The Bureau of Internal Revenue (BIR) has released a detailed guide on invoicing requirements under Revenue Memorandum Circular No. 77-2024. Titled "GABAY PARA SA INVOICING REQUIREMENTS," BIR Commissioner Romeo D. Lumagui Jr. offers businesses and taxpayers clear ways to adhere to proper...

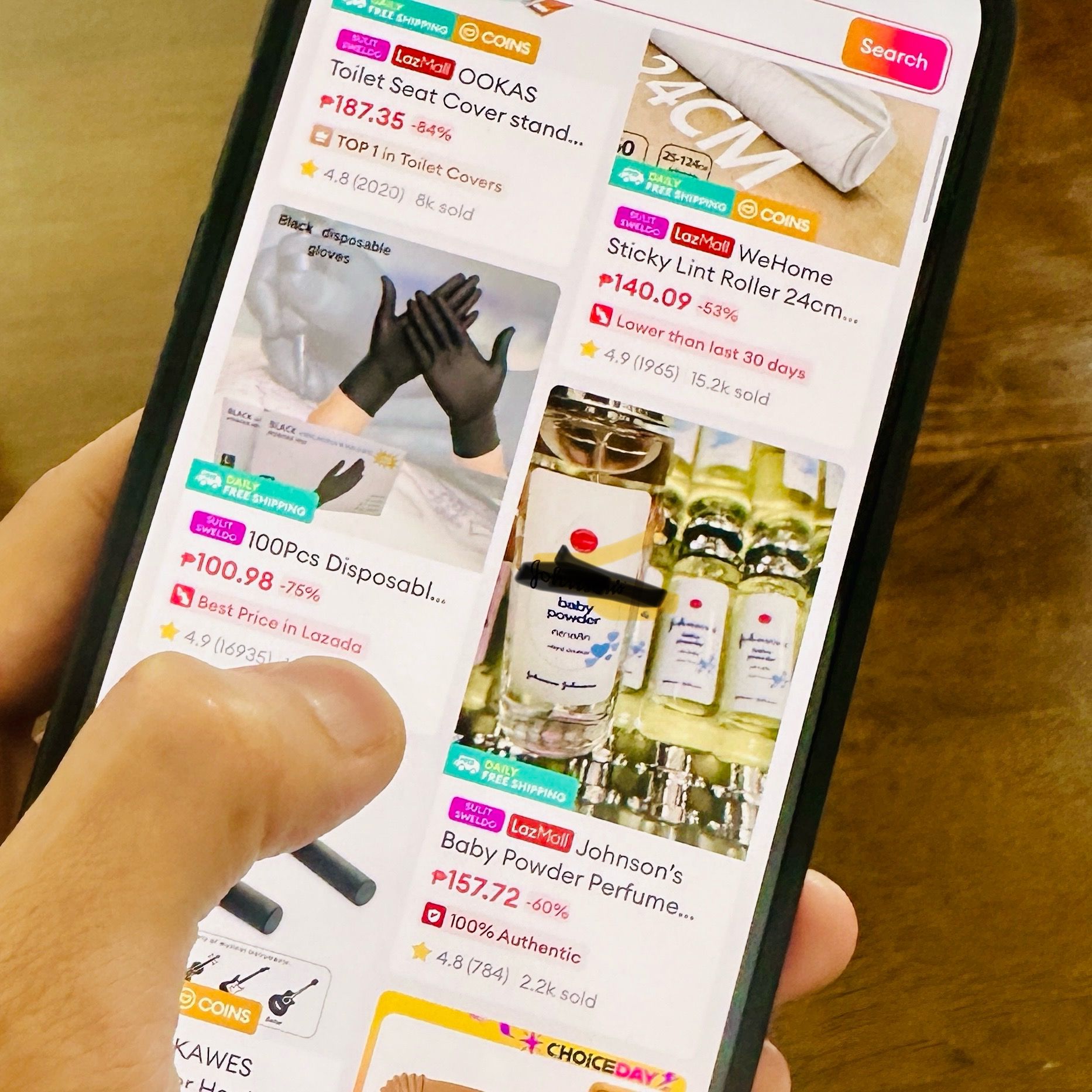

The Bureau of Internal Revenue (BIR) has started implementing the withholding tax requirement for online sellers who conduct business on electronic marketplaces like Lazada and Shopee. In a statement, BIR Commissioner Romeo D. Lumagui Jr. said there will be no further extensions for online...

The Bureau of Customs (BOC), the government's second largest tax agency, has surpassed its revenue collection target for the first half of 2024, bringing in P456.053 billion from January to June. In a statement on Monday, July 8, the Customs Commissioner Bienvenido Y. Rubio said the amount...

The Bureau of Internal Revenue (BIR) announced that the agency has removed the five-year validity period for electronic certificate authorizing registration (eCAR). In a Facebook post on Monday, June 24, BIR Commissioner Romeo D. Lumagui Jr. said that eCAR is now valid until its presentation...

The Bureau of Internal Revenue (BIR) has issued additional guidelines regarding registration procedures and invoicing requirements following the passage of the Ease of Paying Taxes (EOPT) Act. These new guidelines aim to provide relief to taxpayers in meeting the new invoicing requirements....

The Commission on Elections (Comelec) is studying the possibility of disqualifying candidates who will fail to make use of biodegradable materials in their campaign activities. This was according to Comelec Chairman George Erwin Garcia, who recently wrote to the Comelec En Banc regarding the...

The Bureau of Internal Revenue (BIR) has instructed its employees to refrain from connecting government-issued laptops to public Wi-Fi networks. Under Revenue Memorandum Order (RMO) 22-2024, dated June 14, 2024, and signed by BIR Commissioner Romeo D. Lumagui Jr., the bureau said the directive is...

In a move aimed at easing administrative burdens for taxpayers, the Bureau of Internal Revenue (BIR) has removed the time limit for utilizing converted official receipts (ORs) as invoices. Under the newly released BIR Revenue Regulation (RR) No. 11-2024 , taxpayers are now allowed to convert any...

The Bureau of Internal Revenue (BIR) cautioned individuals using or holding vapes without a tax stamp about the possibility of facing legal consequences. BIR Commissioner Romeo D. Lumagui Jr. said on Monday, June 3, that the regulations requiring tax stamps on vape products are also...

The Bureau of Internal Revenue (BIR) has reminded vape sellers that they have until Saturday, June 1, to affix tax stamps on their products before distributing them to buyers. BIR Commissioner Romeo D. Lumague, Jr. warned that any unstamped vape products will be seized, and owners will face...

The Bureau of Customs (BOC) and local industry leaders convened for the first general assembly of the Customs Industry Consultative and Advisory Council (CICAC). The assembly aimed to streamline customs clearance processes, achieve revenue targets, and address industry-specific challenges,...

The Bureau of Customs (BOC) has revamped customs procedures at key airports by introducing modern scanning machines, ensuring swift processing for air travelers. Rapiscan 920CT scanner Customs Commissioner Bienvenido Y. Rubio announced the deployment of the Rapiscan 920CT (Computed...