Two-time Olympic gold medalist Carlos Yulo will not be required to pay taxes on his winnings and incentives, according to the Bureau of Internal Revenue (BIR). BIR Commissioner Romeo D. Lumgui Jr. explained that prizes, awards, rewards, gifts, or donations received by Yulo are not subject to...

The Bureau of Internal Revenue (BIR) has warned celebrities and influencers against promoting vape products that may not comply with tax regulations. In a statement on Thursday, Aug. 22, BIR Commissioner Romeo D. Lumagui Jr. urged public figures to verify the tax compliance of the vape products...

The festive mood took a hit on Sunday, Aug. 18, when the Bureau of Internal Revenue (BIR) conducted a raid at the Philippine Vape Festival 2024, targeting illegal products. BIR Commissioner Romeo D. Lumagui Jr. headed a team that raided this year's vape festival in Las Piñas after surveillance...

The Bureau of Internal Revenue (BIR) has extended the deadline for filing and paying various taxes to July 31 due to the economic and financial hardships caused by Super Typhoon Carina in affected areas. "In this time of need and disaster, the BIR will extend the deadlines for submission, filing,...

The Bureau of Internal Revenue (BIR) seized a vending machine openly selling illegal vape products near popular hangout spots for youth. In a Facebook post by BIR Commissioner Romeo D. Lumagui Jr., he said the vending machine in a public building housing several businesses was found to sell illegal...

The Bureau of Internal Revenue (BIR) has released a detailed guide on invoicing requirements under Revenue Memorandum Circular No. 77-2024. Titled "GABAY PARA SA INVOICING REQUIREMENTS," BIR Commissioner Romeo D. Lumagui Jr. offers businesses and taxpayers clear ways to adhere to proper...

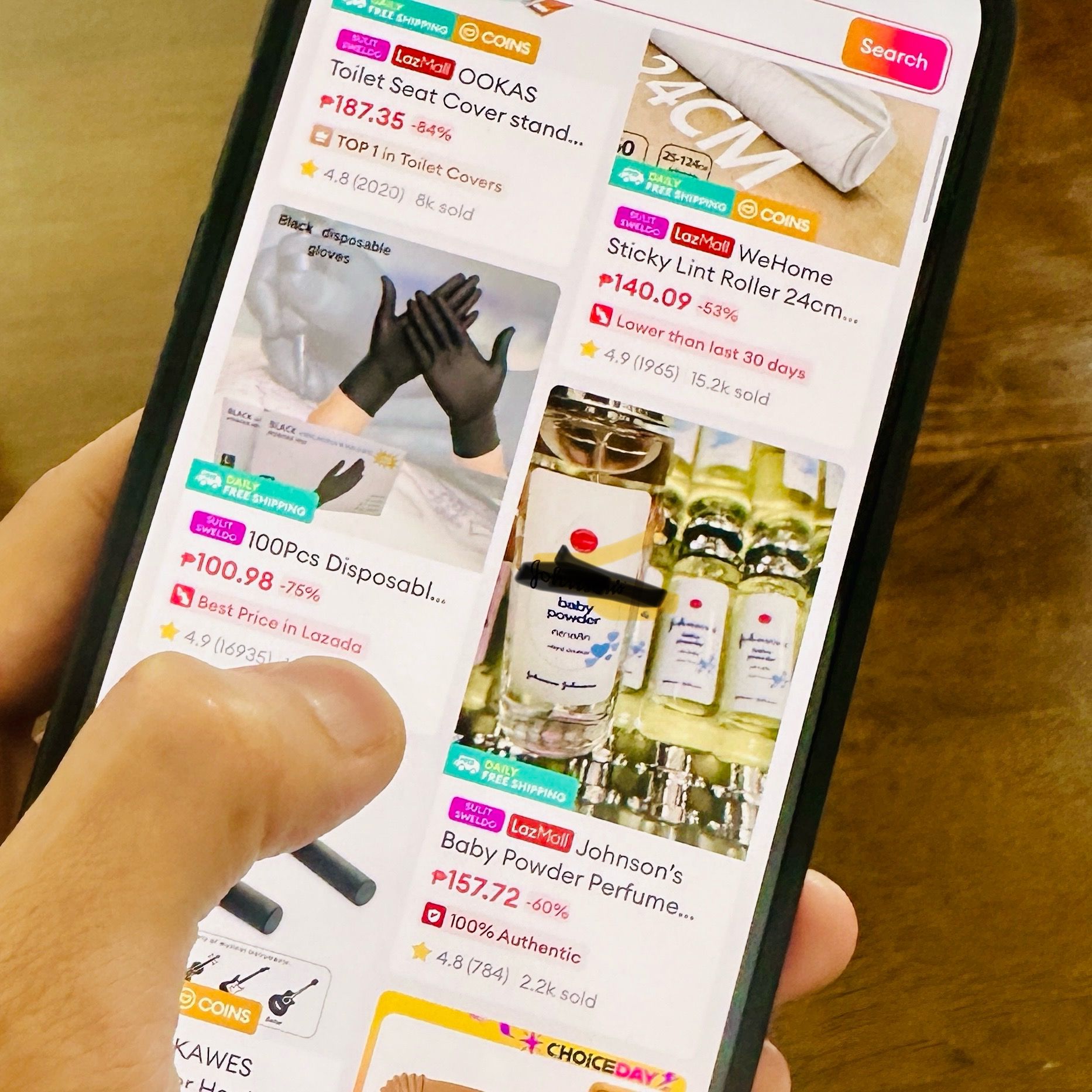

The Bureau of Internal Revenue (BIR) has started implementing the withholding tax requirement for online sellers who conduct business on electronic marketplaces like Lazada and Shopee. In a statement, BIR Commissioner Romeo D. Lumagui Jr. said there will be no further extensions for online...

The Bureau of Internal Revenue (BIR) announced that the agency has removed the five-year validity period for electronic certificate authorizing registration (eCAR). In a Facebook post on Monday, June 24, BIR Commissioner Romeo D. Lumagui Jr. said that eCAR is now valid until its presentation...

The Bureau of Internal Revenue (BIR) has issued additional guidelines regarding registration procedures and invoicing requirements following the passage of the Ease of Paying Taxes (EOPT) Act. These new guidelines aim to provide relief to taxpayers in meeting the new invoicing requirements....

The Bureau of Internal Revenue (BIR) has instructed its employees to refrain from connecting government-issued laptops to public Wi-Fi networks. Under Revenue Memorandum Order (RMO) 22-2024, dated June 14, 2024, and signed by BIR Commissioner Romeo D. Lumagui Jr., the bureau said the directive is...

In a move aimed at easing administrative burdens for taxpayers, the Bureau of Internal Revenue (BIR) has removed the time limit for utilizing converted official receipts (ORs) as invoices. Under the newly released BIR Revenue Regulation (RR) No. 11-2024 , taxpayers are now allowed to convert any...

The Bureau of Internal Revenue (BIR) cautioned individuals using or holding vapes without a tax stamp about the possibility of facing legal consequences. BIR Commissioner Romeo D. Lumagui Jr. said on Monday, June 3, that the regulations requiring tax stamps on vape products are also...