The Court of Tax Appeals (CTA) has granted P3.1 million out of the P5.5 million refund sought by the Philippine Airlines, Inc. (PAL) for the excise taxes the firm paid for imported wines, liquors and cigarettes in 2009 for consumption in its international flights. In its Oct. 5, 2023 decision, the...

The Bureau of Internal Revenue (BIR) has introduced a new exemption for certain agricultural producers with annual gross sales of less than P1 million, aimed at streamlining government transactions. According to Revenue Regulations No.12-2023, signed by Finance Secretary Benjamin E. Diokno and...

Senator Sherwin Gatchalian has called on the Bureau of Internal Revenue (BIR) and the Bureau of Customs (BOC) to fix its issues on unfilled positions and low salaries of personnel. Sen. Sherwin Gatchalian (Senate PRIB Photo) During the Senate hearing on the...

The Bureau of Internal Revenue (BIR) has embarked on a new approach to recover huge delinquent tax debts, using its electronic capabilities. BIR Commissioner Romeo D. Lumagui Jr. ordered regional directors and other collection officers to use e-mails in serving warrant of garnishments (WGs) to...

The Securities and Exchange Commission (SEC) has partnered with the United Nations Office on Drugs and Crime (UNODC) and Open Ownership (OO) in using its beneficial ownership data (BOD) to promote tax integrity. Last Sept. 22, the SEC conducted a focus group discussion (FGD) on Beneficial Ownership...

The Court of Tax Appeals (CTA) has ordered the Bureau of Internal Revenue (BIR) to refund or issue tax credits amounting to P43.9 million to Petron Corporation for the erroneously collected excise taxes on the firm’s importation of more than 9.7 million liters of alkylate in 2016 and 2017. Google...

The Bureau of Internal Revenue (BIR) seized thousands of cartons of untaxed perfumes, colognes, and toiletries during a nationwide inspection of malls and retail outlets. The majority of these confiscated items were found in Metro Manila, with the largest seizure occurring at the facilities of...

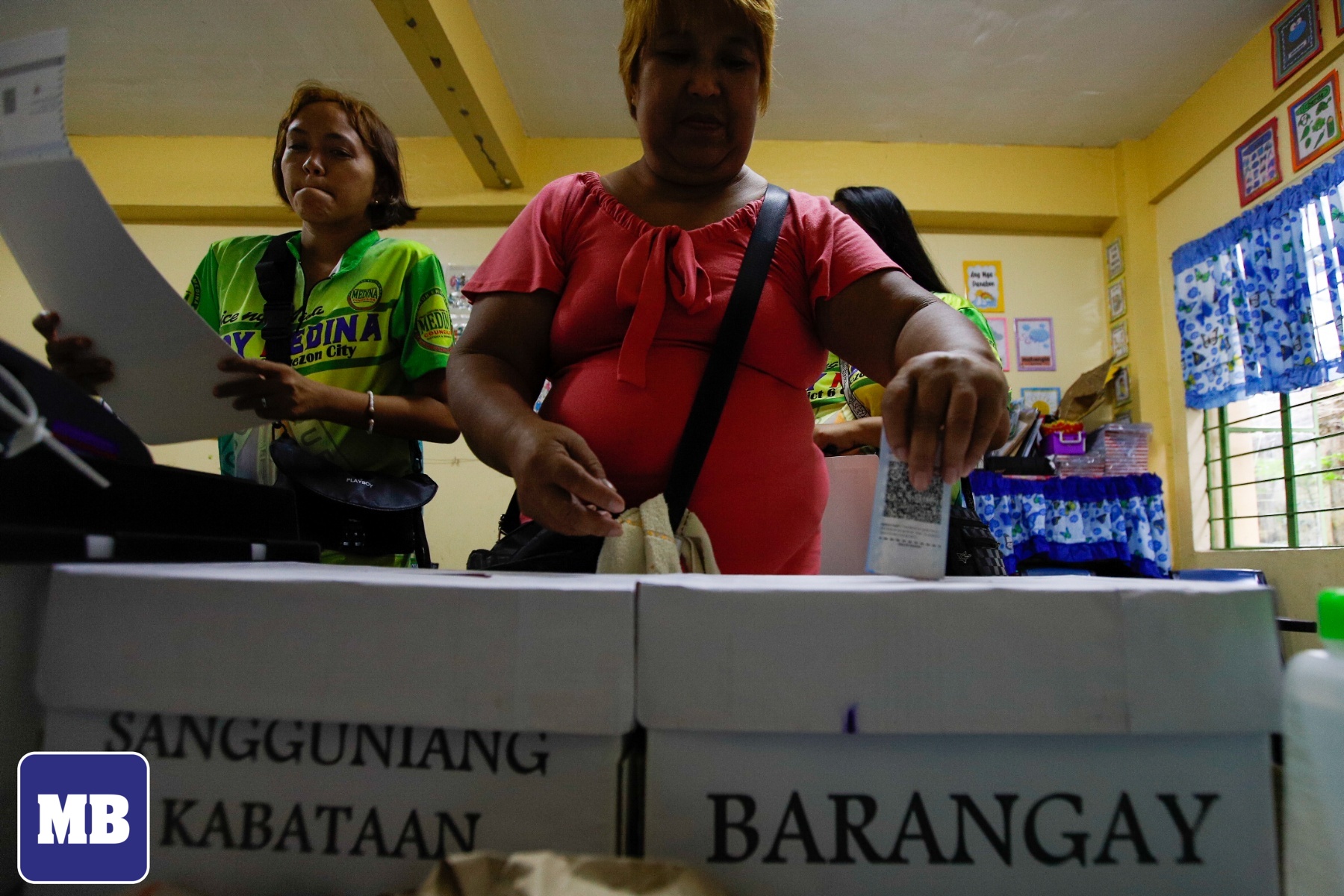

Candidates running for national and local elections, including barangay positions, no longer need to register with the Bureau of Internal Revenue (BIR). BIR Commissioner Romeo D. Lumagui, Jr. clarified in Revenue Memorandum Circular (RMC) No. 97-2023 that registration and registration fees are not...

The Bureau of Internal Revenue (BIR) has successfully addressed all complaints and inquiries forwarded by Malacañang during the initial seven months of this year. The 8888 Citizens' Complaint Center, affiliated with the Office of the President, conveyed a total of 842 concerns from January to...

P500 bills, Northern Samar 1st district Rep. Paul Daza (Unsplash, PPAB) House Senior Deputy Minority Leader and Northern Samar 1st district Rep. Paul Daza has asked the Commission on Elections (Comelec) to do away with the "burdensome" tax registration fee being...

The Court of Tax Appeals (CTA) has affirmed its division's ruling that cancelled the order for the payment of over P902 million taxes and compromise penalty, and more than P182 million in deficiency taxes issued by the Bureau of Internal Revenue (BIR) against Philusa Corporation, a firm engaged in...

The Court of Tax Appeals (CTA) has ordered the Bureau of Internal Revenue (BIR) to refund to British American Tobacco, Limited P305.8 million representing the unutilized advanced deposit in Internal Revenue Stamp Integrated System (IRSIS) and on credits for unused, spoiled, and bad order internal...