President Marcos has urged the Pag-IBIG Fund to make its home mortgage more accessible to Filipinos.

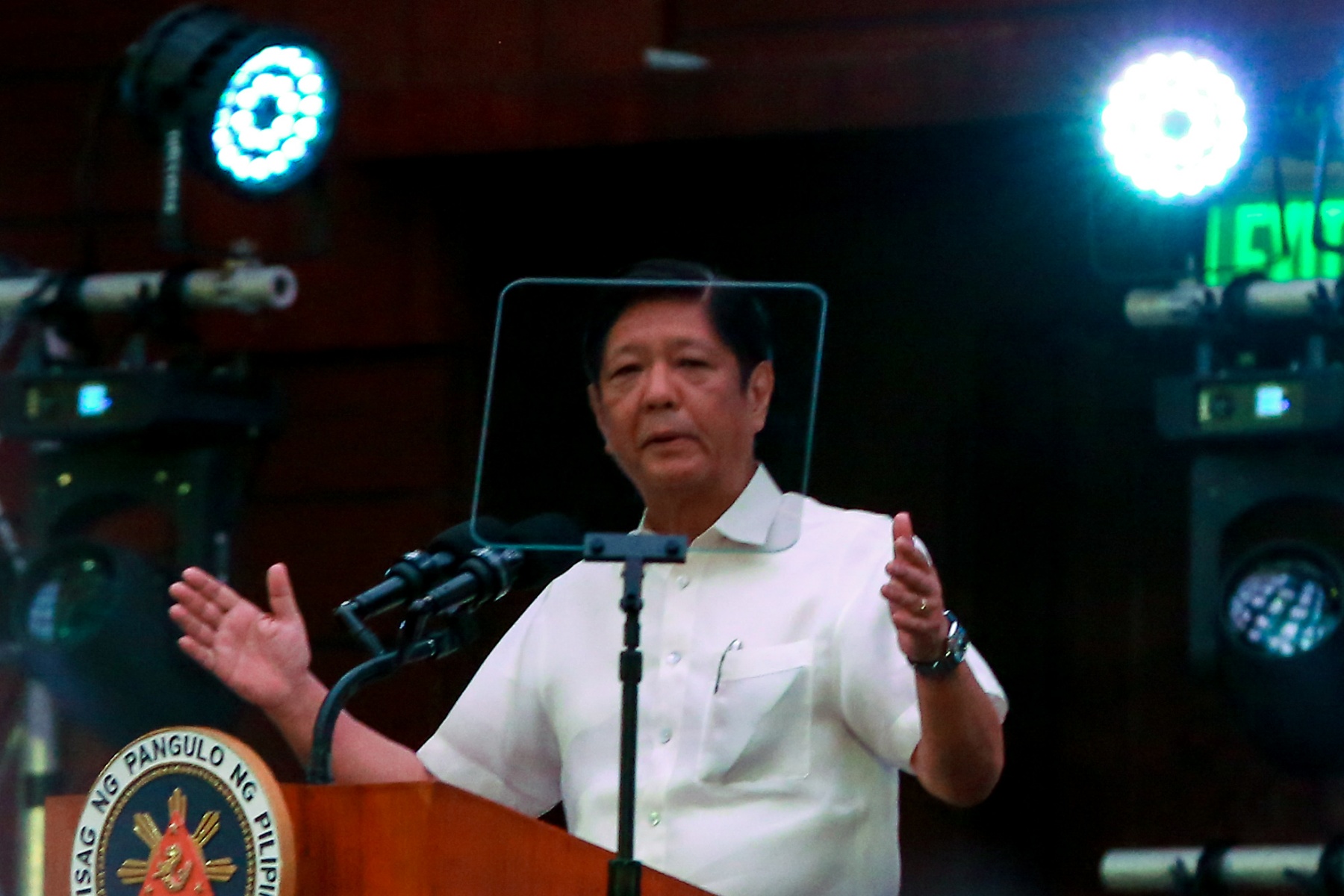

"I urge the Pag-IBIG Fund to make its home mortgage financing even more accessible and to balance this with sustainability," Marcos said in his speech during the 2023 Pag-IBIG Fund Chairman's Report on Tuesday, Feb. 27.

The President stated this as he made mention of the "huge housing backlog" that must be reduced, stressing “we are far from declaring mission accomplished.”

"This is to inspire Filipinos today, and the generations to come, to work hard to reach their goal of a house that they can call their own,” Marcos told Pag-IBIG.

“With millions of our countrymen denied the right to decent shelter, the stakes could not be higher. So, our task is clear: To build the most number of housing units by any administration,” he added.

Pag-IBIG Fund has achieved the highest housing loan at P126.04 billion, helping more than 96,000 Pag-IBIG Fund members gain new or better homes.

The housing financing institution posted Short Term Loans amounting to P59.31 billion, covering 2.65 million members and an annual net income of P43.79 billion.

It has the highest total assets at P925.61 billion and highest member dividends amounting P48.76 billion.

Pag-IBIG Fund's dividend rate for its regular savings programs went up to 6.55 percent, while its modified Pag-IBIG or MP2 savings programs slightly increased to 7.05 percent in 2023.

Pag-IBIG Fund is a government-owned and controlled corporation (GOCC) under the DHSUD responsible for the administration of the national savings program and affordable shelter financing for Filipinos.

The Chief Executive has also reiterated his call to the Department of Human Settlements and Urban Development (DHSUD) "to build the most number of housing units by any administration."

The administration aims to build one million low-cost housing units every year until the end of Marcos' term.