Imagine a surgeon who doesn’t know human anatomy; that’s what it’s like to manage money without financial literacy. Understanding how money works is essential, because money matters not just today, but for a sustainable future. This is why the third edition of the Manila Bulletin’s Sustainability Focus Session, themed “Spend smart, live wise: Financial literacy toward a sustainable future,” will spark a conversation on the importance of financial literacy.

What financial literacy can do

Being financially literate does not mean being rich or well-off. It means understanding how money works. Financial literacy goes beyond simple budgeting or saving. It is about making informed choices, from knowing how to earn and save to spending it wisely. These skills will make a big difference in the future.

Financial literacy is about knowing how to manage money with confidence. It helps you understand your income, track your spending, and see where your money goes. It also teaches you how to set aside funds for emergencies, and for big goals, like buying a car, saving for your first home, or even preparing for retirement. And just as importantly, it’s about making your money work for you by investing in assets that could grow over time.

Imagine being able to budget for groceries without running out of cash before payday. Or knowing how interest rates work before making a big purchase on your credit card or signing a loan agreement, so you can avoid falling into a debt trap. In short, financial literacy helps you make smart decisions. And smart decisions lead to a more secure, sustainable future.

Financial sustainability

Now that we know what to do with our money today, what about for the years ahead? When people understand how money works, they make smarter choices, and that’s where financial sustainability comes in.

Financial sustainability is a broader concept as it goes beyond personal financial growth. It is also about the financial wellbeing of the community, the country, and even the planet. Think of it as a shared responsibility to manage money and resources wisely so everyone benefits, both now and in the future.

True financial sustainability creates a ripple effect. When you manage money in a way that secures your future, you also strengthen your family, uplift your community, and ultimately support the world around you.

Spend smart, live wise

For the third edition of the Manila Bulletin’s Sustainability Focus Session, key voices in finance and sustainability will come together to engage with students from De La Salle University. The session, happening on Sept. 25, will explore how smart money management, rooted in sustainability principles, can empower individuals and communities to build lasting financial stability.

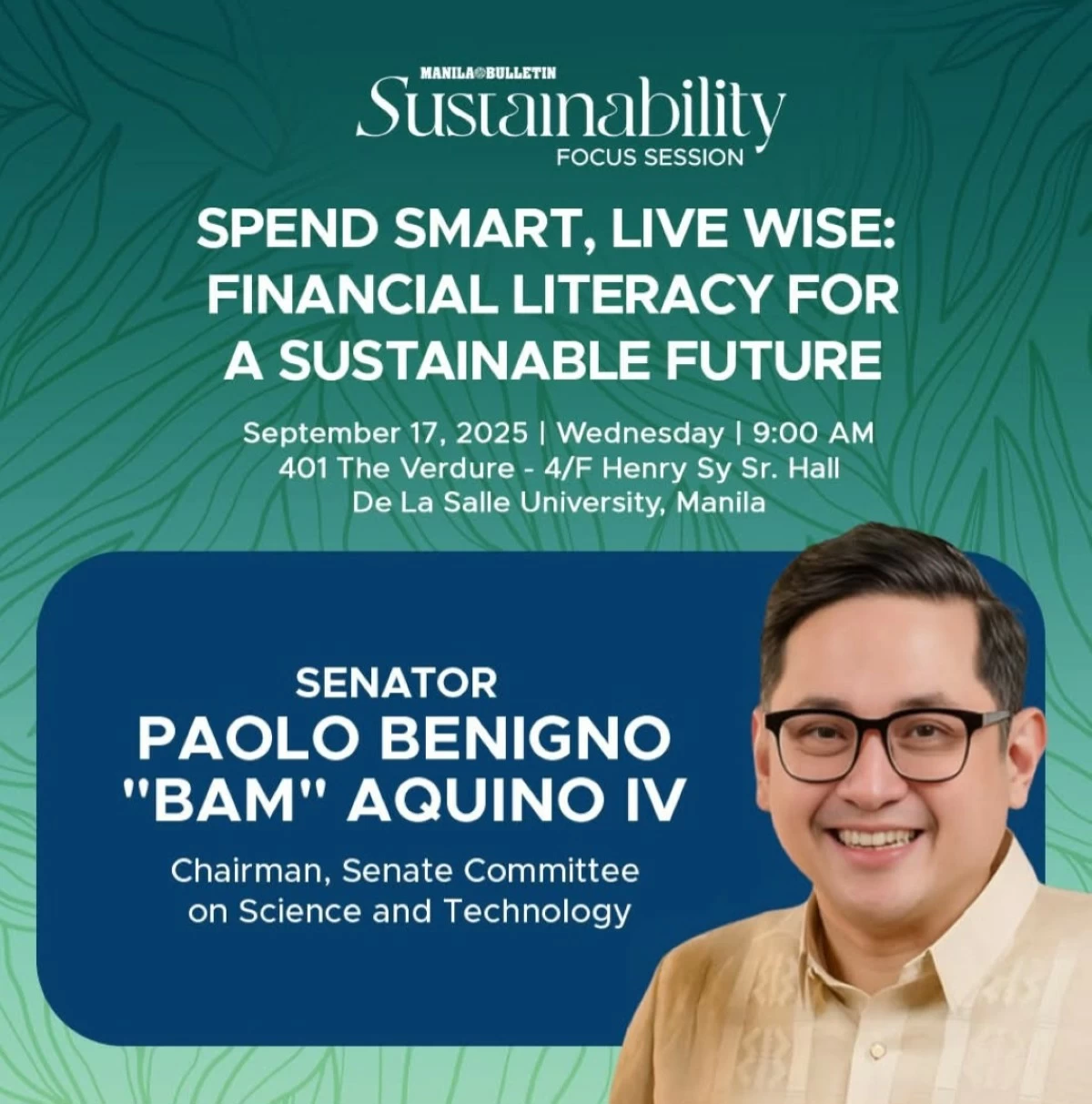

Senator Paolo Benigno “Bam” Aquino, chairman of the Senate Committee on Science and Technology, and Benjamin Diokno, monetary board member of the Bangko Sentral ng Pilipinas, will lead the conversation and share valuable insights on policy, innovation, and economic resilience.

Alongside the keynote speakers, the event will also feature an impressive lineup of thought leaders from leading financial institutions.

Ceejay Hernandez of HSBC will discuss the bank’s role in promoting financial literacy as part of its sustainability mission.

Dave Jesus Deviles, head of Sustainability at EastWest Banking Corporation, will share how the bank’s WAIS approach helps communities become financially empowered.

John Garcia of GCash will dive into digital-first financial literacy and how tech is driving smart, inclusive financial choices.

Japhet A. Luisto, senior talent capability manager for Learning and Development at UnionBank, will present a fresh take on “Reimagining Banking to Uplift Lives.”

Kristina Lim of GoTyme, who will explore “Smarter Finances for an Inclusive Future,” will highlight strategies for broader financial access.

J. Albert Gamboa, Manila Bulletin columnist, will share insights on the collaborative efforts between FINEX and Manila Bulletin in advancing financial literacy.

Building financial independence

Many college students are managing their own money for the first time. This focus session aims to equip them with real-world skills that go far beyond the classroom.

Without financial literacy, students risk falling into financial pitfalls that can haunt them for years. They may sign up for a credit card without understanding interest rates, overspend or miss payments, all of which can lead to debt.

For graduating students landing part-time or full-time jobs or on paid internships, financial literacy can help them create a savings plan, start an emergency fund, and maybe begin investing, even in small amounts.

The Bangko Sentral ng Pilipinas’ 2021 Financial Inclusion Survey shows that many adult Filipinos struggle with basic financial skills like budgeting, saving, and managing debt. This makes now the perfect time to learn. The forum will help them build financial independence and security early, so they’ll be prepared for life’s responsibilities after graduation.

Financial literacy isn’t just for college students; it is for everyone. No matter your age or stage in life, it is never too late to take charge of your money and build the future you deserve. Remember, money isn’t just currency. It is power, freedom, and possibility. That is why we should all learn it, own it, and live it.