DOE enticing global investors with 4 more RE capacity auctions

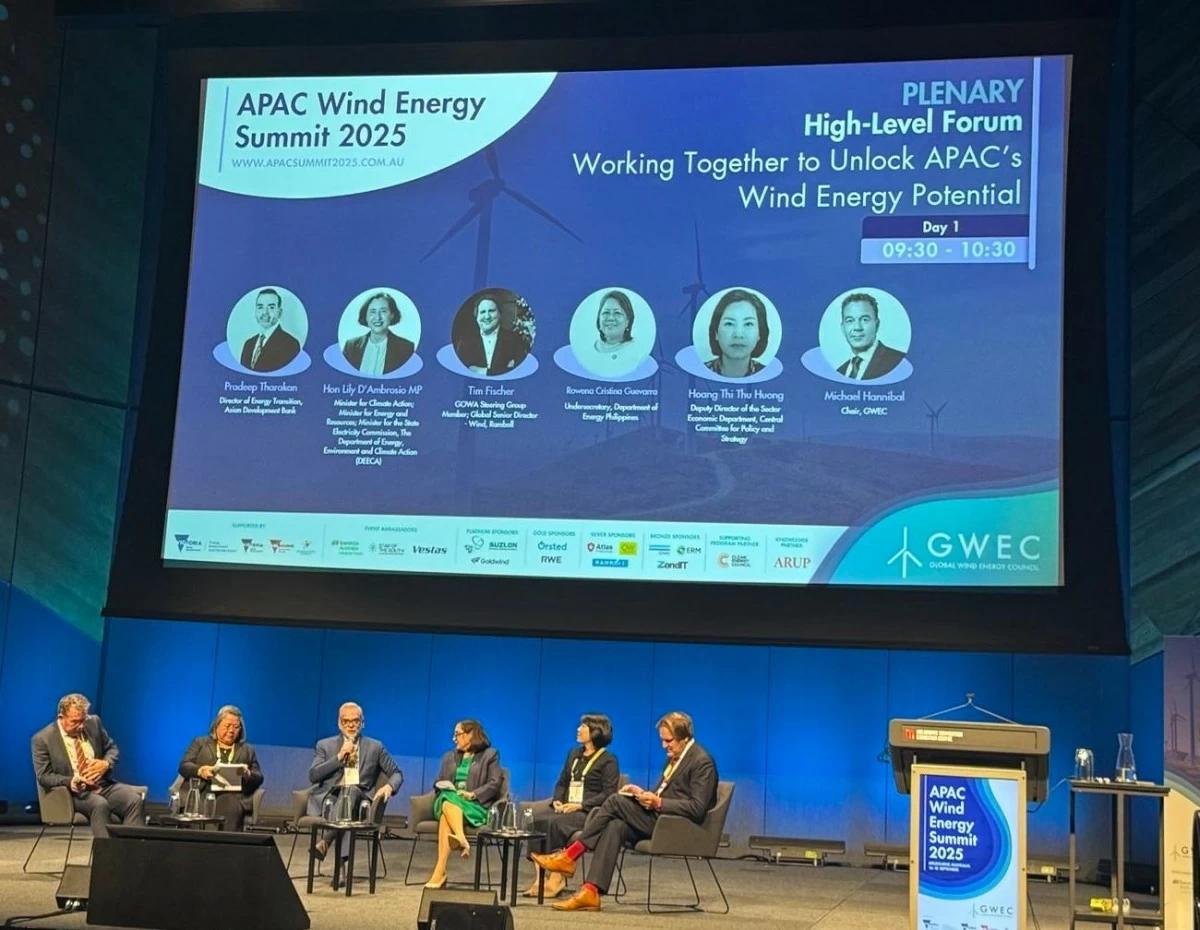

Philippine Energy Undersecretary Rowena Cristina Guevara joining a high-level forum on offshore wind chaired by the Asian Development Bank; and participated in by other markets like Australia and Vietnam as well as other key global stakeholders.

Melbourne, Australia—After the 5th green energy auction (GEA) for 3.3 gigawatts of offshore wind wraps up this year, the Department of Energy (DOE) is gearing up to launch at least four more renewable energy (RE) capacity tenders so it can open wider doors of opportunity for interested local and foreign investors.

During a high-level panel discussion at the APAC Wind Energy Summit that was chaired by the Asian Development Bank (ADB), Energy Undersecretary Rowena Cristina Guevara declared to regional peers as well as global investors and funders that the DOE will soon reveal new bidding timelines, along with the volumes or capacities up for grabs by project sponsors in the coming phases.

“By the end of this year, we plan to announce auctions number six, seven, eight, nine and so on – so that people will know; and the developers and bankers especially will know when the projects are going to come online; and when the projects need the funding,” she said.

As originally targeted, GEA-6 will zero in on waste-to-energy projects, while the energy department is still studying and fine-tuning the timing, magnitude of capacity as well as the technology offers for GEAs seven to nine.

“We also need to pace ourselves in terms of the auctions that we’re doing and when the projects are coming in – this way, we can guarantee that there is synergy among us in terms of supply,” Guevara stressed.

This year, the DOE aims to award a massive 20GW of renewable energy capacities—including 6.6GW from GEA 3 that had been awarded to pumped storage hydro and geothermal projects; then the 9.4GW subscribed to under the recent GEA-4 winning bids, prospective 3.3GW from offshore wind, while the remaining gap will be filled by GEA-6's capacity offerings.

“This is the year of auctions in the Philippines, we’re holding four auctions for a total of 20GW – we already finished the first one early this year for pumped storage hydro and geothermal, we awarded 6.6GW; and a few weeks ago, we finished onshore wind and solar – rooftop, ground-mounted and floating solar – and we’re going to award around 9.4GW. Then comes offshore wind – this is the first time that we’re doing 3.3GW of offshore wind with a very ambitious first kilowatt by 2028,” she reiterated.

Guevara qualified “the work that we are doing right now for our offshore wind developers is that: we dovetail what they are doing to make sure that the government permitting processes are facilitated for our 16 front-runner projects. Our belief is that, if we are going to get the first offshore wind project working, then it will inspire other developers to come online.”

On concerns of tricky financing for offshore wind, the energy official pointed out that apart from the 20-year power supply agreement (PSA) secured through GEAs, RE developers can also convert as retail electricity suppliers (RES) or tap into the merchant market once their two-decade contract expires.

“We have seen companies which requested to move to RES because they have seen that they can get better price in the retail market, and we allow that as long as they will pay the bond … we already have a case like that in GEA 1; and the company just needed to pay the P100 million bond,” she cited.

In the country’s energy transition pathway, Guevara highlighted that offshore wind will be the differentiating factor—with the government's clean energy scenario-1 targeting 19GW of offshore wind, while the more ambitious clean energy scenario-2 sets its sights on a higher end target of 50GW by mid-century.

Guevara nevertheless acknowledged that turning the ambitious offshore wind vision into reality would be tough, noting that the Philippines faces similar challenges as other markets—including grid integration, port infrastructure and securing steady supply of critical minerals to ensure the long-term viability of these projects.

“The road is not easy – everybody has the same problems—transmission, permitting and of course, bankability. Building an offshore wind is quite complex and we’re learning from our developers all the problems that they are encountering,” she stressed.

Guevara expounded “we also have this question about critical minerals. In the Philippines, we do have copper and nickel – and we do have rare earth minerals but we have not gone over them; and we believe that there is room for coordination in the region, especially in APAC (Asia Pacific), such that we could have a better management of the supply chain.”