Crunching the Malampaya 'discovery': Reality check for PH energy sector

Every new gas find is a hard-won victory for the Philippines—whether it is a fresh discovery or added production. President Marcos’s revelation that Malampaya East-1 (MAE-1) holds an estimated 98 billion cubic feet (BCF) of reserves signals that the country has struck a deeper kind of confidence beneath its seabed: reserves certainty.

But beyond the math and the headlines, the real questions cut deeper: what does this actually entail for the country’s energy supply, and will it truly rewrite the rules of energy security for the Philippines?

Beyond the well: What Malampaya Phase 4 signals to the E&P world

When the Department of Energy (DOE) announced the Prime Energy–led Malampaya drilling program, the statement was straightforward: an $893-million targeted investment for the Malampaya Phase 4 project. Part of that commitment involves drilling three production wells—Camago-3, Malampaya East-1, and Bagong Pag-asa—underpinned by the Noble Viking drillship with operations slated for completion by October 2025.

Local and global oil and gas experts are unanimous in their assessment: if the MAE-1 well was already tied to Service Contract (SC) 38 as a committed production well under Phase 4, then its commercial viability was already proven. Technically, this may not be a “discovery” in the traditional sense, but rather a strategic step in enhancing gas production from a known, proven asset.

Reflecting on Malampaya Phases 2 and 3 during Shell Exploration B.V.’s operatorship, an additional $1.0 billion was strategically deployed. Phase 2 involved a $250-million investment to drill two new production wells in 2013 to fortify output, while Phase 3 commanded a $750-million capital outlay to install a cutting-edge depletion compression platform—a critical intervention to sustain reservoir pressure and operational continuity.

At that time, gas tapped from those wells was strictly classified as supplemental output under SC 38, not a new discovery. This underscored that Phases 2 and 3 were continuous reinvestments in an existing field—a trajectory Phase 4 was designed to follow. The drilling of new wells under Phase 2 was unequivocally aimed at augmenting production, not registering a discovery, reflecting a sustained obligation already codified under the commercial terms of the contract.

Revisiting the Phase 4 announcement, the objective remains the same: reinforce production through additional wells, with the contractor fully reimbursed for associated costs as explicitly written into the 15-year extension of the service agreement. The debate reverberating through the exploration and production (E&P) arena hinges on a pointed question: was this truly a "discovery," or merely incremental output whose viability had long been established within the legal and technical framework of SC 38?

If it is indeed a discovery, other critical questions require forthright answers. We must consider the ultimate recovery rate and the commercial cost of development, especially since the gas lies five kilometers away from the existing platform. This raises the question of whether a new platform is needed or if existing infrastructure can be leveraged. During Phase 3, the installation of a second platform linked by a 43-meter bridge required a staggering $750-million investment.

Back then, Shell identified further prospects and sought a 10-year extension for SC 38, but after past DOE officials failed to act, the major shareholders eventually chose to exit the market. These investment figures are vital because they drive the consortium’s final call. Since the announced "discovery" barely covers a year's worth of historical peak demand, sinking massive funds into connecting it to the platform may prove prohibitively expensive if no additional gas is extracted. This data will also provide a clear view of the consortium’s cost-recovery rights and help the public set realistic expectations for the government’s ultimate royalty share.

Malampaya’s output metrics

To put Malampaya’s output in perspective, its early commercial discovery in 1989–1990 pegged recoverable reserves at a massive 2.7 to 3.0 trillion cubic feet (TCF) of gas and 85 million barrels of condensate. These figures underscore the sheer scale the field delivered over the past two decades. Thanks to the Phase 2 and 3 investments, national gas production reached 2.757 TCF by 2024, inclusive of the marginal production from the San Antonio field in Isabela.

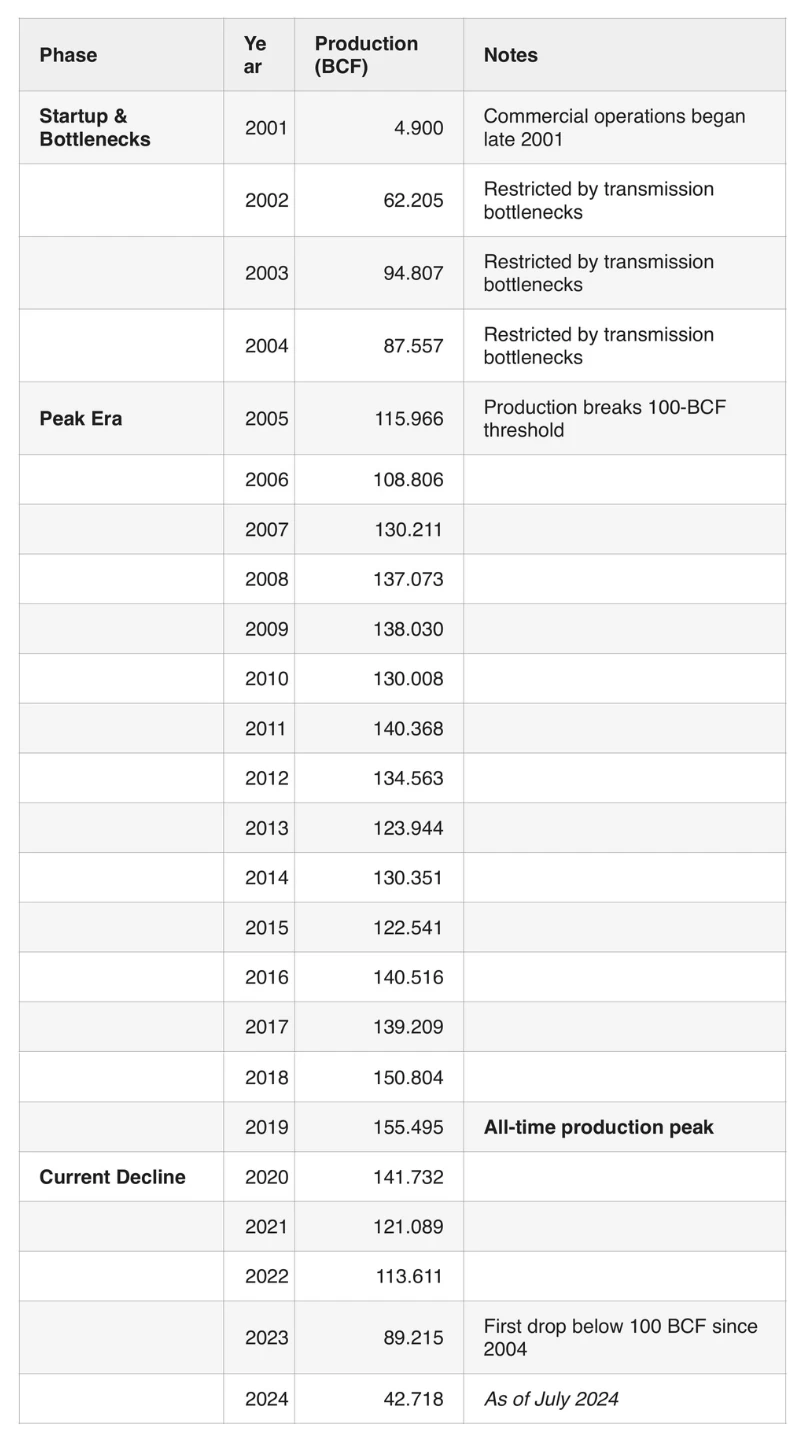

DOE data shows that Malampaya hit peak production of 150 to 155 BCF annually following the Phase 2 and 3 investments, but by 2023, output had dropped to 89.2 BCF—a clear sign of a declining field. Through this lens, it is easier to assess what a 98 BCF “discovery” really means for an aging asset. Furthermore, E&P experts note that even if classified as a discovery, the recovery rate—essentially 40 percent to 80 percent of reserves in-place—must be considered, as actual production could fall short due to extraction losses or water encroachment.

From its commercial start in late 2001 at 4.9 BCF, Malampaya’s output grew to 137 BCF by 2008. The following decade told a story of peaks and gradual decline, maintaining above 100 BCF per year until 2022, before hitting 89.2 BCF in 2023 and just 42.7 BCF as of July 2024. If we compare this to ASEAN neighbors like Malaysia and Indonesia, which produce 6.0 to 7.5 BCF of gas per day, the total 98 BCF find amounts to roughly two weeks of their output. Even against producers like Brunei or Thailand, this find could be consumed by demand in just one to two months.

As Filipinos, any boost in production is worth celebrating, but expectations must be tempered by reality. Understanding the technicalities of extraction is crucial because this supply determines our energy strategy: whether we can run power plants on local gas to support renewables, or if we must continue relying on massive LNG imports and advanced storage technologies. We can only wish the DOE and the Malampaya consortium success in drilling the remaining wells. Any additional gas is a national achievement that benefits consumers, as Malampaya gas is VAT-free and helps lower electricity bills. We hope these humble victories eventually lead to finds that bring us closer to the vast reserves enjoyed by our neighbors.

For feedback and suggestions, please email: [email protected]