The PSEi rose further as investors continued to bet on a policy rate cut on expectations of a low inflation print for March. The main index jumped 66.96 points or 1.08 percent to close at 6,247.68 as Banks surged while only the Industrial counter retreated. Volume amounted to 1.31 billion shares...

While the Philippines would be insulated from the tariff wars initiated by United States (US) President Donald Trump, it cannot reap the potential benefits from the supply chain restructuring of affected businesses in targeted countries. This highlights the need for the Philippines to enhance the...

The Philippines would buck the trend of weak growth prospects in emerging markets (EMs) amid the United States' (US) tariffs threat, according to the think tank Capital Economics. "In all, aggregate EM GDP growth is likely to slow in the coming quarters... we think growth will generally fall short...

GT Capital Chief Financial Officer George Uy-Tioco, Jr. GT Capital Holdings Inc., the investment arm of the Ty family, is looking to invest $100 million to $200 million in prospective partners as part of moves to diversify its business portfolio and lessen its dependence on the banking and...

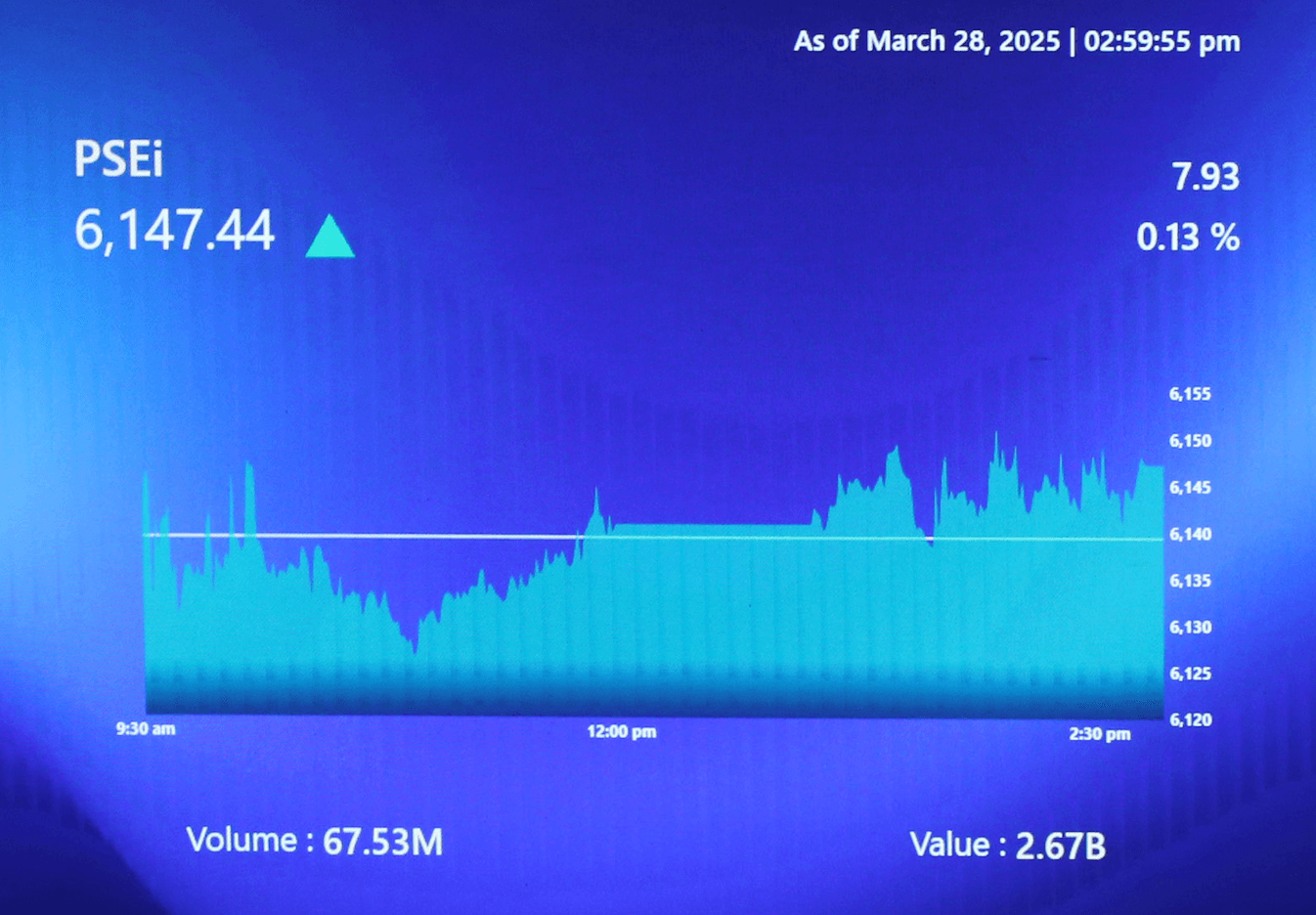

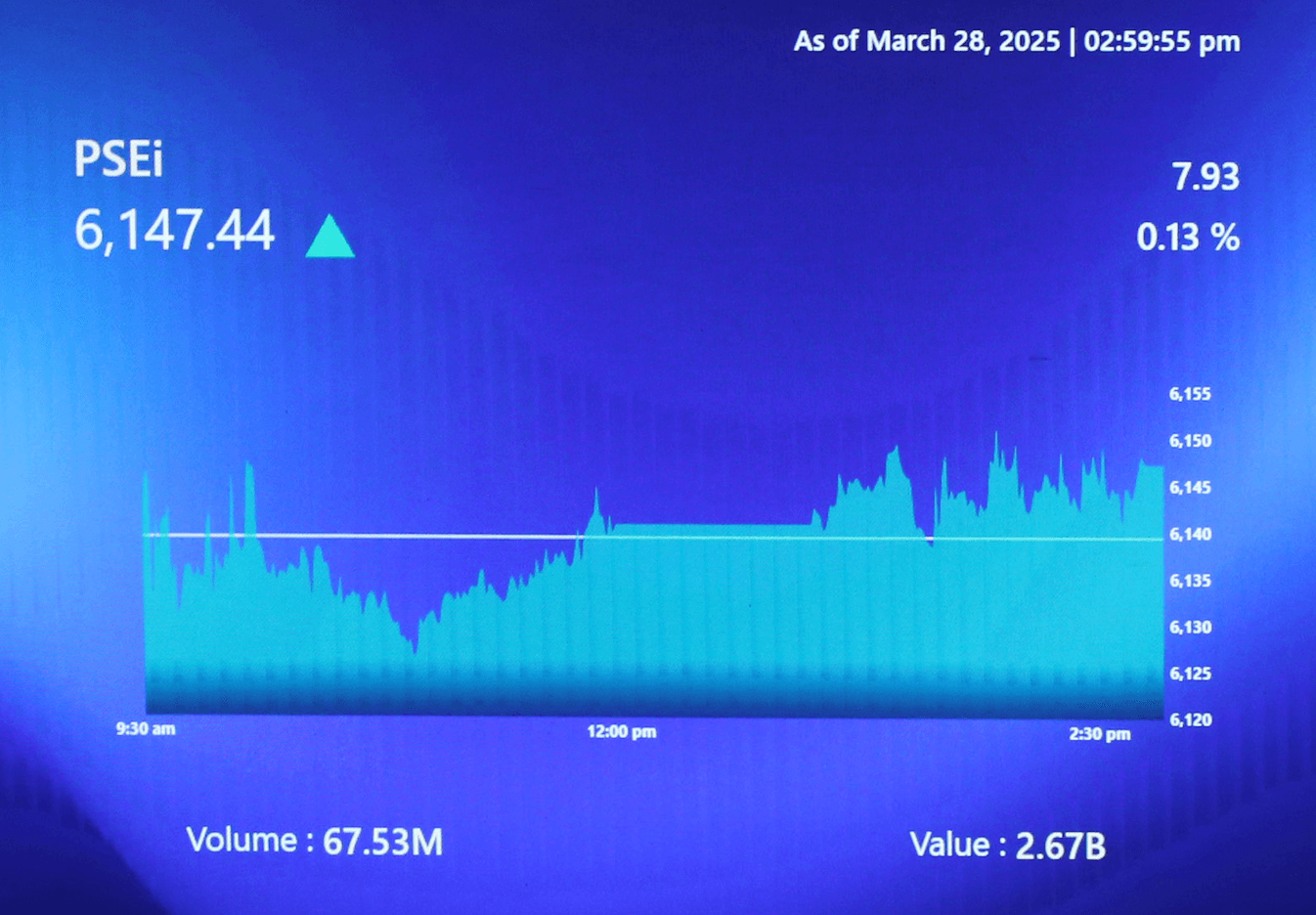

The PSEi inched up on some bargain hunting as well as window-dressing with the first quarter about to end. The main index added 7.93 points or 0.13 percent to close at 6,147.44 with sector indices evenly mixed. Volume fell to 1.54 billion shares worth P3.41 billion as gainers outnumbered...

The local stock market resumed its downward trend after a minor pause the previous day as Trump's tariff pronouncements continue to unnerve investors. The PSEi lost 26.54 points or 0.43 percent to close at 6,139.51 although sector indices were equally divided. Volume dipped to 828 million...

The Philippine Stock Exchange index (PSEi) managed to stay above the red line on late bargain-hunting as investors start betting on a rate cut next month. The main index added 6.20 points or 0.10 percent to close at 6,166.05 as the Services sector led the advance while Conglomerates and...

US President Donald J. Trump's protectionist policies remain the top risk to Philippine economic prospects this year, according to the think tank Capital Economics. "A key uncertainty over the coming year is whether and to what extent Donald Trump follows through with his threats to impose tariffs...

GT Capital Holdings Inc., the investment arm of the Ty family, reported a two-percent dip in consolidated net income to ₱28.8 billion for 2024, from the ₱29.3 billion it earned in 2023, due to non-recurring gains in the previous year. Excluding non-recurring gains from lot sales and incentives...

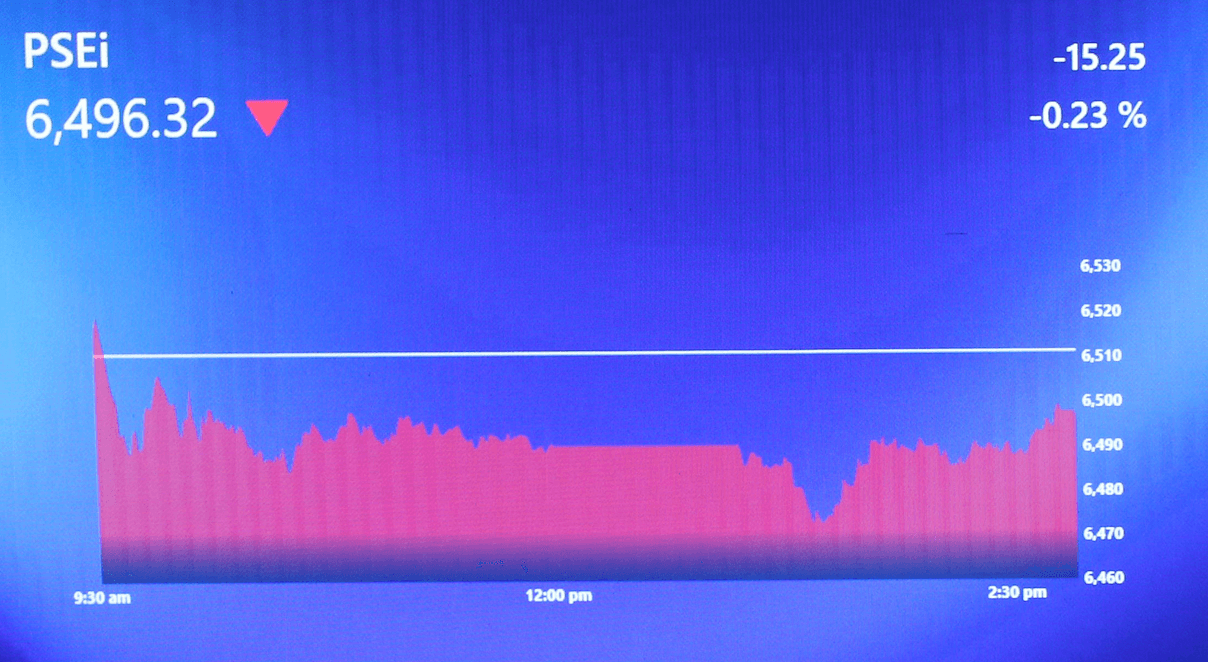

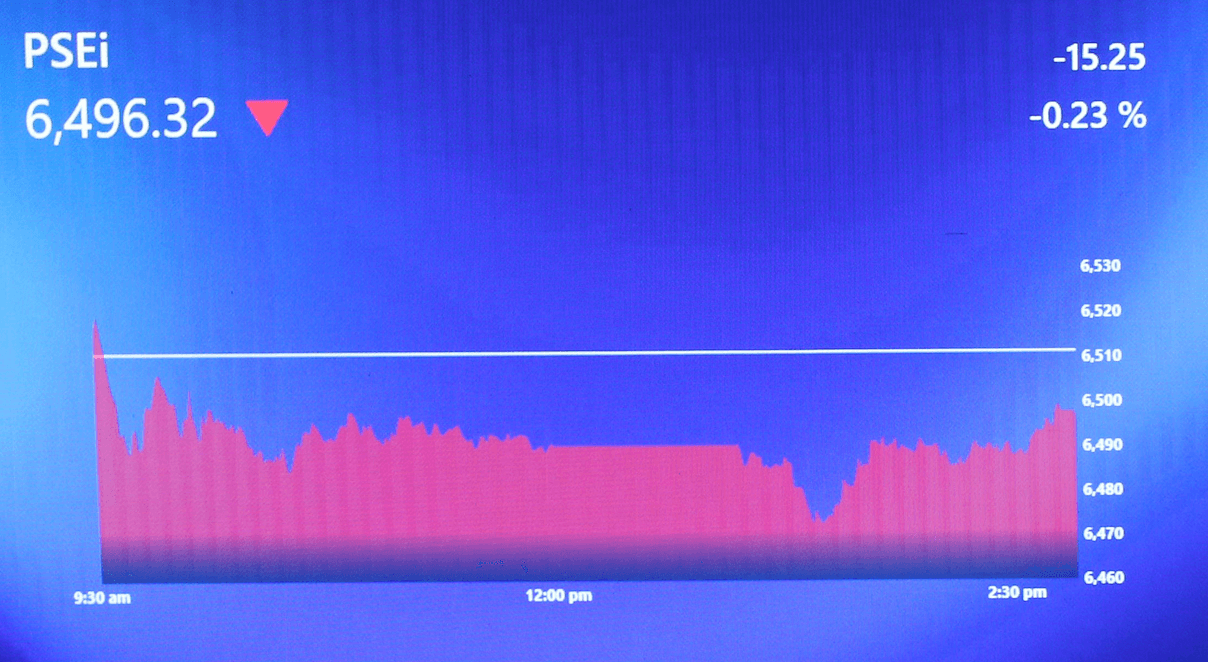

The Philippine Stock Exchange index (PSEi) declined for the third straight session as investors continue to fret over possible impact of Trump’s tariff plans. The main index shed 32.17 points or 0.52 percent to close at 6,159.85 as the Mining counter led losses while Property and Services managed...

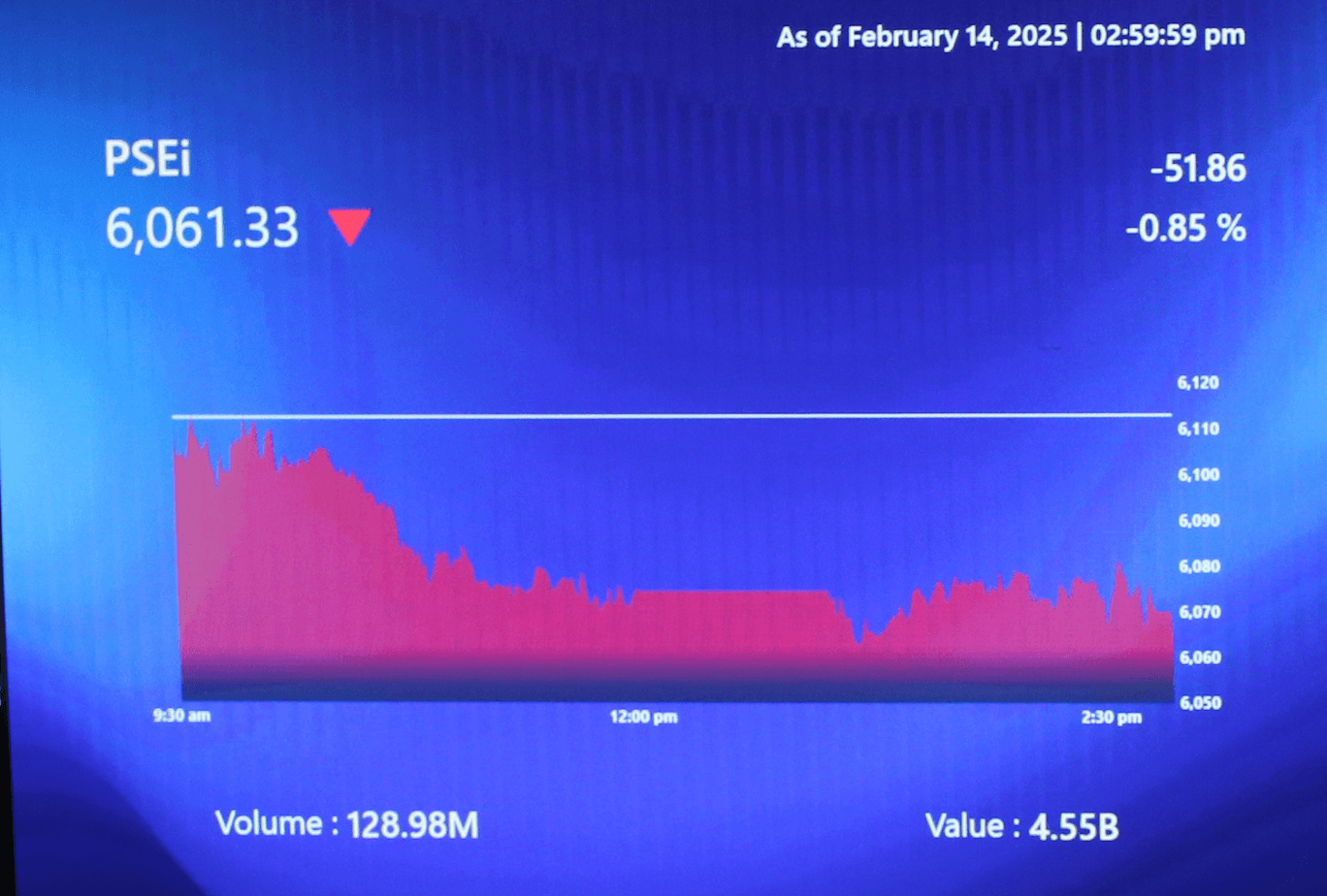

The PSEi fell at the close of a trading day shortened by almost two hours due to technical issues, as investor confidence continues to be buffeted by politico-economic issues overseas. The main index dropped 74.73 points, or 1.19 percent, to close at 6,192.02, with the retreat across the board led...

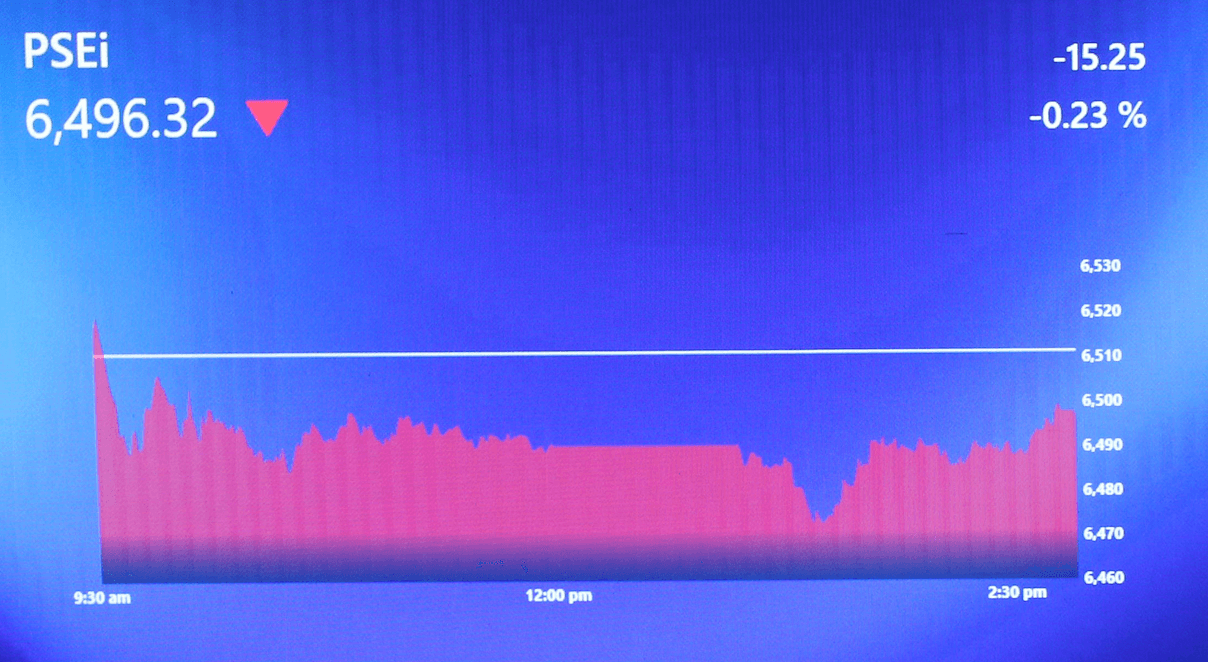

The local stock market closed the week in the red, following overnight losses in the US, as investors grappled with uncertainty over Trump’s tariff policy. The main index dropped 56.38 points or 0.89 percent to close at 6,266.75 on Friday, March 21, as Property firms and Conglomerates led the...