Philippines to be ASEAN's top performer? S&P Global ups 2025 growth outlook

By Derco Rosal

At A Glance

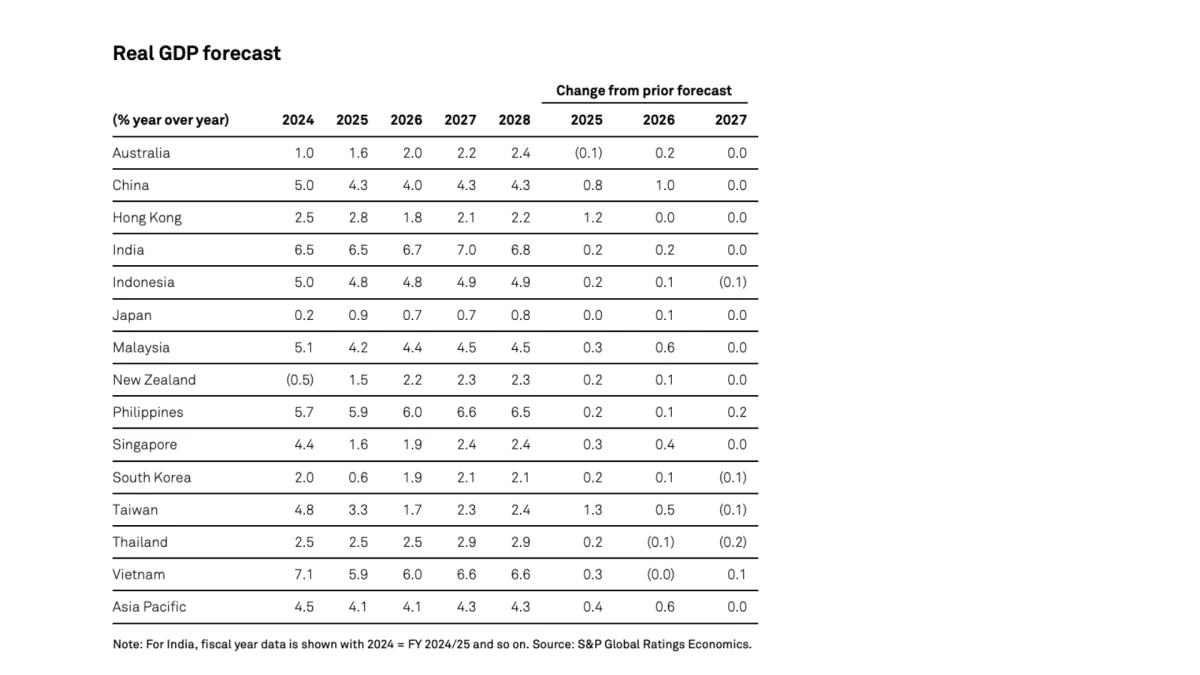

- Debt watcher S&P Global has tweaked upwards its 2025 gross domestic product (GDP) growth forecast for the Philippines to a pace that would make it at par with region's best performer Vietnam's projected growth of 5.9 percent.

Debt watcher S&P Global has revised upwards its 2025 gross domestic product (GDP) growth forecast for the Philippines to a pace that would make it at par with region’s best performer Vietnam’s projected growth of 5.9 percent.

According to the latest report of S&P Global, published on Tuesday, June 24, the credit rating agency expects the Philippine economy to improve from the 5.7 percent growth it previously projected.

While slightly below the six percent to eight percent growth target of the Philippines, S&P Global sees this movement to continue through 2026 (at six percent), 2027 (6.6 percent), and 2028 (6.5 percent).

Among the member-countries in the Association of Southeast Asian Nations (ASEAN) included in the report, the Philippines is projected to expand at the same rate as Vietnam, the fastest-growing economy in ASEAN.

“Domestic demand resilience is particularly relevant in limiting the economic slowdown in economies less exposed to goods exports such as India and the Philippines,” said S&P Asia-Pacific chief economist Louis Kuijs and economist Vishrut Rana.

The Philippine economy expanded by 5.4 percent in the first quarter, slightly faster than the previous quarter’s 5.3 percent, but slower than the 5.7 percent seen in the same period last year.

On a larger scale, growth in Asia-Pacific is expected to slow from 4.5 percent in 2024 to 4.1 percent in both 2025 and 2026. It is projected to pick up to 4.3 percent in 2027 and remain at that level until 2028. Still, Kuijs and Rana see growth over the next three years coming in below last year’s level.

Meanwhile, Kuijs and Rana have forecast consumer price hikes to average 2.3 percent this year, 3.2 percent in 2026, 3.3 percent in 2027, and three percent in 2028—all of which fall within the government’s target band of two percent to four percent.

With a still-calm increase in consumer prices seen through 2026, the S&P Global anticipates the Bangko Sentral ng Pilipinas (BSP) to proceed with slashing borrowing costs by another cumulative of 125 basis points (bps), the total size seen recently.

Citing the global growth slowdown and external risks, the policy-setting Monetary Board (MB) decided to cut the key interest costs by a quarter point to 5.25 percent last week from 5.5 percent previously.

Kuijs and Rana expect the BSP to cut rates by a total of 75 bps by the end of this year and by 100 bps by the end of next year. They have forecast that the rate will hold steady at four percent from 2026 through 2028.