has urged the Pag-IBIG Fund to make its home mortgage more accessible to Filipinos. President Ferdinand 'Bongbong' Marcos Jr. (Noel Pabalate) "I urge the Pag-IBIG Fund to make its home mortgage financing even more accessible and to balance this with sustainability," Marcos said in...

Filipinos looking to take out loans for major expenses can find some relief, as the Department of Finance (DOF) expects that interest rates are likely to remain steady or even decrease in the latter half of the year. On the sidelines of the Bureau of Internal Revenue’s National Tax Campaign...

The Pag-IBIG Fund Board of Trustees officially approved the postponement of the agency’s contribution hike in 2023, citing the continuing recovery of both workers and business owners from the pandemic, its top officials announced Monday (06 March). Secretary Jose Rizalino L. Acuzar, who heads the...

Pag-IBIG Fund members collectively saved nearly P80 billion in 2022, setting yet another record for the highest amount saved by members with the agency in a single year, its top officials said. In 2022, the amount collectively saved by Pag-IBIG members totaled P79.9 billion – the highest in the...

Up 27%; MP2 Savings surpass P33B, up 57% Pag-IBIG Fund members have saved more than P66 billion in the last 10 months, breaking yet another record for the period and exceeding all prior full year figures, top agency officials announced on Monday (November 14). From January to October, the amount...

Pag-IBIG Fund financed 8,471 socialized homes for minimum-wage and low-income members amounting to ₱3.67 billion in the first half of 2022, its top officials said Wednesday (July 20). Socialized home loans make up 19% of the total number of housing loans financed by the agency from January to...

Bulk purchase of housing loan receivables in the offing Housing developers and originators participated in the consultation meeting spearheaded by NHMFC Securitization Group Vice President, Maria Luisa Favila, to gather insights on the proposed HLRPP Bulk Purchase Scheme. The National Home Mortgage...

Members to earn dividend rate of 5.16% on Regular Savings, 5.66% on MP2 Pag-IBIG Fund netted an income of over P30 billion for the fifth consecutive year in 2021 despite the ongoing pandemic, the agency’s top executive announced on Thursday (Feb.24) during the Pag-IBIG Fund Chairman’s Report....