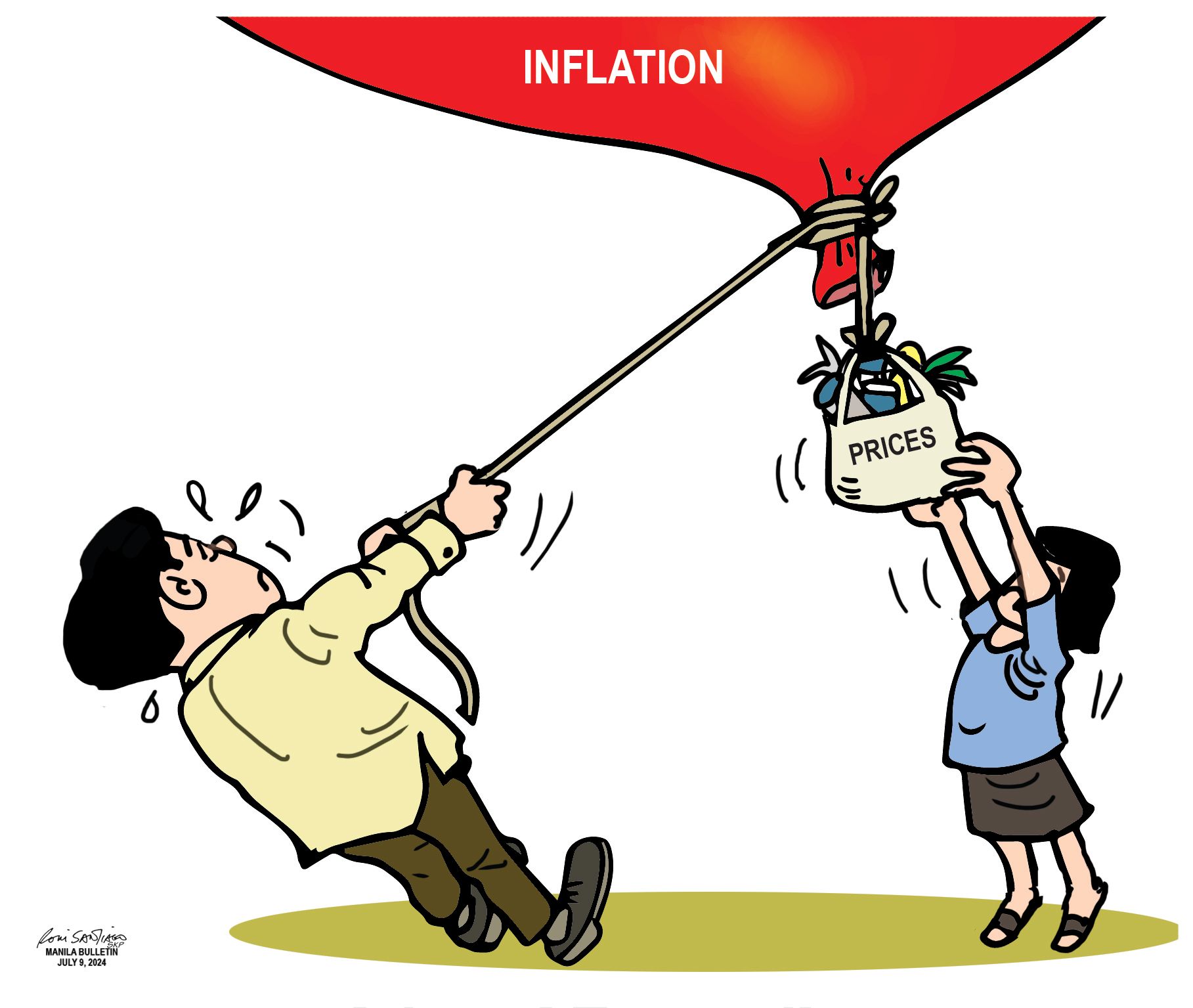

Lower inflation eases economic stresses; government fine-tunes growth targets

Last week, the Philippine Statistics Authority (PSA) reported that inflation had eased to 3.7 percent in June 2024, lower than the 3.9 percent rate posted in May. According to National Statistician Claire Dennis S. Mapa, this was due to the slower increase in the housing, water, electricity, gas and other fuels index. This was an offshoot of the faster decline in electricity prices, which dipped by 13.7 percent, compared to the previous decline of 8.5 percent. Other major contributory factors were lower inflation rates in personal transport (3.5 percent from 5.3 percent) and gasoline (2.3 percent from 5.2 percent); this latter decrease resulted from the additional rollback in gasoline prices in early June 2024.

Rice inflation slowed to 22.5 percent in June, compared to 23.0 percent in May. Executive Order No. 62, issued Last June 21, lowered the tariff on rice imports from 35 percent to 15 percent but it will take some time before its full impact is felt. Meantime, the government is providing rice priced at ₱29 per kilo in Kadiwa outlets and rolling stores. Overall food inflation increased from 6.1 percent to 6.5 percent due to higher vegetable and meat prices.

President Marcos continued to reach out to economically distressed farmers in the provinces, traveling as far down south as Sulu and Lanao del Norte where he distributed financial assistance from the Department of Social Welfare and Development (DSWD), as well as e-titles to agrarian reform beneficiaries.

According to Economic Planning Secretary Arsenio Balisacan, the DSWD has distributed ₱1.37 billion in cash assistance and food packs to farmers and fisherfolk affected by El Niño, with each recipient receiving ₱10,000 under the Ayuda sa Kapos ang Kita Program (AKAP). This is on top of the Food Stamp Program which is directed at softening the impact of higher food prices on the vulnerable and marginalized sectors.

The whole-of-government approach to fighting inflation seems to be gaining ground as monetary and fiscal policies are being harmonized to ensure beneficial results. The DBCC has proactively recalibrated the government’s medium-term macroeconomic assumptions, growth targets and fiscal program for this year and until the end of the current administration’s term.

While inflation is still below the maximum 4.0 percent rate, the government has adjusted the lower end of the target range from 3.0 percent to 2.0 percent and maintained the upper end at 4.0 percent. This is based on a $65 to $85 price range forecast for Dubai crude. The peso-dollar exchange rate assumption has been adjusted to a range of $56 t0 $58, “given increasing tourism receipts, growing BPO revenues, and robust overseas Filipino remittances that will support and keep the currency stable and resilient against persisting global headwinds.”

Fiscal targets have also been recalibrated. The digitalization of the tax system and improved collection efficiency are geared toward achieving an annual growth rate of 10.3 percent to attain ₱6.250 trillion or 16.9 percent of the GDP by 2028.

Meanwhile, hard-pressed Filipino families nurture fresh hopes for alleviation that are anchored on their government’s vigorous efforts to achieve sustained economic growth and stability.