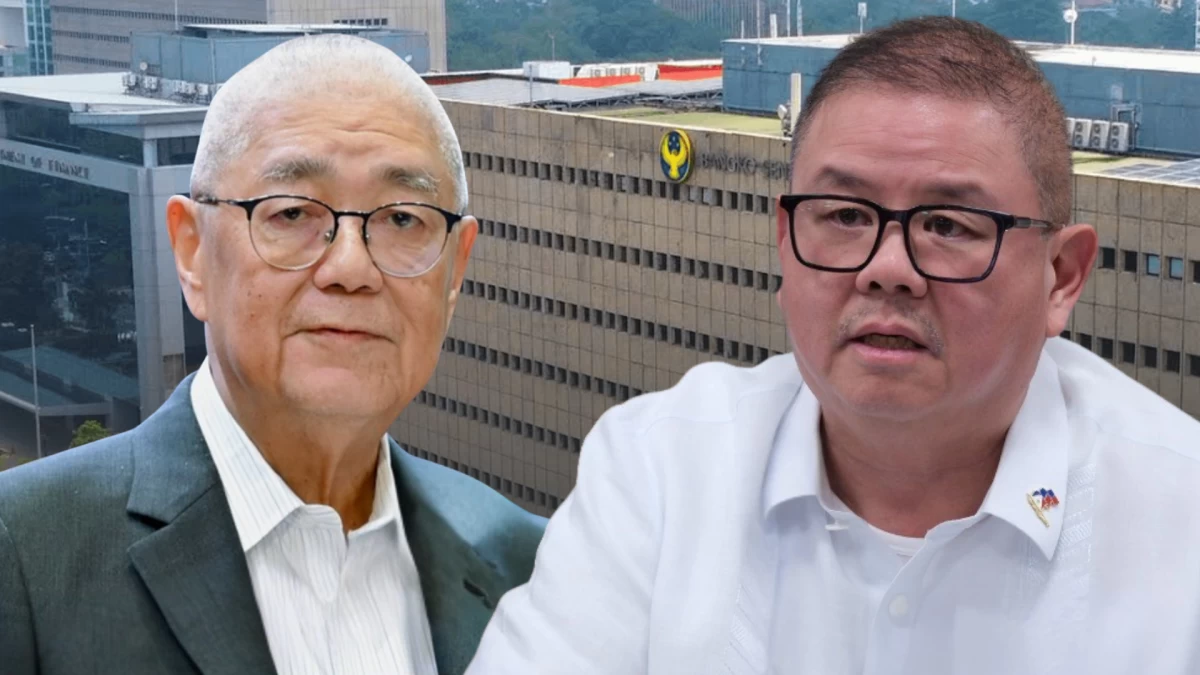

Agriculture Secretary Francisco Tiu Laurel is casting doubt on the Bangko Sentral ng Pilipinas’ (BSP) projection that inflation likely quickened in September due to higher rice prices, maintaining that retail prices of the staple remain stable. The BSP estimated that last month’s inflation rate...

The ongoing mudslinging in the political arena, arising from the floodgate mess, sent shivers through the financial market. The peso suffered continuous beating against the United States (US) dollar, and the bourse slid down. Yes, Virginia, the currency, bond, and equities markets are uptight! The...

Lending by big banks or universal and commercial banks (UK/Bs) expanded more slowly in August, with loans—excluding placements in the Bangko Sentral ng Pilipinas’ (BSP) reverse repurchase window—rising 11.2 percent year-on-year, down from 11.8 percent in July. This was the slowest annual...

Posting a double-digit growth, the Philippines registered a net foreign liability of $68.3 billion as of end-June, based on its international investment position (IIP). According to the Bangko Sentral ng Pilipinas (BSP), this increase was driven by inward foreign investments outpacing the...

Revising its narrower forecast earlier, the Bangko Sentral ng Pilipinas (BSP) now sees the Philippines’ balance of payments (BOP) deficit to widen this year and next year due to widening trade-in-goods gap. As of September, the BSP is projecting the BOP hole to widen to 1.4 percent of the...

Driven by decreases in both principal and interest payments, the Philippines’ external debt service burden (DSB) declined to $6.72 billion by the end of the first semester, from $7.16 billion in the same period in 2024. Data from the Bangko Sentral ng Pilipinas (BSP) showed that the 6.2-percent...

The Bank of the Philippine Islands (BPI) has announced a standardized ₱15 service fee for all inter-institution cash-in transactions made via InstaPay, effective Oct. 1. In a statement, the Ayala-led bank said the new fee will apply to all cash-in transfers, including those sent to popular...

Pervasive corruption in the Philippines is preventing the country from realizing its full economic potential, despite President Ferdinand R. Marcos Jr. making “steady progress” on his reform agenda, according to the think tank Capital Economics. In its Asia Economic Outlook report for the...

Driven by the decline in condominium unit prices, housing price growth in Metro Manila grew at its slowest pace in one and a half years in the second quarter of the year, a sluggish rate not seen since property prices contracted in late 2023. According to the residential property price index (RPPI)...

Interested players planning to enter the Philippine market are given until Nov. 30 to complete their applications, as the Bangko Sentral ng Pilipinas (BSP) will stop accepting digital banking license applications in December. This planned closure follows the policy-setting Monetary Board’s (MB)...

Long-term time deposits in the Philippine banking industry plummeted 95 percent in recent months, as Filipino depositors may have withdrawn or opted not to renew their placements following the removal of a key tax exemption. “So the five-years-plus-one-day time deposit product of our member...

The Bangko Sentral ng Pilipinas (BSP) reported a decline in net earnings for the first half of the year, driven by steeper reduction in revenues than in expenses. Data from the BSP showed that the central bank’s net income fell by 17.8 percent to ₱70.3 billion in January to June this year, from...