Philippine financial inclusion lags behind regional, income peers—World Bank

Despite the vulnerability of Filipino households to socioeconomic shocks and natural disasters, their access to financial services remains a laggard compared to the Philippines’ regional and income-level peers, the 2025 Global Findex Database of the World Bank showed.

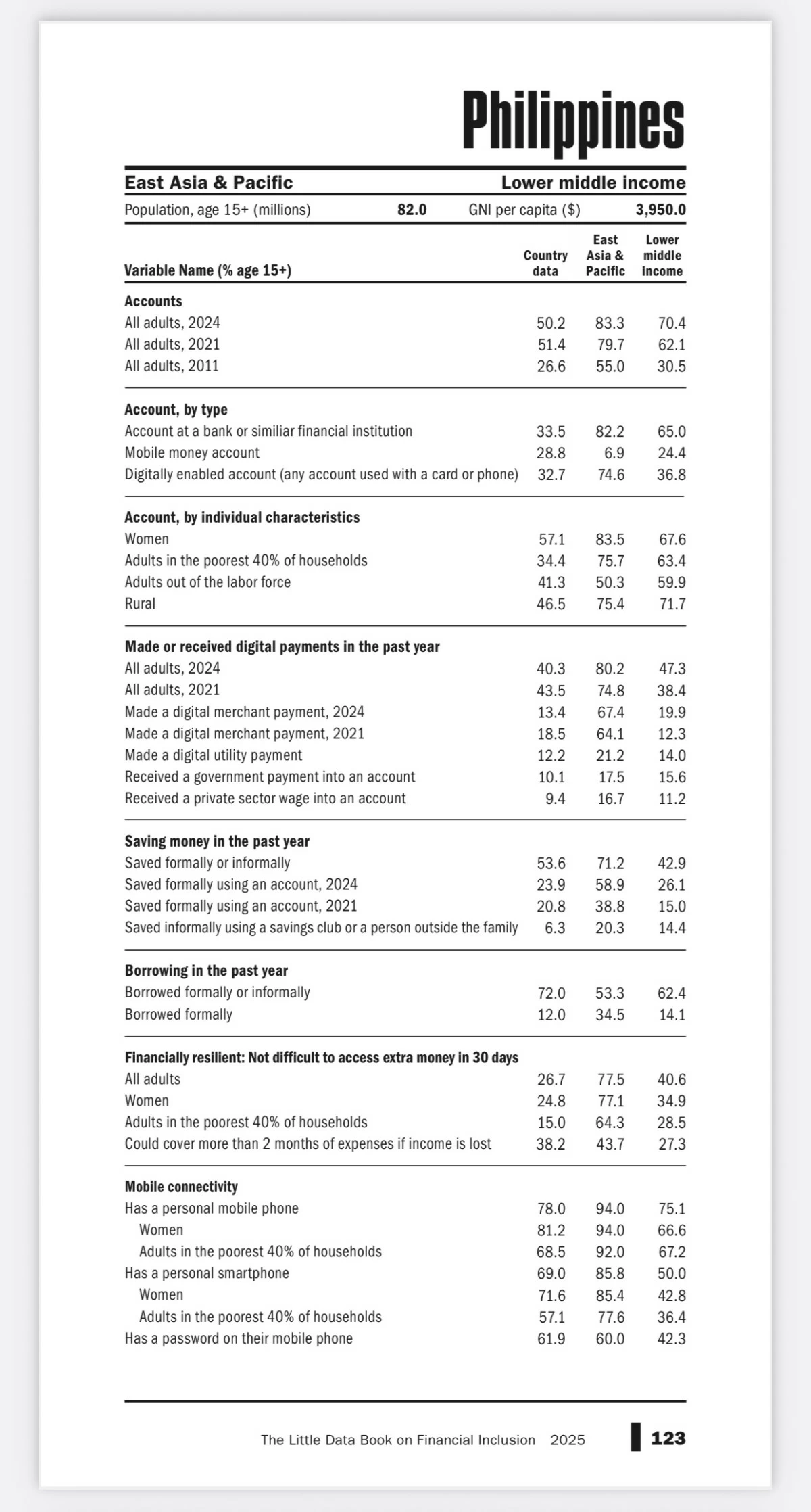

According to the World Bank’s latest survey across 141 economies, which the Washington-based multilateral lender conducted last year, 50.2 percent of Filipino adults have financial accounts—below the average of 83.3 percent in the East Asia and Pacific region and the 70.4-percent average among lower-middle-income economies.

Based on World Bank data, a slightly higher 51.4 percent of Filipino adults had access to bank, mobile money, and digitally enabled accounts at the height of the most stringent Covid-19 lockdowns in 2021, which was about double the mere 26.6 percent in 2011.

The stagnant share of Filipinos included in the financial inclusion net between 2021 and 2024 contrasts with the regional climb in East Asia and Pacific to 83.3 percent from 79.7 percent, as well as the jump among lower-middle-income countries (LMICs) to 70.4 percent from 62.1 percent.

In 2024, 33.5 percent of Filipinos had bank accounts, below the regional and income group averages of 82.2 percent and 65 percent, respectively.

Digitally enabled financial accounts used with a card or phone were held by 32.7 percent of Filipinos, lower than the averages of 74.6 percent in the region and 36.8 percent in the lower-middle-income level.

But a bright spot for the Philippines is the 28.8-percent share of Filipino respondents with mobile money accounts, which was higher than the 6.9-percent share in East Asia and Pacific and the 24.4-percent average among LMICs.

In the Philippines, 78 percent have a basic mobile phone, including 81.2 percent of women and 68.5 percent of adults belonging to the poorest 40 percent of households.

More sophisticated smartphones are owned by 69 percent of Filipinos, including 71.6 percent of women and 57.1 percent of adults in the bottom 40-percent income households.

While 57.1 percent of women, 34.4 percent of adults in the poorest 40-percent households, and 46.5 percent of Filipinos living in rural areas have financial accounts, these vulnerable sectors lag behind the Philippines’ regional and income peers.

More than two-fifths of Filipino adults made or received digital payments in 2024, while over half of them saved money—of which only 23.9 percent saved formally using an account, up from 20.8 percent in 2021.

“More than 20 percent of adults saved using a mobile money account in Malaysia, the Philippines, and Thailand,” the World Bank noted.

While East Asia and Pacific had the highest share of online shoppers—at 65 percent of adults in 2024—the World Bank said that cash is still king for payments among the larger Southeast Asian economies, including the Philippines.

“In Malaysia and Thailand, between 30 percent and 40 percent of adults making online purchases pay cash on delivery; in Indonesia and the Philippines, more than half do,” the World Bank said.

To augment incomes, 72 percent of Filipinos borrowed from formal and informal lenders last year, but only 12 percent borrowed formally, the survey showed.

“Even though family or friends are the most common source of extra money in low- and middle-income economies, they are also among the least reliable sources... In Namibia and the Philippines, where about 30 percent of adults rely on family or friends for extra money, three-quarters of those who do rely on them say the money would be very difficult to get,” the World Bank noted.

The World Bank cited that access to financial services is also crucial for remittances-dependent economies like the Philippines, where household incomes are augmented by money sent back home by Filipinos working or living overseas.

“In the Philippines, remittances increase in response to adverse income shocks, such as poor rainfall, acting as a countercyclical insurance mechanism that smooths consumption and buffers against income losses,” it noted.

The Philippines’ high exposure to natural calamities also highlights the need to ramp up financial inclusion in the country as part of quick disaster response.

“In the 10 economies with the highest share of adults saying they personally experienced a natural disaster—Armenia, Chad, the Comoros, Madagascar, Malawi, Morocco, Mozambique, the Philippines, Zambia, and Zimbabwe—50 percent or more of all adults were exposed. These economies are particularly vulnerable, and the people who live there are more likely than average to suffer adverse consequences from a disastrous event,” the World Bank said.

The survey showed that in the Philippines, Armenia, and Madagascar, both the poor and the rich are highly exposed to natural disasters.

Also, “rural adults in Morocco and the Philippines were no more likely than their urban counterparts to experience disasters,” the World Bank added.

The Philippine survey for the World Bank’s 2025 Global Findex Database was conducted from Aug. 29 to Nov. 6, 2024, with 1,000 face-to-face interviews nationwide yielding the survey results.

According to the World Bank, its Global Findex Database for 2025, published on July 16, “includes updated indicators on access to and use of formal and informal financial services to save, borrow, make payments, and manage financial risk, as well as globally comparable data on ownership of mobile phones, internet use, and digital safety.”

“The data also identify gaps in access to and use of digital and financial services by women and poor adults,” as this information is “used to track progress toward the United Nations Sustainable Development Goals” or UN SDGs, the World Bank noted.