Gatchalian: Illicit cigarette trade leads to "Lose-Lose Situation" for country

Senator Sherwin Gatchalian warned that the growing trade of illicit cigarettes has plunged the country into a “lose-lose situation,” causing significant drops in government revenue and reversing gains in public health.

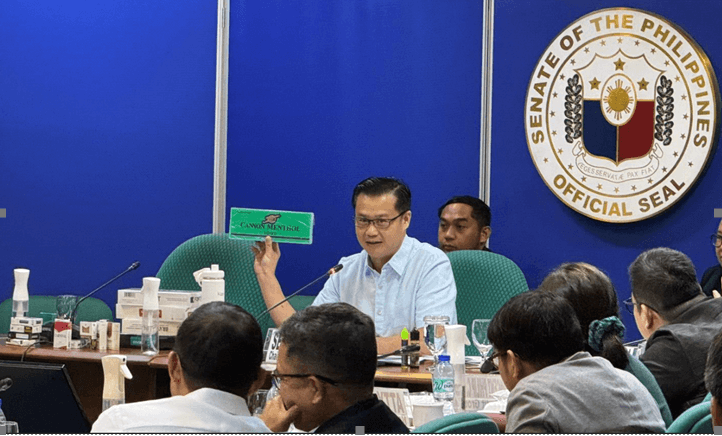

Speaking at a Senate Ways and Means Committee hearing, Committee Chairman Gatchalian emphasized the purpose of the tobacco excise tax.

“The reason we impose excise tax on tobacco products is so we can have better health outcomes. But smoking prevalence has now reversed. We’re now in a lose-lose situation because smoking prevalence is going up, tax collection is going down,” he said.

According to the Food and Nutrition Research Institute (FNRI), adult smoking prevalence rose from 19% in 2021 to 24.4% in 2023. Meanwhile, tobacco excise tax collections plummeted from P176 billion in 2021 to P130 billion in 2024.

“From the standpoint of this committee, revenue is going down, but smoking prevalence is going up, so where are the cigarettes coming from? A 5% jump (in smoking prevalence) is quite big,” Gatchalian noted.

The Department of Finance (DOF) has endorsed measures to address the issue, including a moratorium on excise tax hikes and the implementation of a track-and-trace system, said DOF Director Atty. Nina Asuncion.

However, Gatchalian urged immediate action. “If we don’t focus our attention on this, we’ll end up with a scenario where illicit trade might be bigger than legal activities. We want to press on the DOF to take a look at this problem and give us solutions to curb this illicit trade,” he said.

Data from the Bureau of Internal Revenue (BIR) revealed that in 2024, excise taxes due on illicit vapor products exceeded P64 million, while illicit cigarette taxes surpassed P342 million.

Philippine Tobacco Institute (PTI) President Jericho “Koko” Nograles assured the committee that the industry remains committed to improving excise tax collections. He expressed support for the proposed tax hike moratorium, citing potential stabilization of prices and a reduction in demand for smuggled products.

In a prepared statement, PMFTC Inc. President Gijs de Best stressed the need for a fair business environment.

“There should be a level playing field where all the industry participants are paying the right tax and complying with all laws and regulations,” he said.

De Best also called for consistent enforcement of laws, including the Vape Law and the Anti-Agricultural Economic Sabotage Act, prosecution of illicit traders, and addressing loopholes in the taxation of vapor products. He encouraged international cooperation to disrupt the illicit trade supply chain.

Gatchalian underscored the urgency, stating that illicit trade could cost the country P70 billion in lost taxes over the next three years.

“Aside from enforcement, we should think of other ways – maybe economic ways – to curb illicit trade,” he said.

“Because of the huge incentives of the prices of illicit cigarettes versus legal cigarettes, we cannot take away the fact that criminals are being incentivized because of this huge arbitrage between illicit cigarettes and licit cigarettes.”